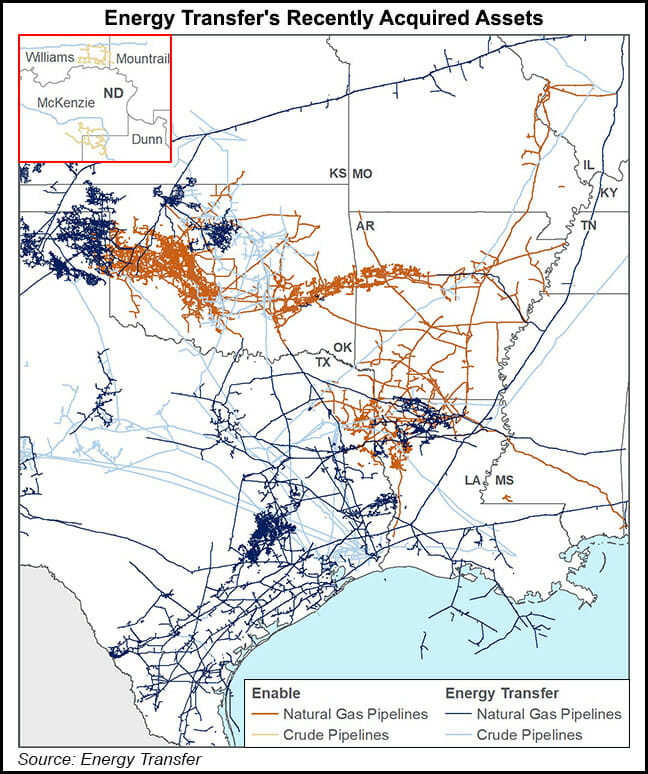

Dallas-based Energy Transfer LP owns and operates another 14,000 miles of natural gas and oil pipeline in Arkansas, Louisiana, Oklahoma and Texas after completing its merger earlier this month with Enable Midstream Partners LP.

The $7.2 billion tie-up, first announced in February, strengthens the midstream and gas transportation systems in the Anadarko Basin in Oklahoma, along with intrastate and interstate pipelines in Oklahoma and surrounding states.

The merger also boosts Energy Transfer’s gas gathering and processing assets in the Arkoma Basin across Oklahoma and Arkansas, as well as in the Haynesville Shale in East Texas and North Louisiana. Altogether, Energy Transfer said it has more than 114,000 miles of pipelines and other infrastructure.

[Download Now: In our 2024...