EOG Resources Ups the Ante in Wyoming PRB

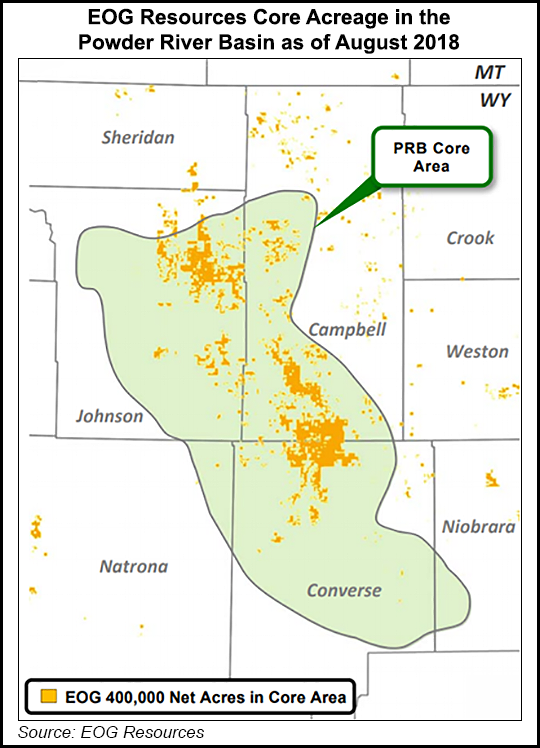

Known for its diverse holdings in major plays and basins stretching from South Texas to the Rockies, Houston-based EOG Resources Inc. on Friday went all in on parts of the Powder River Basin (PRB) in Wyoming to exploit the Mowry and Niobrara formations, with the PRB now its third-largest asset.

“PRB demonstrates the value of our exploration focus where we have been able to expand our assets in size and quality, adding many new locations much faster,” said CEO Bill Thomas.

EOG has identified what exploration chief David Trice called two “premium plays” in the PRB — tapping into the Mowry and Niobrara, which makes them good targets for “additional efficiencies” in the future. “These two new plays overlap much of our existing acreage in the PRB allowing development of both concurrently.”

“The Mowry and the Niobrara are in the range of premium return rates with very low development costs,” said Trice, adding that EOG’s share of the plays equals 1.2 billion boe from 875 locations using 660-foot spacing, with at least half of the resource expected to be crude oil. “The PRB is now ready to become a meaningful contributor to EOG’s future growth.”

EOG executives talked just as bullishly about the midstream gathering and processing infrastructure the company has available and/or planned in the PRB. EOG’s Lance Terveen, senior vice president for marketing, said there are four processors for liquids-rich natural gas in the operating area “with significant high pressure gathering systems and back-up systems as contingencies.”

In response to questions from analysts, Thomas cautioned that the real uptick in production volumes in the Mowry and Niobrara is not likely until late 2019 and into 2020 because activity will need to be increased earlier next year, including the building out of takeaway infrastructure.

Thomas was also asked whether EOG was acquiring too many new potential drilling sites spread over too many basins and facing a 13-year backlog. Trice noted that the replacement efforts aimed at improving the quality of the company’s overall portfolio rather than just adding volumes.

“What that does is give us the ability to shift our capacity, based on returns,” Trice said.

Ultimately, Thomas noted that generating more and better inventories for a portfolio is not a problem. And he is confident that his company can convert the majority of those wells into premium sites, although they may not be designated as such initially.

EOG earned $696.7 million ($1.20/share) in 2Q2018, compared with $23.1 million (4 cents) for the same quarter last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |