E&P | NGI All News Access | NGI The Weekly Gas Market Report

E&Ps STACK-piling Acreage, See Major Upside in Midcontinent

Though often overshadowed by its Permian cousin to the south, the Anadarko Basin, with its stacked reservoirs, is generating plenty of buzz in its own right heading into 2017.

Among the major Midcontinent players, the talk of 2Q2016 was the Sooner Trend of the Anadarko Basin, primarily located in Canadian and Kingfisher counties — better known as the STACK, an apt acronym that also describes the overlapping target horizons that characterize the area’s geology.

The STACK is often referenced in the same breath as the nearby SCOOP (South Central Oklahoma Oil Province) located to the southeast. The SCOOP and STACK share similar characteristics, and both came onto the scene fairly recently, but Baker Hughes Inc. data suggests it’s the STACK that’s been getting more of the attention in 2016.

For the week ending Oct. 14, the number of rigs in the SCOOP climbed out of the single digits to reach 11, up from a low of 6 in April, but down from 16 in the year-ago period, according to Baker Hughes data and NGI calculations. Meanwhile the STACK rig count, after bottoming out at 16 in June, increased to 28 last week, up from 20 in the year-ago period.

With a long slog of a recovery visible just over the horizon, a number of producers have been turning drillbits in the STACK to hold by production (HBP) and delineate their acreage, hoping to pick out the right time and place to strike as prices improve. To see where producers are focusing their attention and capital, check out NGI’s latest special report: THE SOONER BOOMER: How SCOOP, STACK and the OK Liquid Plays are changing the game in the Midcontinent.

Newfield Exploration Co. CEO Lee Boothby, speaking to investors during a conference call to discuss second quarter results, laid out the exploration and production (E&P) company’s strategy as it waits out the downturn: “No. 1, HBP our STACK play. No. 2, maintain a strong balance sheet. No. 3, sell non-strategic assets. And four, ready the organization for the timely acceleration of our top-tier developments in the SCOOP and STACK when the commodity prices provide the right signals.”

Midcontinent Players Making STACK-quisitions

For signs that the STACK will be next in line behind the Permian during the recovery, look no further than the recent acquisition activity among some of the play’s largest acreage holders.

Newfield announced in August that it was selling its Texas portfolio, including Eagle Ford Shale acreage and conventional natural gas assets, to focus capital on the STACK (see Shale Daily, Aug. 3). This came after Newfield agreed in May to pay $470 million to Chesapeake Energy Corp. to add 42,000 net acres prospective for the Meramec formation (see Shale Daily, May 5).

In June, Marathon Oil Corp. agreed to pay $888 million to acquire PayRock Energy Holdings LLC, adding 61,000 net acres in the Anadarko to its portfolio (see Shale Daily, June 20).

And in August, Austin, TX-based Jones Energy Inc. dipped its toes in the STACK with a $136.5 million, 18,000 net-acre deal with SCOOP Energy LLC to buy up assets in Canadian and Grady counties (see Shale Daily, Aug. 18).

Going back to December 2015, when West Texas Intermediate prices dipped below $40/bbl, Oklahoma City-based Devon Energy Corp. opened its wallet to the tune of $1.9 billion to buy up acreage in Blaine, Canadian and Kingfisher counties from Felix Energy LLC (see Shale Daily, Dec. 7, 2015a). Meanwhile, its majority-owned partnership EnLink Midstream shelled out $1.55 billion to purchase gathering and processing assets for the Felix production (see Shale Daily, Dec. 7, 2015b).

It’s not the land grab that’s been taking place in the Permian (see NGI’s special report, Permian Basin: ”The Mother Lode’). However, it’s clear that producers view the STACK as one of the most economic plays around, especially under a new normal of lower-for-longer crude prices.

In a September note on the recent slew of Permian and STACK merger and acquisition (M&A) deals, BTU Analytics LLC’s Marissa Anderson calculated a per-acre price for the Devon, Newfield, Marathon and Jones acquisitions of $12,350. That’s compared to $34,300/acre for recent acquisitions in the Permian’s Midland sub-basin and $24,350/acre in the Delaware sub-basin.

Anderson also calculated the price per drilling location, noting that this metric might better reflect the value of these transactions given the multiple stacked targets in the two plays.

Counting producer-reported drilling locations, prices in the Permian averaged out to $1.6 million/location in the Midland and just under $1.8 million in the Delaware. The STACK deals averaged out to slightly more than $1 million/location, lower than the Permian “though still significant” in Anderson’s estimation.

“The Permian and the STACK are both areas that provide attractive growth opportunities for producers,” Anderson said. “M&A activity will continue in these areas as producers look to establish and grow positions in plays deemed likely to factor into the North American supply stack no matter what commodity price environment lies ahead. But given that some of the recent acquisitions seem to be pricing in significant upside potential, time will tell whether buying at today’s purchase prices are good strategic moves or ill-advised actions in a frothy market.”

NGI’s Patrick Rau,director of strategy and research, had a similar takeaway regarding the recent string of M&A activity in Texas and Oklahoma.

“It seems to me these acreage premiums in the Delaware, and to a lesser extent in the STACK, are being driven by actual economics, and the fear that in the ”lower for longer’ crude oil price world, these are going to be two of the only truly economic areas going forward,” Rau said. “Not to mention that increased production from these multiple zones is likely going to increase U.S. crude production, which could drive the world crude price even lower going forward, making it all that much more important to hold acreage in the very best areas.

“I don’t know if this is a big panic time, a la the urgency the industry saw back during the great unconventional land grab of 2008, in terms of ”if we don’t get into these plays now while everyone else is doing it, we are screwed,’ but more and more, it’s starting to smell like it.”

While Oklahoma’s economic stacked reservoirs have piqued the interest of producers, the state’s oil and gas activity has also drawn negative attention in 2016 as a result of seismicity linked to underground injection wells. September saw Oklahoma experience its largest earthquake to date — a 5.8 magnitude temblor that struck Pawnee County — prompting further action from regulators already carefully tracking seismicity in the state (see Shale Daily, Sept. 13). The U.S. Environmental Protection Agency has recommended a moratorium on oil and natural gas disposal wells in sensitive areas of the Arbuckle Formation (see Shale Daily, Oct. 11).

Early Well Results Showing Promise

Recent well results from the STACK have shown plenty of promise, leading producers to wax optimistic about the play’s economic viability heading into 2017.

In September, Devon reported initial production rates of 2,200 boe/d per well (55% weighted to oil) from its seven-well Pump House pilot project targeting the Meramec in Kingfisher County, the independent’s third Meramec spacing pilot (see Shale Daily, Sept. 8).

“Results from our initial three Meramec spacing tests are outstanding, with flow rates exceeding type-curve expectations and minimal interference between wells,” COO Tony Vaughn said. “These positive results indicate the potential for tighter spacing and increased inventory in the core of the over-pressured oil window.

“We continue to advance several additional Meramec spacing tests that will help us accelerate learnings and further prepare for full-field development in 2017 across our industry-leading position in the STACK.”

Reporting its 2Q2016 results, Marathon Oil said it drilled two gross company-operated STACK Meramec wells with extended laterals (XL) during the quarter, the Irven John and the Olive June, which produced at 30-day rates of 1,710 boe/d (70% oil) and 1,570 boe/d (75% oil) respectively. The company also announced results from three other Meramec wells brought online since closing on its STACK acquisition — Moeller, Blackjack and Post — reporting production rates of 1,925 boe/d (51% oil), 1,365 boe/d (47% oil) and 780 boe/d (51% oil) respectively (seeShale Daily, Aug. 5a).

Continental Resources Inc., the second largest acreage holder in the STACK heading into the third quarter at 351,000 acres, raised its production guidance in August based on “outstanding” results from the play (see Shale Daily, Aug. 5b).

Continental drilled five wells targeting the Meramec in 2Q2016. In the overpressured oil window, the Madeline, Frankie Jo, Gillilan and Oppel wells yielded initial production (IP) rates of 3,538 boe/d (71% oil), 2,627 boe/d (56% oil), 2,439 boe/d (70% oil) and 1,308 boe/d (76% oil) respectively, with the Madeline well setting a company record. In the overpressured gas window to the south, Continental completed its Yocum well, with an IP rate of 2,355 boe/d 99% weighted to gas.

In June, Newfield raised its 2016 production guidance on the strength of its STACK well results. Three recent XL wells in the company’s eastern area of the STACK — Edgar, Vickie and Church — averaged 751 boe/d, 774 boe/d and 740 boe/d respectively through the first 90 days. Newfield’s Helen well, drilled for a record-low $6.2 million at the time, produced 1,168 boe/d gross over its first 30 days in production (see Shale Daily, June 22).

Newfield’s Boothby, speaking to analysts, offered some insight into why the operator has made such a big bet on the Anadarko moving forward.

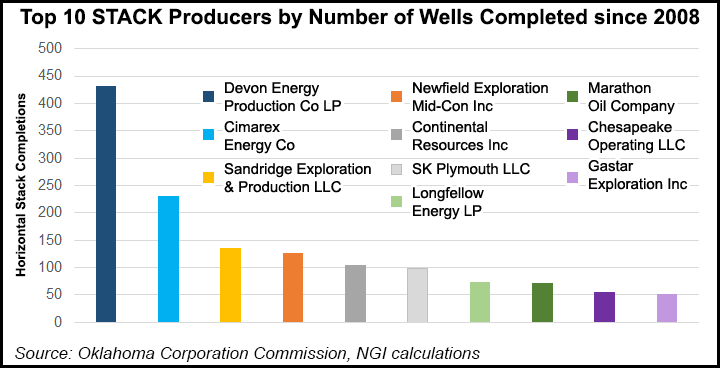

“Industry activity has led to the drilling of more than 500 STACK wells to-date with consistent results across a multi-county area. This extensive well control along with our more than 100-plus operated STACK wells today provide us with heightened confidence in the size of this prolific resource, the depth and quality of our undrilled prospect inventory and its ability to drive corporate growth and production and reserves well into the future,” he said.

As Newfield has been focusing on HBP’ing its acreage, the E&P has been drilling with future growth in mind, purposefully leaving two miles undeveloped between its initial wells, Boothby said.

“We have exposure to all hydrocarbon phases across our acreage. As you transition from dry gas in the Cana Field and move north and east, you enter the oil window, which is what we originally targeted when our leasing began here five years ago. Today, we have solid representation to the west where we are confident that EURs [estimated ultimate recovery] and gas content both move significantly higher,” he said.

“For us, it’s about rate of return. Well costs are lower in the oil window. As gas content increases to the west, EURs also rise. It all has a great rate of return, and we are very fortunate to be represented across the entirety of the STACK play today. Oklahoma, more specifically the Anadarko Basin, provides commodity diversity and optionality. Once HBP’d, we will have the flexibility to target the right commodity at the right time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |