Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Equitrans Sees ‘Inflection Points’ Ahead as MVP Works Through Delays

Mountain Valley Pipeline (MVP) is unlikely to enter service this year as its backers continue to grapple with a morass of regulatory issues that will take more time to resolve, lead sponsor Equitrans Midstream Corp. said this week.

“At this point, while the completion of our project by year’s end may appear unlikely, a narrow path continues to exist,” COO Diana Charletta said of management’s slim hopes for the pipeline entering service sometime in the fourth quarter as its backers have been guiding for.

MVP has been plagued by strong opposition from environmental groups that has led to successful legal challenges, permit issues and work stoppages that have held up the project since construction started early last year. The company has since increased its cost estimate to $4.6 billion from the initial forecast of $3.5 billion. It’s already been forced to push back the target in-service date twice, most recently from 1Q2019 to 4Q2019. Equitrans affiliate EQM Midstream Partners LP would fund $2.2 billion of the project.

“There’s no real change in our guidance,” Equitrans CEO Thomas Karam said on Tuesday during a first quarter earnings call with analysts. While the project is 80% complete, it’s simply a matter of time before MVP can enter service, he conceded.

While a number of issues continue to challenge the project, Karam said three “inflection points” are ahead for MVP. It needs a Nationwide Permit (NWP) 12 from the U.S. Army Corps of Engineers, authorization to work in the Jefferson National Forest and clearance to cross the Appalachian Trail after an adverse decision in December from a federal court.

“We are not tired of talking about MVP because MVP is going to be the largest driver of our growth in both the transmission business and ability to service our Appalachian customers to move their gas to better pricing markets in the south,” Karam said in assuring analysts on the call. “Once you get past the headlines, we remain increasingly confident and bullish around MVP.”

He added that the 300-mile, 2 Bcf/d pipeline would be a 50- to 80-year asset that’s “going to be incredibly valuable to this company.”

For now, Equitrans is working with a variety of agencies to address all the issues confronting the project. MVP’s Appalachian Trail crossing was jeopardized by a case involving the similarly routed Atlantic Coast Pipeline in which the U.S. Court of Appeals for the Fourth Circuit found that the U.S. Forest Service (USFS) lacks authority to grant rights-of-way for oil and gas pipelines to cross the scenic trail.

MVP also can’t conduct any water-crossing work along its entire route after the Fourth Circuit last year vacated its NWP 12. Equitrans had been waiting on West Virginia regulators to revise the water quality certification standards and conditions that apply to the NWP 12, which they finished last week. But the Army Corps has to incorporate those changes and reissue its NWP 12, which is expected this summer.

The other key issue to which Karam alluded is work on a segment in the Jefferson National Forest in Virginia and West Virginia that remains on hold after another decision last year from the Fourth Circuit to vacate federal approvals issued by the USFS and the Bureau of Land Management authorizing a crossing. Those authorizations must still be revised.

When asked about the possibility of rerouting the pipeline to get around some of the issues, Karam said that’s a “path of last resort,” as it would create even more delays and cost increases. “As long as we continue to have traction and some positive movement on the other paths, we’re going to continue down those paths,” he said of the options the company is working toward to resolve current delays.

EQT Corp. CEO Robert McNally said last week management remains confident MVP will eventually be built, with timing the only concern. EQT is Equitrans’ largest producer customer. Those comments were also echoed by MVP joint venture partner NextEra Energy Inc., which also said last week the pipeline would begin service later than expected.

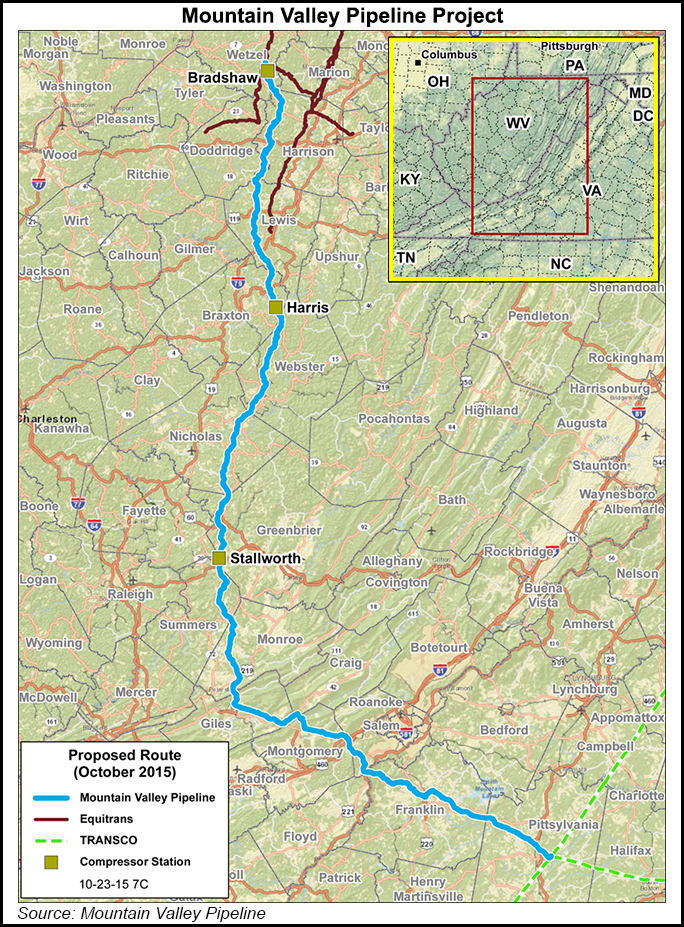

MVP would move Appalachian gas from West Virginia to Virginia and connect with the Transcontinental Gas Pipe Line to deliver more volumes to Southeast markets. Con Edison Transmission Inc., WGL Midstream and RGC Midstream LLC are also partners in the project.

Equitrans reported first quarter net income of $56.3 million (22 cents/share), compared with $82.7 million (33 cents) in 1Q2018 before it had separated from EQT’s upstream business. The company incurred about $5 million in expenses related to the separation and was also set to receive $134 million in cash from its ownership in EQM.

EQM, which now reports with Equitrans after the midstream split, reported first quarter net income of $251.9 million ($1.63/unit) versus $260.4 million ($1.61) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |