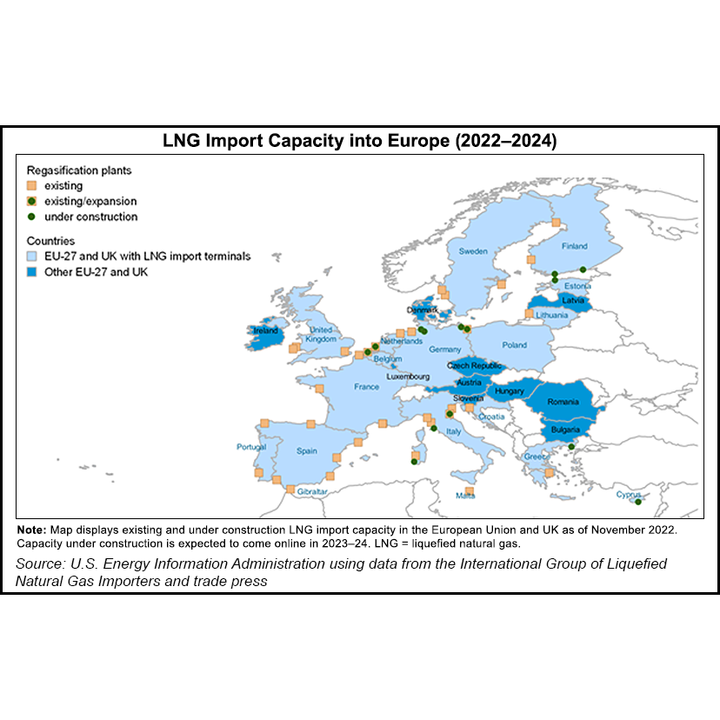

After a decade of relative stagnation, LNG import capacity in the European Union (EU) and the United Kingdom (UK) is set to increase by 34% in 2024 compared with 2021, according to the U.S. Energy Information Administration (EIA).

The EIA, citing data from the International Group of Liquefied Natural Gas Importers (GIIGNL) and trade press, said liquefied natural gas import capacity would reach 5.3 Bcf by the end of 2023 and then grow by an additional 1.5 Bcf/d by the end of 2024.

LNG regasification capacity in the EU-27, before Croatia joined, and the UK remained relatively stable and expanded modestly in the last 10 years, only by 2.8 Bcf/d (16%), EIA said. During this time, import capacity rose to 20.2 Bcf/d at the end of 2021 from 17.5 Bcf/d in 2012, GIIGNL data...