E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Encana Permian, Anadarko Production Tops Records as Costs Fall

North American onshore explorer Encana Corp. smashed oil and condensate production records in 2Q2019, with output from the Anadarko and Permian basins exceeding expectations even as costs came down.

Total production reached 592,000 boe/d, a record, up 11% year/year on a proforma basis, as Encana completed its takeover of Oklahoma-focused Newfield Exploration Co. to build its Midcontinent arsenal.

Second quarter liquids production increased 16% from a year ago to about 324,000 b/d, with oil and condensate production of 234,600 b/d. Natural gas production increased to 1.607 Bcf/d from 1.095 Bcf/d.

“Encana is performing exceptionally well,” said CEO Doug Suttles. “The combination of our high-quality portfolio and relentless focus on efficiency is delivering strong returns, growth and free cash flow.

“Our business is growing and generating free cash flow, and we are firmly on track to deliver on our capital investment outlook for this year. Our free cash flow is significant and will be used to fund the share buyback and strengthen our balance sheet.”

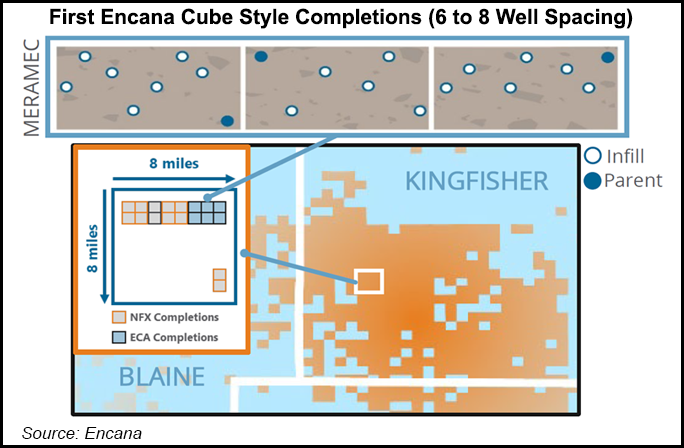

Output from the Anadarko, propelled by Newfield’s volumes, jumped 18,000 boe/d to a record 163,000 boe/d. Well costs in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, exceeded the $1 million savings target by 40%.

Recent growth in the Anadarko was attributed to a 31% sequential gain in STACK oil output, with oil and condensate now accounting for around 37% of volumes.

“Importantly, Encana continued to enhance returns in the STACK through additional reductions in completed well costs,” management noted. “Since closing the acquisition of Newfield in mid-February, well costs have been reduced by $1.4 million to $6.5 million,” versus Encana’s 2018 average of $7.9 million.

“Eighty-nine gross STACK wells in the Meramec completed year to date are tracking type curve including 18 gross cube-style wells that are showing strong oil productivity.”

The Permian also overperformed at a record average of 104,000 boe/d, 84% weighted to liquids. Encana touted a four-rig program focused on cube development and said a recent 14-well pad in Martin County, TX, recently ramped up and was averaging 14,900 b/d after 90 days.

In the Montney formation in Western Canada, production averaged 203,000 boe/d, 27% liquids. Third-party outages and planned maintenance negatively impacted quarterly average production by about 6,800 boe/d, Encana noted.

Meanwhile, cycle times in the Montney were reduced by more than 10% sequentially, averaging less than 70 days. “Wells on production in the year are outperforming the oil and condensate type curve by approximately 25%,” management said.

Capital expenditures (capex) totaled $750 million in the quarter, in line with expectations to front-load spending in the first half of the year. Total costs decreased to $12.78/boe with a cash flow margin of $16.27/boe.

“At current commodity prices, Encana expects to generate significant free cash flow in the second half of 2019,” management said. Capex in the second half of 2019 is expected to be $500–600 million per quarter, with overall production of 565,000-585,000 boe/d, excluding volumes from the Arkoma Basin and China.

At the end of June, Encana had hedged 154,000 b/d of expected oil and condensate production at an average price of $59.48/bbl for the balance of 2019. The company also has about 936 MMcf/d of its expected remaining 2019 natural gas production hedged at an average price of $2.73/Mcf.

For 2020, Encana also has hedged 80,000 b/d of expected oil and condensate production at an average price of $57.05/bbl and about 490 MMcf/d of its expected gas production at an average of $2.71/Mcf.

Net earnings were $336 million (24 cents/share) in 2Q2019, versus a year-ago loss of $151 million (minus 16 cents). Revenue climbed to $2.06 billion from $983 million. Total operating expenses increased to about $1.5 billion from $1.1 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |