Earnings | E&P | NGI All News Access | NGI The Weekly Gas Market Report

EQT Brings Back 1 Bcfe/d in Appalachia as Natural Gas Demand Said Improving

EQT Corp. said Monday it has returned the 1 Bcfe/d of Appalachian production to sales this month that was curtailed in May.

The company deferred the volumes as prices eroded from the coronavirus impact on demand. EQT started bringing back the production earlier this month and said it has so far seen no issues with well performance.

CFO David Khani said the company could curtail production again if prices don’t improve, but noted the company is for now well hedged. Management continues to see the outlook for natural gas improving.

“Looking forward, we believe the market will be much more supportive as the rapid decline in oil directed activity and uncertainty around future oil pricing reduces a material amount of associated gas from the market,” CEO Toby Rice said during a call to discuss second quarter results.

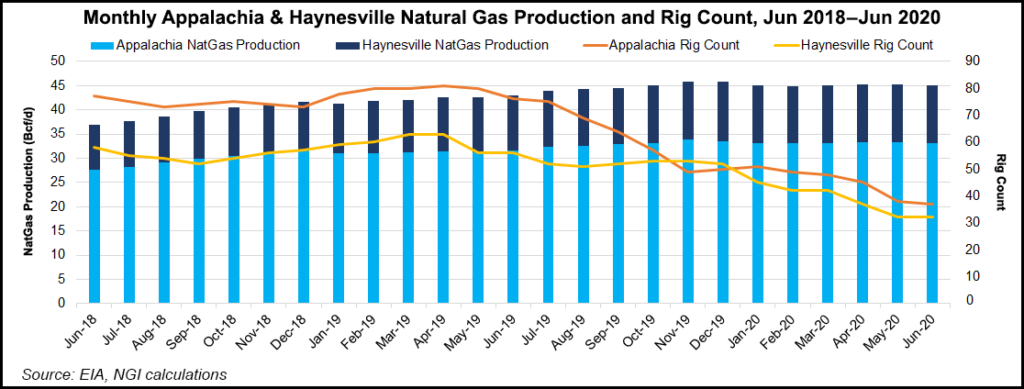

Significant declines in rig counts in Appalachia and the Haynesville Shale, along with winter weather and slowly rebounding demand should help push up prices, he said. “We believe the natural gas strip is undervalued,” Rice added. “Because of this view, we have been patient hedgers, leaving upside in 2021.”

Even still, given the reality of the gas strip, management intends to run the company at maintenance levels until the commodity market improves.

In the near-term, a top priority for EQT is reducing its capacity on the Mountain Valley Pipeline (MVP) to help cut costs. The 1.5 Bcf/d Atlantic Coast Pipeline was cancelled by Dominion Energy Inc. earlier this month after years of regulatory and legal delays. The 2 Bcf/d MVP would serve the same markets and Khani said customers that had signed up for ACP capacity will still need natural gas, a positive development for MVP, which is Equitrans Midstream Corp.’s marquee project.

EQT is Equitrans’ largest customer. Khani said the company is already holding discussions with ACP customers. MVP, which has also faced continued regulatory hurdles is about 92% complete and expected to enter service next year. It got another boost when the U.S. Supreme Court earlier this month reinstated the Nationwide Permit 12, a key authorization for pipeline construction.

Second quarter production came in at 346 Bcfe, or 3.8 Bcfe/d, 24 Bcfe lower than 2Q2019, due to the curtailments. While second quarter production was still above the midpoint of the company’s guidance for the period, the drop in volumes cut operating revenues and dented quarterly profits.

EQT also reported an average realized price of $2.36/Mcfe, a 56-cent premium to New York Mercantile Exchange Pricing, but it was still 9% lower than year-ago prices. Free cash flow also decreased by $1 million, but was in line with year-ago results due to a $163 million cut in capital expenditures.

The company has pursued aggressive cost cutting and completely overhauled its operations under a new management team led by Rice that has now been at the helm for just over a year. As the nation’s largest natural gas producer grappled with the pandemic, management still reported progress in their efforts to turn the company around.

Marcellus Shale well costs in Pennsylvania came in at $680 per foot, or $50 below management’s long-stated target of $730 per foot. Production uptime was also over 98% during the second quarter, while horizontal drilling speeds improved 63% year/year and 12% quarter/quarter. Management also said next generation hydraulic fracturing technology has driven a 20% improvement in pumping time and stages per day since July 2019.

In June, EQT said it set a record by drilling 10,566 feet, or more than 2 miles, in a 24-hour period.

EQT reported a second quarter net loss of $263 million ($1.03/share), compared to net income of $126 million (49 cents) in the year-ago period. Along with a decline in revenues, the company said it took a loss on the divestiture of long-lived assets that impacted earnings, among other things, such as an increase in interest expense.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |