Bakken Shale | E&P | NGI All News Access

Ethane Part of North Dakota’s Value-Added Strategy

As North Dakota attempts to add value to its deep oil/natural gas production, the state’s chief oil/gas regulator, Lynn Helms, said Wednesday that work is ongoing to promote a major ethane industry in the state.

Bakken natural gas produced in conjunction with the state’s 1 million b/d crude oil supplies is very rich in ethane. About 20% of the typical Bakken gas stream is ethane, Helms said.

In talking with news media covering the Williston Basin Petroleum Conference (WBPC) in Bismarck, ND, Helms outlined a scenario that envisions a major Gulf Coast-sized polyethylene plant being built and operating in the state by the 2020-2022 time frame.

A contributing factor in the push for an in-state solution to ethane is the fact that current Canadian natural gas supplies coming into North Dakota on the Northern Border Pipeline are becoming less dry and higher in ethane content and other liquids, said Helms, director of the state Department of Mineral Resources.

“That is going to reduce the ability of Bakken operators to reject ethane and send it in the natural gas stream to Northern Border, creating an opportunity to straddle that pipeline, or work with some of our operators on a percent-of-proceeds basis to purchase their ethane and build a plant here to make plastics in North Dakota,” Helms said. “The difficult thing is that people are looking at a plant on the scale of Gulf Coast plants. I don’t think we are quite ready to support that.

“The ultimate goal, however, is to build a polyethylene plant, and we have Justin Kringstad at the Pipeline Authority working on that, and it may eventually require a smaller-scale plant.”

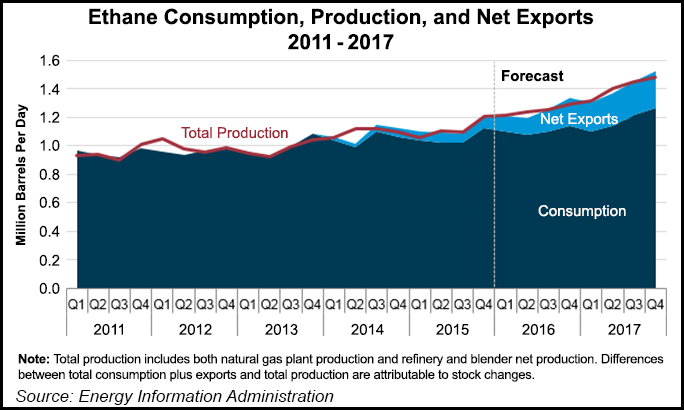

Helms said there is an “ethane wall” that the state forecasts it will hit on its gas transmission pipeline system in about two years. “That then triggers the need for the contracting for a polyethylene plant,” he said. But it will take two or three years to build a plant, he said, pushing the time frame to at least 2020-2021 for such a plant.

“It’s a pretty long time frame and folks are not going to be really motivated to proceed with percent-of-proceeds contracts for at least a couple of years.” He thinks when companies begin looking at 2018 budgets the issue should surface.

“People are out there talking to operators right now in the oil patch trying to get commitments from producers and operators, and some of them are now building their own gas plants to capture the ethane and have the ability to sell it to companies now, but we’re at least five years out [on a major plant].”

A second focus for natural gas value-add in the state is the ramp up of natural gas liquid (NGL) shipments via rail to Mexico for propane and to the West Coast for exports to Asian nations. Currently Bakken NGLs are shipped by pipeline to Kansas or by rail to the East.

“Some of the rail facility people are working on transitioning from crude oil to NGLs working with state and federal authorities, and it is their understanding that there is an enormous demand for NGLs, particularly propane in Mexico and also on the West Coast for the Asian markets, so in the next two years we are going to see a transitioning the crude oil facilities to handle NGLs where it is safe to do so,” Helms said.

“It won’t be easy and it won’t be cheap, but there is a value added here for the state.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |