Energy Transfer Fires Another ‘Bullet’ at Williams Deal

The outlook for the merger of Energy Transfer Equity LP (ETE) and The Williams Companies Inc. dimmed further this week as favorable tax treatment of ETE units and Williams shares was cast into doubt in an ETE regulatory filing.

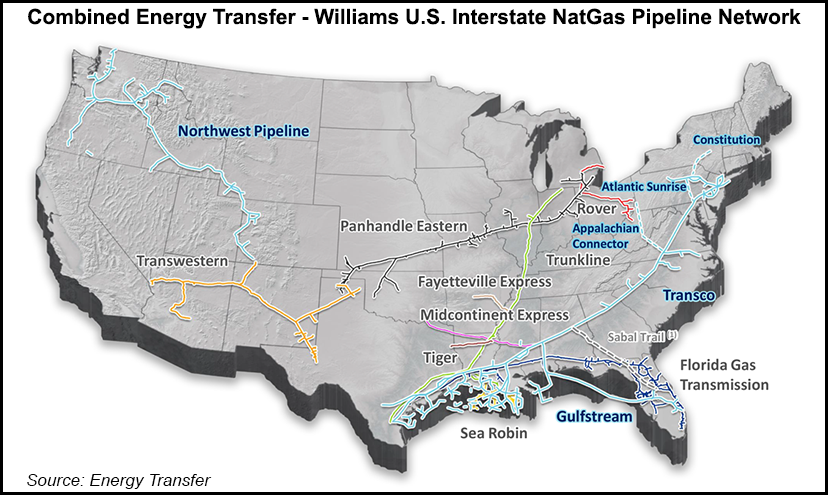

Williams has been trying to push the deal through while recent regulatory disclosures by ETE, along with collapsed commodity prices, have wiped the shine from what last September was touted by ETE as a combination to make a huge, all-of-the-above midstream player (see Daily GPI, Sept. 28, 2015).

The latest disclosure by ETE said that if the merger were to close “as of the date of the proxy statement/prospectus,” advisers to the companies would not be able to issue a favorable “721 Opinion.” This means the contribution of Williams assets and liabilities to the partnership and ETE’s issuance of Class E units to Energy Transfer Corp. (ETC) could be taxable.

“The receipt by ETC and and Williams of the 712 Opinion is one of the conditions to the closing of the merger, and the partnership [ETE] believes that there is a substantial risk that the condition will not be satisfied,” the filing said.

Williams does not agree with ETE on the tax matter, and the companies are in talks, the filing said.

ETE also updated financial and other information related to ETC, ETE and the merger, including forecasted consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) and cash available for distributions.

Consolidated pro-forma EBITDA was cut about 20% for a total reduction of $8 billion from 2016 to 2018, analysts at Tudor, Pickering, Holt & Co. (TPH) said in a note Tuesday. While the commodity price deck was reduced about 10%, it did little to explain the shift in earnings. The “likely culprit comes in the form of project delays/deferrals,” they said.

TPH said the outcome of the merger agreement is “still in flux. We believe the likelihood of a deal close before June 28 (outside date) has degraded materially, with odds now skewed toward a deal break.”

In an April 8 report, U.S. Capital Advisors Senior Managing Director Becca Followill and colleagues said they “think the deal does not and should not go through…Most likely, the breakup is a mutually agreeable one,” they said, “with a cash sweetener from ETE ($1 billion-plus)…

“Our ‘will not go through’ stance is based on our view that ETE will keep firing bullets until the deal dies. We acknowledge that [Williams] has repeatedly stated their commitment to completing the merger.”

Williams is suing ETE over a recent private offering of units and alleged interference in the merger plan (see Daily GPI, April 6). Last month, ETE significantly dialed down the projected benefits to be had from combining the companies (see Daily GPI, March 24).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |