Banks that lend to natural gas and oil producers have substantially raised their price expectations for both commodities, according to the latest biannual Energy Bank Price Deck Survey conducted by Haynes and Boone LLP.

The law firm conducts spring and fall editions of the survey each year to capture the expectations of energy banks for natural gas and oil prices, aka their price decks. The price decks are a principal factor used by the banks in determining oil and gas producers’ borrowing bases, such as the amount of credit a lender is willing to extend to a producer, said Haynes Boone.

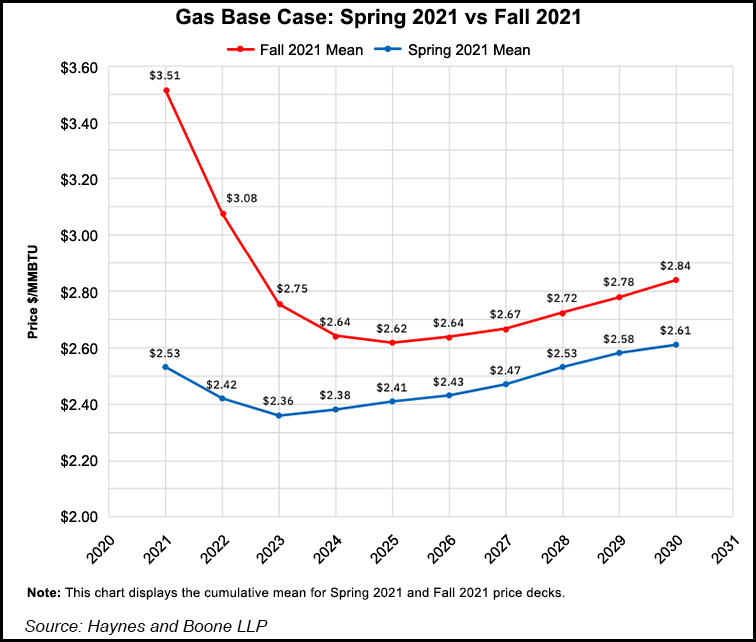

For the near term, i.e. through 2024, average base case natural gas prices predicted in the fall 2021 survey rose by 28% from spring 2021.

“Like weather forecasts, price decks typically...