E&P | NGI All News Access | NGI The Weekly Gas Market Report

EQT Touts Progress to Strengthen Natural Gas Juggernaut

EQT Corp. said it made significant progress in the first quarter on a strategic plan initiated late last year to generate more value and stave off an attempt by shareholders Toby and Derek Rice to take over the company, now the nation’s largest gas producer.

The company said ahead of a recent presentation at the Scotia Howard Weil Annual Energy Conferenceit expects 1Q2019 sales volumes to come in at the high end of its 360-380 Bcfe guidance range. Forecasted capital expenditures are also expected to come in as expected.

EQT has faced intense pressure to perform over the last year-and-a-half, a period in which it acquired Rice Energy Inc. and split its upstream and midstream businesses in two. That pressure has mounted in the face of a challenge for control of the company by the former Rice Energy co-founders, Toby and Derek, who believe EQT is severely undervalued.

EQT managed to identify another $50 million of cost savings during the first quarter in addition to $100 million identified and implemented in January, as it expects to ultimately save $800 million over the next five years. The early cost reductions, EQT said, would positively impact forecasted cumulative free cash flow between 2019 and 2023, which it now projects at $2.9 billion, versus the $2.7 billion it was aiming for when the year began.

CEO Robert McNally said the new management team, most of which was installed last year, is turning into a “free cash flow machine.” The “operating efficiencies we have implemented across EQT are allowing us to do more with less, including increasing lateral lengths across our program and increasing production.”

The Rice brothers have strongly disagreed, pitching their plans for the Pittsburgh-based company to investors and recently naming board candidates they intend to nominate at the shareholder meeting in July. The brothers gained control of about 3% of EQT after the sale of the family business.

Highlights from the Scotia Howard Weil presentation, though, show EQT’s management is trying to stay in control of the narrative. Management was open about how it cut guidance and increased spending in 3Q2018 after a frenzied stretch of drilling in the wake of the Rice acquisition put stress on supplies, logistics and pad operations. Since then, the executives have been intent on fixing those mistakes.

Year-to-date, EQT said it’s had a 40% improvement in rig movement efficiency and has moved completion crews 65% less. Across its Appalachian footprint, the company also said 90% of wells drilled deeper than 12,000 feet have been finished on time and on budget. The company has also seen a 35% improvement in stages per crew per month so far this year, according to the presentation.

The Rice brothers have also pushed for changes in the company’s well spacing, which management has not resisted, saying wider spacing will be targeted albeit at a slower pace than the brothers want.

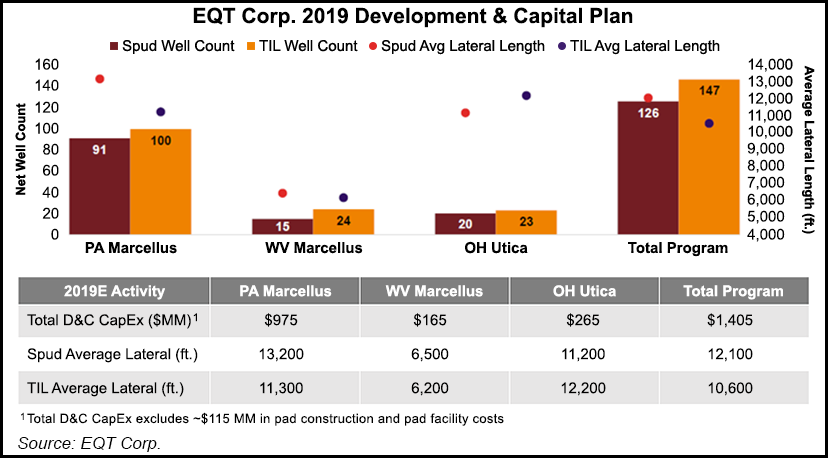

EQT is guiding for 1.470-1.510 Tcfe of production this year. The bulk of its $1.405 billion drilling and completions program will be spent on the Marcellus Shale in Pennsylvania, where it plans to spend $975 million, while the West Virginia Marcellus is slated to receive $165 million and the Ohio Utica is set to receive $265 million.

In recent years, the company’s Marcellus wells in Pennsylvania have been developed on tighter spacing. As recently as 2016, Marcellus wells in the state were spaced at 740 feet. That’s steadily inched up, reaching 840 feet last year. EQT is now targeting 880 feet by year-end 2019.

Statistical analysis, the company said, “identified meaningful performance relationships between interactions,” as neighboring wells and the distance between them played a key role, as they have throughout the basin and the U.S. onshore.

Test results, EQT said, showed support for wider spacing and larger fracture jobs to optimize development. Estimated ultimate recoveries increase on wider spacing, EQT said, going from about 2.2 Bcfe per lateral foot on 700-foot spacing to 2.8 Bcfe per lateral foot on 1,000-foot spacing.

Providing additional detail at the conference, EQT said its Pennsylvania Marcellus wells would have average lateral lengths of 13,200 feet, while its West Virginia wells would average 6,500 feet and its Ohio Utica wells would average 11,200 feet this year. Its five-year outlook also shows 2019 production volumes rising steadily in the coming years to reach nearly 2 Tcfe by year-end 2023.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |