NGI The Weekly Gas Market Report | Coronavirus | E&P | Markets | NGI All News Access

E&Ps, OFS Operators Cutting Capex and Salaries as Covid-19 Reshapes Markets

A stream of oil and natural gas producers, as well as their oilfield services brethren, are proactively responding to the downturn in oil prices and the slump in demand by reducing spending, activity and in some cases, agreeing to take salary cuts.

U.S. exploration and production (E&P) operators stepping up since late Wednesday to announce cutbacks in 2020 capital expenditures (capex) and activity plans in the Lower 48, Gulf of Mexico (GOM) and overseas include Apache Corp., Contango Oil & Gas Co., Devon Energy Corp., Murphy Oil Corp., Noble Energy Inc., Ovintiv Inc., PDC Energy Inc. and QEP Resources Inc.

The parade of pullbacks by the energy sector began earlier in the week after Brent and West Texas Intermediate (WTI) oil prices crashed, with a number of operators already announcing they would retrench. The pullback is likely to continue as analysts calculate the impact on global fuel markets because of reduced travel.

In an ever-evolving demand picture, Rystad Energy on Thursday updated most of its estimates, with the forecast for global oil now projected to decrease by 0.6% this year, or 600,000 b/d year/year. Total oil demand in 2019 was about 99.8 million b/d; it is now projected to decline to 99.2 million b/d in 2020, and takes into account the quarantine lockdown in Italy, cancellations of airline travel, as well as the partial travel ban announced by President Trump last Wednesday.

On Friday, oil prices were recovering somewhat along with the stock market as optimism increased for passage of a U.S. stimulus package, Rystad senior market analyst Paola Rodriguez-Masiu said. However, the Organization of the Petroleum Exporting Countries has canceled a joint technical committee meeting scheduled Wednesday (March 18), sending “a very clear signal that neither Russia nor Saudi Arabia are willing to blink just yet” in their price war.

“Instead, a stronger ”pump-at-will’ attitude is emerging as the Saudis try to build a more appealing case to bring Russia back to the negotiating table. The Saudis know that if prices sink into the $20s there is a higher chance to reach a compromise within the next three months, but if prices remain in the high $30s a deal will be more difficult. Moreover, we find that it is unlikely that Russia is willing to renegotiate cuts until the full impact that the coronavirus will have in demand becomes clearer.”

Rystad estimates that Russia could bring online less than 500,000 b/d more in the short term, while the Saudis could add about 1.5 million b/d. Russia has fiscal breakeven oil prices that are about half of that for the Saudis, according to the firm.

“Moscow said on several occasions that it can withstand oil prices of $30 for six-to-10 years,” Rodriguez-Masiu said. “In addition, Russian floating currency makes Russia more effective to control prices drops, as it acts as a shock absorber.”

Protecting employees who work in the energy industry has become a paramount concern too, as Equinor SA, Repsol SA and Royal Dutch Shell plc recently indicated some staff may have been exposed to Covid-19. The American Petroleum Institute also has published information about safety and health concerns.

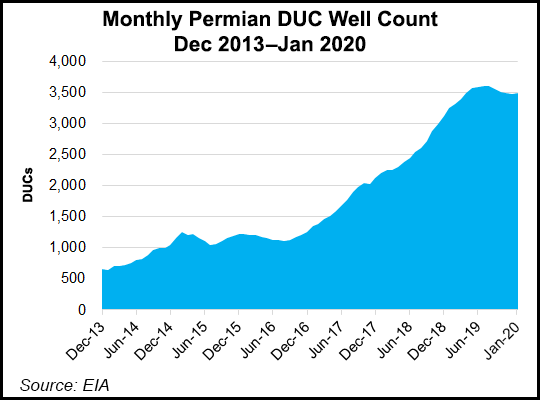

ZERO PERMIAN RIGS

U.S. operators are stepping up, with Houston-based Apache dropping all of its Permian Basin rigs and slicing its dividend by 90%. It has cut capex to $1-1.2 billion from $1.6-1.9 billion and in the coming weeks, “will reduce its Permian rig count to zero, limiting exposure to short-cycle oil projects.” Activity reductions are also planned in Egypt and the North Sea, while a Suriname exploration prospect remains on tap.

Additionally, Apache’s board gave the green light to slash the quarterly dividend to 2.5 cents/share from 25 cents effective March 12, with the estimated $340 million retained from the annual dividend used to strengthen the bottom line.

Houston’s Noble Energy agreed to cut global spend by $500 million, or nearly 30%, to $1.1-1.3 billion. About 80% of the reduction would be in Lower 48 capex, and more than half of the pullback in the Permian Delaware.

“Deferring activity until commodity prices recover protects our investment returns, maintains free cash flow and strengthens the balance sheet,” CEO Dave Stover said. “The impact of bringing a mega-project like Leviathan on production is evident today, as it provides greater certainty of cash flows, supports strong financial liquidity and improves our annual production decline profile.”

Oklahoma City-based Devon has reduced capex by 30%, or $500 million, to $1.3 billion. The capital reductions would be “diversified across Devon’s portfolio,” with the brunt of the cutbacks in the Powder River Basin and Oklahoma’s Anadarko Basin. Activity this year is now to be centered in the Permian Delaware and Eagle Ford Shale.

Denver-based Ovintiv Inc. (formerly Encana Corp.) also is pulling back, reducing capex by $300 million and full year cash costs by $100 million. Said CEO Doug Suttles, “It is imperative to take immediate action and we are dropping roughly two-thirds of our operated rigs and reducing our cash costs by $100 million. Market conditions are changing rapidly, and we have full operational flexibility to further adjust activity to maintain our balance sheet strength.”

PRIORITIZING BOTTOM LINE

Denver-based PDC Energy Inc., which works in the Permian and the Wattenberg field of Colorado, is reducing capex by 20-25% from original guidance of $1-1.1 billion. Production is now expected to be flat from 2019. The updated operating plan is using a WTI oil price average of $35/bbl for 2020 and $40 in 2021. Assumed New York Mercantile Exchange natural gas prices average $2.00/Mcf for 2020 and $2.40 in 2021, with natural gas liquids realizations of $7-9 /bbl through next year.

Meanwhile, El Dorado, AR-based Murphy Oil Corp. has reduced 2020 capex by $500 million to $950 million, a 35% reduction from the midpoint of original guidance. The revised plan includes delaying some U.S. GOM projects and development wells. Murphy also plans to reduce activity in the Eagle Ford, with no operated activity in the last six months of this year, and it plans to defer well completions in the Montney formation in Canada.

Denver-based QEP Resources Inc. also has cut capex by $300 million, down by about 30%. The company is suspending completions in the Permian from early May to the end of the year and plans to suspend refracturing operations in the Williston Basin through 2020.

CONSIDERING SHUT-INS

Houston’s Contango Oil & Gas Co. also is taking actions to preserve its liquidity and is undertaking “an extensive review of all of its producing areas to determine the economic or operational justification for continuing to produce unhedged barrels in this price environment, and where determined not justified, and operationally feasible, evaluate potentially shutting in or curtailing production.”

In addition, Contango management is reevaluating the “economic justification in this price environment for proceeding with the production-enhancing workover program originally scheduled for the first half of 2020.” The limited onshore development drilling planned for 2020 also is being reevaluated.

Utilities also are accommodating customers during the pandemic.

San Francisco natural gas utility Pacific Gas and Electric Co. on Friday said because of the pandemic, it has voluntarily implemented until further notice a moratorium on service disconnections for nonpayment for residential and commercial customers.

As well, New York’s Consolidated Edison has suspended temporarily any electric and gas service shutoffs involving customers having payment difficulties to its entire service area of New York City and Westchester County. In addition, the Public Service Commission of Wisconsin also has directed water, electric and natural gas utilities to cease disconnecting residential service for nonpayment until the state public health emergency has been lifted. Additionally, utilities must make reasonable attempts to reconnect service to an occupied dwelling that has been disconnected.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |