Encana Pushes Case For Montney NatGas as Transport Costs to Decline

The Montney formation in Western Canada, already connected to existing — and unconstrained — pipeline infrastructure, will be called upon to increasingly meet North America’s natural gas demand, Encana Corp. executives said Tuesday.

The Calgary-based gas heavy held an investor conference in New York City to lay out the strategy going forward for the Montney, a siltstone multi-stacked reservoir that straddles British Columbia and Alberta in the Western Canadian Sedimentary Basin (WCSB). During the first quarter conference call, executives claimed that the gassy Montney should become an even match with the Marcellus Shale (see Shale Daily, May 3). During the morning-long conference, management pressed its case.

Executive Vice President (EVP) Renee E. Zemljak, who runs the midstream, marketing and fundamentals division, said the Montney and Appalachia gas will team up as the top supply sources for North America’s growing gas demand to 2020. She offered a detailed gas supply/demand forecast based on “conservative” internal and external projections.

Gas demand in North America is projected by Encana to increase by about 14 Bcf/d by 2020. Gulf Coast liquefied natural gas (LNG) exports are forecast to reach a total of 7 Bcf/d. North American industrial demand is seen up by 4 Bcf/d, bringing total North industrial demand to 30 Bcf. Mexico exports are expected to hit about 4.5 Bcf/d.

“Our demand outlook will bring us to a total market of just over 100 Bcf by 2020,” Zemljak said. “In our view, the Montney and the Northeast shale gas are going to be required to meet this demand outlook. They’re the lowest cost gas plays in North America.”

Demand growth through 2020 is concentrated in the Gulf Coast region, but “we also see a significant growth in Western Canada, the Midwest and the Northeast. The U.S. Gulf Coast will have over 8 Bcf of demand growth, and the growth will come from industrial expansions in both fertilizer and petrochemical facilities. We’ll also include new power generation, and the exports to Mexico and then the LNG exports out of the Gulf Coast. The U.S. Midwest demand growth will be driven by the industrial and power sectors as well.”

Demand growth in the WCSB primarily would be driven by oilsands development and some power sector growth.

“The oilsands and power demand growth in our outlook is highly likely because our forecast only includes oilsand projects that are either in service today or they are under construction, and the demand outlook that we have included for the power sector only includes power demand for projects that have announced” final investment decisions (FID), she said.

The outlook doesn’t include any LNG exports from Canada’s West Coast as none have reached FID. If LNG exports were to start up off British Columbia, the two most advanced projects alone “could add an additional 2 Bcf to 3 Bcf to our demand outlook,” she said.

Encana figures into all of this because by 2020, its annual output from the Montney is on course to average 7 Bcf/d (see Shale Daily, May 17). Based on its estimates, the Montney’s gas output would represent about 7% of North American supply by then. For its forecasts, Encana used price assumptions of $3.00/MMBtu New York Mercantile (Nymex) gas and $50/bbl West Texas Intermediate crude oil, as well as a 61-cent differential to the AECO Hub and a 75-cent U.S.-to-Canada exchange rate.

The market may not have realized how reliant the Montney has remained through the volatile commodity price drop. Since 2011, the gas rig counts across North America have declined drastically — except in the Montney and the Marcellus Shale, where the rig counts have remained relatively flat for the past five years, Zemljak said.

“This is an indication that those plays are maintaining their competitiveness, and they’re maintaining the rig counts.”

In the WCSB, the Nova Gas Transmission system (NGTL) captures most of the gas and is able to export almost 12 Bcf “on any given day,” she noted. The basin also is importing about 250,000 b/d of condensate, which has created a market dynamic where the condensate sold in Canada receives a premium over any other condensate sold in North America. “This is really important for Encana because this condensate pricing increases our netback prices for Montney and increases our profit margins.”

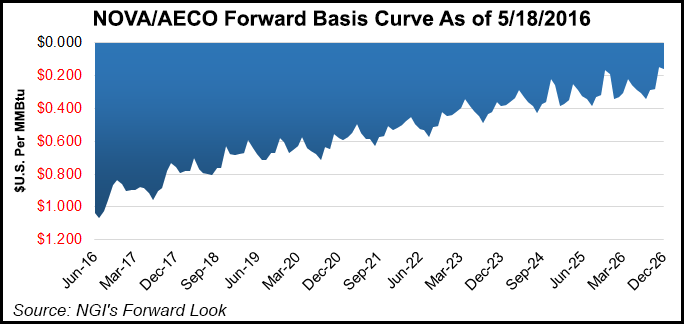

As demand has grown and supply has fallen in the region, excess transport capacity has been on the rise too. EVP David Hill, who handles exploration and business development, said the AECO Hub basis has averaged Nymex less about 50 cents since 2009. The recent price weakness into the second quarter has been a result of record high storage inventories.

“We actually had a phenomenal lack of withdrawals out of storage in Alberta this year, 17 Bcf,” Hill said. “In a typical normal winter, we will see 17 Bcf drawn out of storage in Alberta in a week. So it just gives you an idea of the effect that the warm winter had this year and we have come into the summer season with high storage levels, which again is forcing more gas and the export pipelines, which has to cover the cost of tools.” That means a wide basis in the short-term.

On NGTL, gas is connected to the intra-basin grid, and while the system is shared, it provides some advantages, he said.

“You have access to all of these export points and storage points throughout the basin. There are no limitations to a single market point, which is typically the case for gas connected on U.S systems…Expansions can occur in a friendly regulatory environment within the province of Alberta and within the WCSB. The NGTL System provides flow security, deliverability and access for approximately 12 Bcf/d of gas.

“Historically, this system accommodated up to 18 Bcf/d, which is important to note…so the basin is capable of moving much larger volumes than more flowing today. The connectivity of the NGTL system to multiple export points is also a distinct advantage because it allows for diversity of market.”

For the Montney, this means access to export capacity, he explained. “Not only do we have capacity to grow volumes and access export points to 2020, but much beyond that. Current access capacity is approximately 2.7 Bcf/d and…capacity exists on these currently unserviced pipelines.”

Encana is forecasting U.S. gas supplies from Appalachia “will grow preferentially on brownfield capacity,” with most demand growth in the U.S. Gulf Coast, providing a “natural flow path for Marcellus production that captures demand.”

Because U.S. Northeast markets now lack connectivity to Eastern Canada, Appalachian gas does not compete with western markets, Hill said. And Encana has brownfield capacity from Montney directly to the West, which “should be a natural market for Montney production…And again, in that area it’s not even going head-to-head with Marcellus…”

Montney gas should “out-compete Northeast supply” because the Marcellus/Utica gas would require greenfield pipe at a higher cost. “We estimate that we can out compete Northeast supply and Eastern Canadian markets by anywhere from 15-30 cents U.S.,” Hill said. In addition, tolls from the WCSB are seen decreasing as TransCanada Corp.’s Mainline approaches full depreciation and the pipeline operator begins to offer lower toll structures.

“The Montney has a highly competitive supply cost, advantage connectivity to the NGTL system, and existing peer export infrastructure, which will allow the Montney to do a few things,” Hill said. “Firstly, it’ll backfill declines and support demand growth in the WCSB in the Western U.S. And secondly, it will compete on a delivered cost basis in the Northeast markets as production growth is required to meet demand in those areas.

“The existence of relatively depreciating infrastructure on the TransCanada mainline and the friendly regulatory environment in the province of Alberta should allow for steady long-term growth without the risk of greenfield pipeline development.”

CEO Doug Suttles, who helmed the discussion was asked about the new pipeline startups in Appalachia that may push gas to the Dawn Hub.

“We can get gas to Dawn at probably less than $2.00/MMBtu,” Suttles said of the Montney gas. “That’s all in, that’s development cost, that’s processing cost, that’s operating cost and transportation cost. We can get to Dawn for $2.

“If you just take the average condensate from our Montney…not the best stuff…at a $50 Nymex price, we would also make another $2.00/MMBtu from condensate. In other words, if you do that math, we could give gas away at Dawn and still make money…At a $2 Dawn price, we’re covering all of our cost and on the gas side, and we’re still getting all the condensate, which is worth at a $50 WTI price…about $10 MMBtu per Mcf…The big difference of shift there is as that Mainline gets fully depreciated, roughly at the end of the decade…” Encana is in discussions with TransCanada about changing the toll structure to bring the costs forward.

“What that means is, transportation costs to Dawn becomes more attractive on the Mainline than it is for newbuild…coming out of Appalachia,” Suttles said.

There’s also a timing factor, Hill said. “If you were to move gas into Dawn and all of a sudden producers from the Marcellus look at that and they are competing against some costs versus newbuild, I think they will probably look for other markets for their gas to flow to.”

The outlook for more supply from the WCSB changes things “dramatically” for local distribution companies (LDC), Suttles said.

“If you look at what LDCs started doing a decade ago, they were worried that Western Canadian gas was on permanent decline. They not only looked at cost of supply, they looked at security of supply and looked out to Appalachia…We’ve got to get them caught up with today,” the CEO said. “The Montney could probably grow to over 15 Bcf/d.” The 7 Bcf/d estimated to be produced in Montney by 2020 would be to fill up available export capacity only.

“In fact, we could probably argue that it could easily be 20 Bcf, but the Montney, it’s actual resource potential is incredible. So, there’s plenty of capacity to feed new growth in the oilsands, plenty of resource capacity to feed LNG off the West Coast to Canada and plenty of capacity to feed eastern markets. And we need to make sure the LDCs understand that because part of their strategy to go to Appalachia was security spot, it wasn’t just cost…

“We’re actually working with TransCanada on this to make sure these big — and basically end purchasers of this gas — understand how resource-rich this play is. It’s not just in Canada’s position in the play that helps the big plays itself.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |