Equity Market Factors Driving ‘Relentless’ Natural Gas Supply Growth Expected to Continue

Going back to last year, natural gas production forecasts based on drilling fundamentals missed key signals from equity markets that had predicted the recent surge in Lower 48 supply, according to East Daley Capital’s Matthew Lewis, who directs financial analysis for the firm.

Leading indicators like producer hedges, guidance and firm transportation commitments all foretold the 8-10 Bcf/d of supply growth seen since last year, he said during a presentation at the recent LDC Gas Forum conference held in Chicago.

“If we go back in time, I remember a lot of forecasts from the commodity space that said anywhere from 2-5 Bcf/d,” he said, and “most people were at 4 Bcf/d natural gas supply growth back in August 2017…So how did they get to that? Most of the commodity space uses drilling fundamentals. It’s what you should use. It’s a great indicator of where we’re headed.”

However, drilling fundamentals didn’t fully capture what was happening, especially these key “variables” on the equity side, he said. “You have the same variables over the next two years as you had last year” in the lead-up to what has been “relentless” supply growth. “The same variables are still in place.”

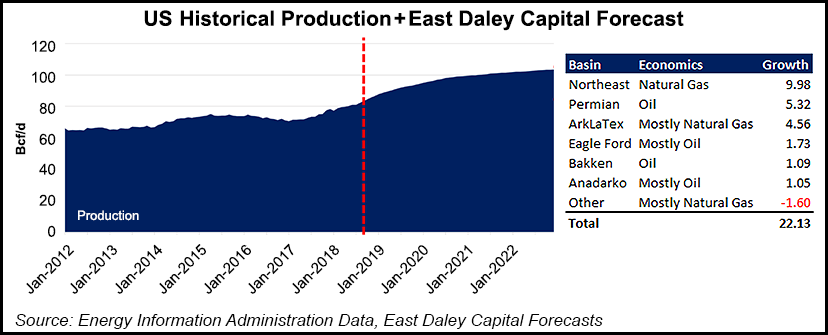

East Daley is forecasting roughly 22 Bcf/d of production growth through the end of 2022, driven by about 10 Bcf/d of incremental Northeast output. The projection models in lower gas prices over the forecast period based on recent forward curves. Lewis added that pipeline delays or a drop in oil prices could also pose downside risks.

Looking at supply/demand balances and the forward curve, not all Northeast E&Ps will be able to meet their growth targets, Lewis said. “There’s way too much supply there…That means, in our mind, prices have to go lower to balance the market in some way.”

Supply growth over the past year has already “decimated” the forward curve, despite storage sitting at five-year lows.

“To be honest with you, I would be very hesitant to be short this winter with storage the way it is, but further out you can be confident that it looks pretty bearish for prices,” Lewis said. “…The producers, as they try to grow and try to hit their commitments, they are selling into that forward curve.”

East Daley’s forecasted growth rate, which has total U.S. dry gas production topping 100 Bcf/d sometime in 2021, would appear to outpace recent growth projections from the Energy Information Administration, which said in its latest Short-Term Energy Outlook that it expects 2019 dry natural gas production to average 84.7 Bcf/d, versus an expected average of 81.0 Bcf/d in 2018.

East Daley President Jim Simpson recently expounded on the pressure Northeast exploration and production (E&P) companies face to continue drilling to fill their pipeline capacity commitments even when breakevens might tell a different story. Lewis elaborated on some of those points.

“What I think the commodity side misses a lot is how detrimental it is to these producers’ balance sheets and income statements if they don’t fill the pipeline capacity they’ve signed up for,” Lewis said. “…Let me assure you that these guys have to fill their capacity over the long term. They absolutely have to.”

Commodity markets could have also better predicted the recent growth by simply listening to what E&Ps were saying at the time, he said.

“I’m surprised more people don’t use this, but you actually have producers — especially in the Northeast, where they’re large, public producers — doing quarterly and yearly guidance…They tell you what they’re going to produce to. Now you have to be a little bit careful in using this because long-term it can be somewhat unreliable.

“But from the equity side of things, telling your investors at the beginning of the year you’re going to hit a production target and then not hitting it is not well-received, typically.”

A look back at production guidance for 2017 from big Northeast E&Ps including Antero Resources Corp., Cabot Oil & Gas Corp., EQT Corp. and Range Resources Corp. showed them outlining plans to hit compound annual growth rates in the neighborhood of 10-25%, Lewis noted.

Hedges also play a key role in predicting E&P behavior, he said. For example, “Antero’s an interesting case here” as it locked in “a significant amount of hedges way back a long time ago at really good prices,” Lewis said. “So the hedges they have locked in for 2018 and 2019 are to sell their gas at $3.70 or $3.50…so there shouldn’t be any question that they’re going to produce into that amount, because there’s no price volatility for them.

“…This becomes interesting in 2020 when their hedges start to roll off,” he said of Antero. “They only have about 60% of their gas hedged in 2020. By the time that comes around, if prices are still lower than the $3.25 they have hedged, they actually have to produce more to keep cash flow constant.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |