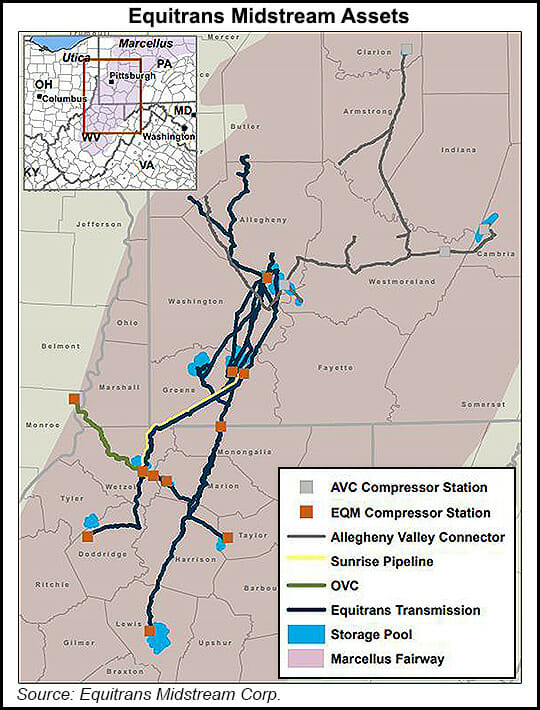

Equitrans Midstream Corp. is making headway to increase natural gas connectivity in the Appalachian Basin, with management evaluating shipper interest received during a recent open season.

The binding open season was related to Equitrans’ transmission system. It would increase shipper access to downstream markets in the Midwest and Gulf Coast, primarily through existing delivery interconnects with interstate pipelines in Clarington, OH.

Management is evaluating the shipper requests, “and there were several,” according to Equitrans COO Diana Charletta. Also under evaluation are the costs to complete the expansion and the project economics.

“There is still some back and forth with those shippers as far as where they want to come from and where they want to go,”...