Eagle Ford Shale | E&P | Earnings | LNG | NGI All News Access | NGI The Weekly Gas Market Report

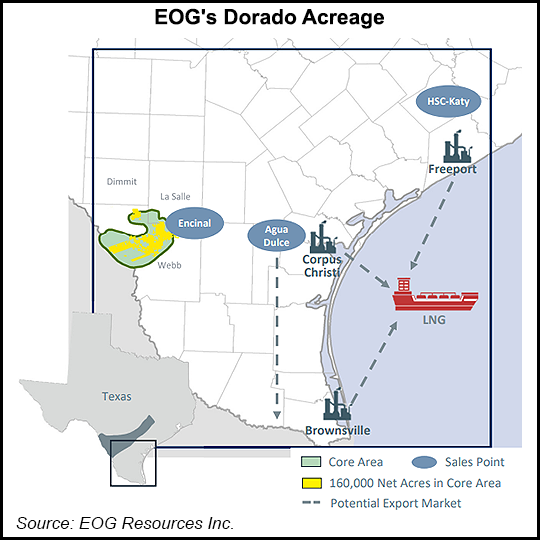

EOG to Develop Austin Chalk, Eagle Ford Zones in Tandem at Gassy Dorado

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |