Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

ETP Units Ink 15-Year Natgas Supply Deals for South of the Border Electricity

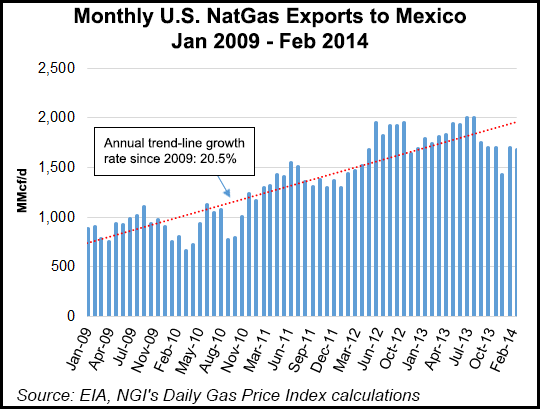

Energy Transfer Partners LP (ETP) said Tuesday two of its subsidiaries have entered into 15-year agreements with Mexico’s electric utility, Comision Federal de Electricidad (CFE), to provide transportation services for 930,000 MMBtu/d.

Dallas-based ETP plans to use its existing pipeline infrastructure to help subsidiaries Houston Pipe Line Co. LP (HPL) and Oasis Pipeline LP facilitate the agreement. ETP plans to build a 24-inch diameter pipeline, the Edinburg Extension, which would run from HPL’s line near Edinburg, TX, to a new international border crossing near McAllen, TX. ETP also plans to construct the Nueces Crossover, a 36-inch diameter pipeline running from its Robstown pipeline system in Nueces County, TX, to its facilities in Live Oak County, TX, a distance of 51 miles.

ETP said it expects the Edinburg Extension and the Nueces Crossover to be in service during 4Q2014 and 1Q2015, respectively. The financial terms of the agreements were not disclosed.

“We are honored to team with CFE to help them meet the growing demand for natural gas-fired generation in Mexico,” ETP’s Roy Patton, senior vice president for commercial operations, said. “ETP’s extensive intrastate pipeline system provides CFE with geographical diversity and flexibility in sourcing its natural gas supplies. In addition to supporting new pipeline infrastructure, these agreements will generate upstream fee-based revenue for ETP’s existing intrastate pipeline network.”

FERC approved the border-crossing segment of the Edinburg Extension in March (see Daily GPI, March 20). The Federal Energy Regulatory Commission authorized construction of the 24-inch diameter pipeline under the Rio Grande River, which forms the international border between the United States and Mexico, with an international crossing segment measuring 703 feet. The FERC order said HPL anticipates the 23-mile Edinburg Extension would eventually connect with other intrastate and interstate pipeline systems, transporting gas produced both inside and outside of Texas.

Last month, CFE said it planned to seek bids to build five gas pipelines in northern Mexico. The projects are collectively expected to cost $2.25 billion (see Daily GPI, April 22).

Mexico is currently considering a bold series of legislative reforms to its energy policies (see Daily GPI, May 2). One change reportedly under consideration is for CFE to be given the authority to enter into midstream contracts for natural gas. That authority currently resides exclusively with Mexico’s national oil company, Petroleos Mexicanos (Pemex).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |