LNG | LNG Insight | NGI All News Access

Eni’s Bashrush Natural Gas Well Builds Eastern Med Export Potential

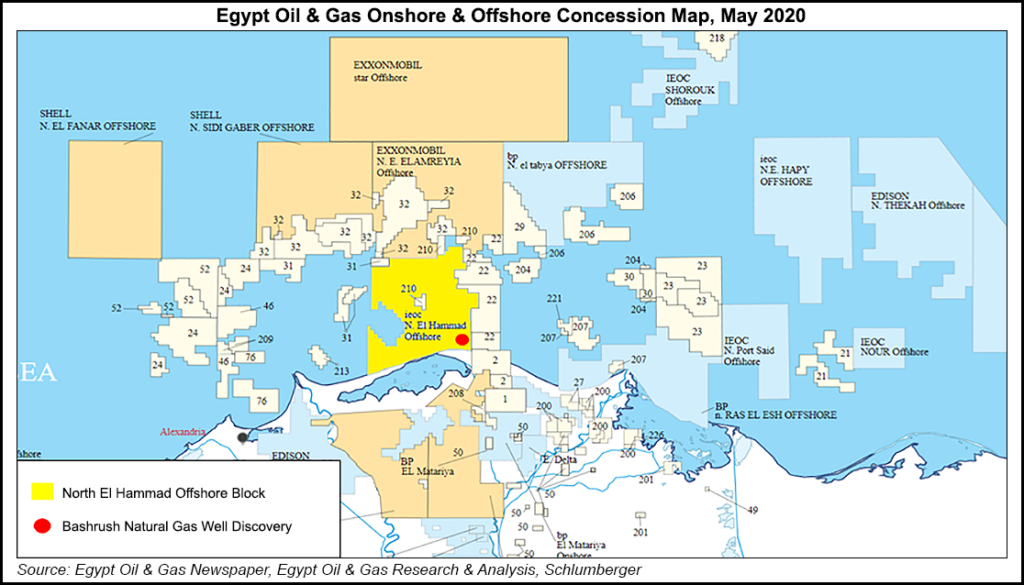

Eni SpA, together with partners BP plc and Total SE, said they have successfully tested a well drilled on the Bashrush prospect offshore Egypt, expanding the possibility for exports to thirsty ports.

Bashrush is in the Eastern Mediterranean (Med) within the North El Hammad concession, in the Nile Delta. Seven miles from the coast, the well is around 7.5 miles northwest of the Nooros field and about a half-mile west of the Baltim South West field, both already in production, Eni noted in early July.

Bashrush was discovered in a single gas column about 500 feet thick, “within the Messinian age sandstones of the Abu Madi formation with excellent petrophysical properties,” Eni said.

The well was opened to test the production potential, delivering up to 32 MMcf/d, Eni said. The well’s test rate “was limited by surface testing facilities.”

Production deliverability was estimated at up to 100 MMcf of gas and 800 b/d of condensate.

Eni and its partners, in coordination with Egyptian Natural Gas Holding Co. (EGAS), plan to continue to screen the development options of Bashrush, with the aim to fast track production through synergies with the area’s existing infrastructure.

In the North El Hammad concession, in participation with EGAS, Eni affiliate IEOC holds a 37.5% interest in Bashrush and operates the well. BP also has a 37.5% stake, while Total has a 25% share.

Eni, which has worked in Egypt since 1954 through IEOC, said current equity production is estimated at more than 300,000 boe/d.

Offshore natural gas discoveries have been frequent in the past few years, and the Eastern Med has become a hotbed.

One of the newest was last year by ExxonMobil and partner Qatar Petroleum Co., which made a discovery offshore Cypress that could hold natural gas resources of 5-7 Tcf.

Houston-based Noble Energy Inc., which has a definitive takeover offer on the table by Chevron Corp., has made a big splash in the Eastern Med’s Leviathan and Tamar gas fields. Noble operates and holds a 39.66% interest in Leviathan with Israel-based Delek Drilling LP (45.34%) and Ratio Oil Exploration LP (15%). Noble also has a 25% stake in the Tamar project with partners Isramco Negev 2 LP (28.75%), Delek (22%), Tamar Petroleum Ltd. (16.75%), Dor Gas Exploration (4%) and Everest Infrastructures (3.5%).

The first phase of Leviathan, which began flowing in late 2019, an estimated 22 Tcf development, includes four subsea wells, each capable of flowing more than 300 MMcf/d. Proved reserves were around 3.3 Tcf net (9.4 Tcf gross), or 550 million boe net.

Last October, Noble said it planned to double the 1.15 Tcf of firm volume commitments to Egypt’s Dolphinus Holdings Ltd. from the Leviathan and Tamar fields and extend the sales terms.

Also last fall, Noble said it expected to complete with its partners their acquisition of stakes in the Eastern Mediterranean Pipeline to move gas to Egypt. In addition, the partners are considering a floating liquified natural gas vessel that would transport Leviathan volumes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |