Earnings | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

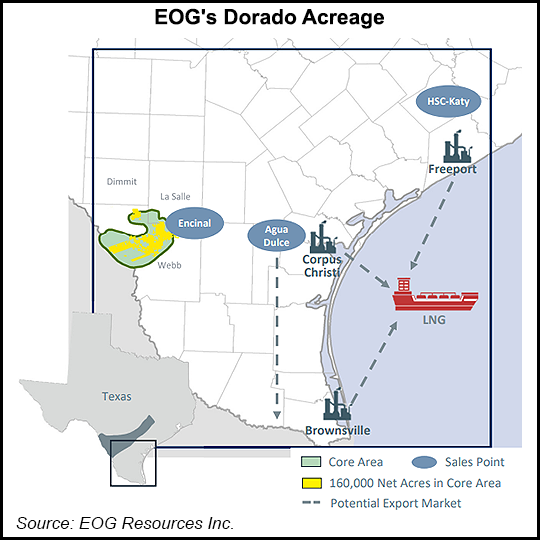

EOG CEO Calls Firm ‘Better Than Ever,’ Boosted by Permian, Dorado Output

Markets

Natural Gas Futures Retreat as TC Energy Limits Effects of Western Canada Pipeline Rupture

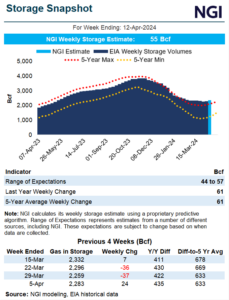

Natural gas futures gave back some of Tuesday’s gains Wednesday after TC Energy Corp. said it was able to isolate the impacts of a rupture of its Nova Gas Transmission Ltd. (NGTL) pipeline in Western Canada. At A Glance: NGTL incident is contained Analysts expect moderate injection Production at 98.4 Bcf/d Futures jumped more than…

April 17, 2024Natural Gas Prices

Canadian Natural Gas Production Holds Strong, on Track for Record Year Despite Price Weakness

April 17, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.