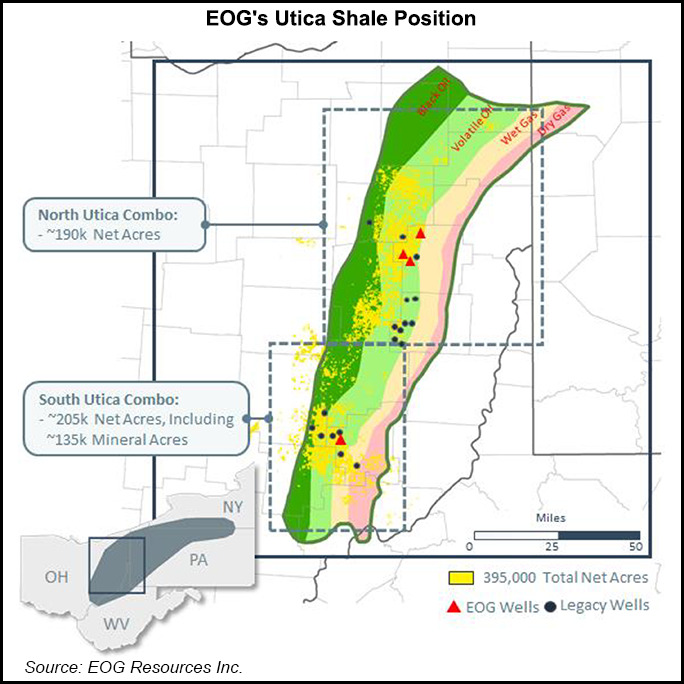

EOG Resources Inc. expects the Utica Shale in Appalachia “to be its next large-scale premium resource play” following the acquisition of 395,000 net acres and 135,000 mineral acres for a combined cost of less than $500 million, management said.

The Houston-based exploration and production firm unveiled the acquisition alongside its third quarter earnings.

The acreage spans a 140-mile trend targeting oil and both wet and dry natural gas in the Utica, management said.

“EOG is now operating seven significant resource basins with the addition of the Utica Combo in Ohio,” said CEO Ezra Yacob. “Our growing multi-basin portfolio of high-return plays positions EOG for long-term sustainable value creation.”

EOG’s vast Lower 48 footprint includes operations in the...