NGI Archives | NGI All News Access

EQT Hits Record Sales Volumes Overall and in Marcellus

EQT Corp. announced Thursday that horizontal drilling in the Marcellus Shale helped the company achieve record sales volumes overall and in the Marcellus in 2012 — the latter an 85% increase from 2011 — as it posted net income of $183.4 million for the year.

The Pittsburgh-based company said overall production sales volumes were 258.5 Bcfe in 2012, a 33% increase from 2011.Of that total, approximately 58% came from the Marcellus. Overall production sales volumes were 76.2 Bcfe in 4Q2012, up 44% from the preceding year’s fourth quarter and up 12% from 3Q2012.

EQT waxed optimism for 2013, projecting production sales volumes from 335 to 340 Bcfe for the year, a 31% increase over 2012.

The company’s production division drilled 135 gross wells in 2012, with most (127) targeting the Marcellus with an average length of pay of 5,485 feet. Seven of the remaining wells were drilled into the Huron Shale, while one well targeted the Utica Shale. The company classifies its assets in the Lower Huron, Cleveland, Berea sandstone and other Devonian shales — except Marcellus — as the Huron play.

EQT said that as of Dec. 31, 2012, it had cumulatively drilled 375 horizontal wells in the Marcellus. Of those, 262 were online and 17 were complete but not yet online. The company has also cumulatively used 7,289 frac stages, a figure that includes planned stages for wells that have not yet been hydraulically fractured.

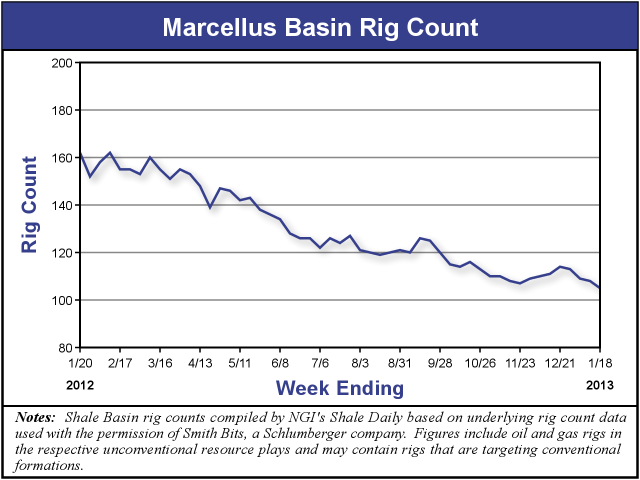

While drilling activity in the Marcellus has dropped precipitously over the last year due to relatively low natural gas prices, the shale play is still one of the most active in the country. For the week ending Jan. 18, there were 105 rigs actively drilling for oil and gas in the Marcellus, which is down 35% from the 162 rigs in operation one year ago, according to NGI’s Shale Daily Unconventional Rig Count. However, the play is third in unconventional drilling activity in the United States behind only the Bakken/Sanish/Three Forks (209 rigs) and the Eagle Ford Shale (229 rigs), which are both classified as being more liquids-rich.

Production operating income totaled $187.9 million in 2012 (down $199.2 million, a 51.4% decrease, from 2011), while operating revenue was $793.8 million in 2012 (up $2.5 million, a 0.32% increase, from 2011). The company said increased revenue from sales volume growth was nearly offset by lower realized commodities prices and the resale of unused transportation capacity.

The average wellhead sales price was $4.26/Mcfe (down 21% from 2011), of which $3.05/Mcfe was allocated to EQT Production and the remaining $1.21/Mcfe given to EQT Midstream.

The company’s midstream division had operating income of $237.3 million in 2012, an 11% increase from 2011. That figure excludes the $202.9 million the company made before taxes from the sale of its Big Sandy Pipeline in eastern Kentucky to Spectra Energy Partners LP (see Daily GPI, May 13, 2011), and its gas processing complex in Langley, KY, to MarkWest Energy Partners LP (see Shale Daily, Jan. 5, 2011).

EQT Midstream said it realized higher gathered volumes — a record 335.4 TBtu, up 30% from 2011 — and an increase in firm transportation revenues in 2012. Net operating revenues for the division were $449.4 million in 2012 (up $44.8 million, an 11% increase, from 2011), and net gathering revenues were $302.3 million (up 21% from 2011). The company attributed the latter to a 30% increase in gathered volumes, which itself was partially offset by lower gathering rates.

The midstream division also saw net transmission revenues increase in 2012, by 16% to $104.5 million. EQT said the increase was driven by increased capacity on its Sunrise Pipeline project (see Shale Daily, July 23, 2012; June 14, 2012).

Although the $183.4 million of net income EQT earned in 2012 was much lower than the $479.8 million it made in 2011, the company said that “to accurately review and compare the year-over-year earnings results, certain items should be considered.” Specifically, the company said the Big Sandy and Langley sales boosted the 2011 figures, while $62.2 million in net losses dragged down the bottom line for 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |