A dramatically improved commodity price environment helped drive strong results in 2Q2021 for Enterprise Products Partners LP, and looking ahead management anticipates an “extended recovery cycle” for the oil and gas industry.

The Houston-based midstreamer’s 2Q2021 results “reflect the ongoing recovery in demand for hydrocarbons” as the global economy emerges from Covid-19 restrictions, co-CEO Jim Teague said during a conference call with analysts Wednesday.

Compared to the cratering crude oil prices and shrinking rig counts this time a year ago, in 2021 “the environment and sentiment are completely different,” the executive said.

Now, West Texas Intermediate crude prices have been trading north of $70/bbl.

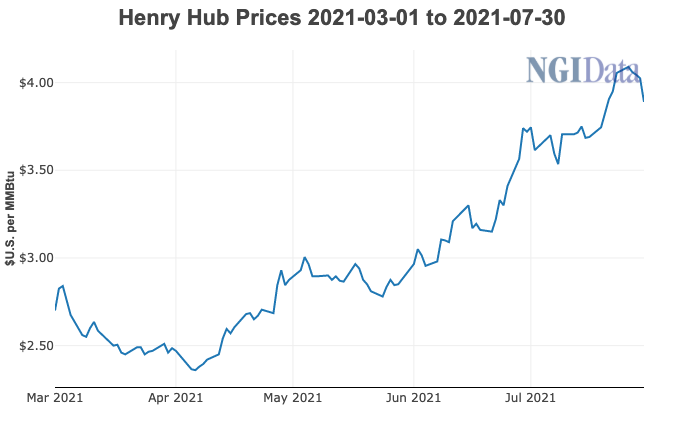

“Natural gas has more than doubled from...