Shale Daily | Bakken Shale | Coronavirus | E&P | Eagle Ford Shale | Earnings | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

EOG Positioned to ‘Weather the Storms’ Amid Market Volatility, CEO Says

EOG Resources Inc. CEO Bill Thomas expressed confidence Friday in the company’s ability to withstand a sustained decline in commodity prices, even as the coronavirus roiled financial markets and put downward pressure on demand forecasts for oil and natural gas.

Houston-based EOG, a major onshore producer across multiple basins in the Lower 48, implemented what it called a “premium” well standard in 2016 following the global commodities crash that began in mid-2014.

“The premium well strategy dictates that a well isn’t a well unless it earns at least 30% return at an oil price of $40,” Thomas told analysts during a 4Q2019 earnings call. After three years of adding well inventory under those guidelines, “our median premium inventory well today actually yields a direct, [after-tax] rate of return of over 55% at flat $40 flat oil prices. With a $50 oil price, the median return soars to more than 80%.”

EOG’s portfolio of producing assets spans the Permian, Powder River, Denver-Julesburg and Williston basins, as well as the Eagle Ford Shale.

“With our strong balance sheet and flexibility, EOG is better positioned now, both financially and operationally, to weather the storms than it’s ever been in the past,” Thomas said, citing that operational performance in 2019 was the best in the company’s history.

“With an industry-leading return on capital employed of 12% in 2019, we beat our plan in every respect…We grew oil production at a lower cost per barrel than ever before, and delivered on our goal of double-digit returns and double-digit growth in a modest oil price environment.”

Thomas claimed EOG has among the lowest natural gas flaring rates in the industry, citing an industry friendly report recently compiled by Railroad Commission of Texas member Ryan Sitton. Thomas also highlighted that EOG’s water consumption fell by 25% year/year (y/y) in 2019, and that produced accounted for 75% of the water used by EOG for its operations.

Asked by an analyst about the threat posed by the coronavirus, Thomas said, “We certainly hope and pray it’s a short-term event, but if it turned to a longer-term event…we’re in a fantastic position.” He added that “we’ve got a great balance sheet…and then we’re very flexible. We have an operational ability to adjust activity.”

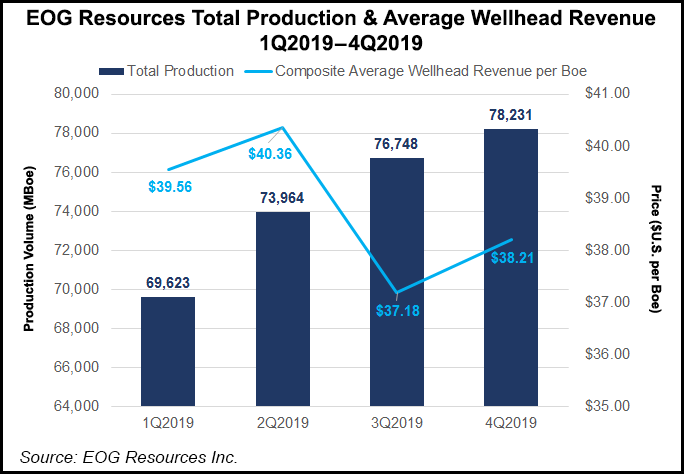

EOG’s oil volumes in the fourth quarter totaled 468,900 b/d, above the midpoint of its guided range, and up 8% y/y. Natural gas liquids (NGL) production rose 17% to 144,000 b/d, while natural gas output expanded 15% to 1.425 Bcf/d, comprising 1.15 Bcf/d in the United States, 242 MMcf/d in Trinidad and Tobago, and 35 MMcf/d from other international operations.

Full-year U.S. oil volumes rose 15% to 455,500 b/d, with NGL output rising 16% to 134,100 b/d, and natural gas production up 12% to 1.37 Bcf/d.

EOG reported net income of $637 million ($1.10/share) for the fourth quarter, versus $893 million ($1.54) in the fourth quarter of 2018. Full-year net income was $2.7 billion ($4.71/share), down from $3.4 billion ($5.89) in 2018.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |