Dallas-based EnLink Midstream LLC has increased its earnings guidance for 2021 amid strengthening natural gas and oil prices, with an eye on expanding operations and lowering carbon emissions.

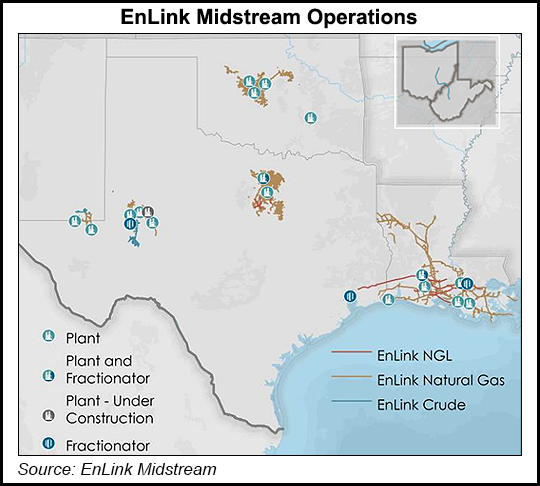

“We are pursuing exciting growth opportunities in the Permian and Louisiana, as well as experiencing improved activity in Oklahoma and North Texas,” CEO Barry E. Davis said. “Coupled with our commitment to capital efficiency and execution excellence, these opportunities have resulted in a substantial increase” to expected free cash flow (FCF) and profits.

EnLink also is continuing to “benefit from a supportive commodity price environment and a ramp-up of producer activity,” Davis noted.

In the first three months, the Permian segment had “robust producer activity,”...