Bakken Shale | E&P | NGI All News Access

Enbridge Touts Liquids, Bakken Pipe Buy While Spewing Red Ink For Sandpiper Project

While reporting a one-time $406.4 million impairment for the suspended Sandpiper oil pipeline project, Houston-based Enbridge Energy Partners (EEP) senior executives on Monday changed the subject during a 3Q2016 earnings conference call to emphasize EEP’s recent joint venture (JV) interest purchase in the Bakken Pipeline System, including a stake in the beleaguered Dakota Access oil pipeline project now under construction.

Prospects for restarting the Sandpiper project were not seen as very good, at least in the next five years, according to the EEP executives speaking on a conference call.

EEP President Mark Maki characterized the company’s core liquids pipeline business as “continuing to perform well,” and the pipelines deliveries having withstood the interruptions of Alberta’s wildfires this summer are expected to stay strong the rest of the year with “oversubscribed” heavy crude oil pipelines, for the most part.

Maki noted that EEP wrote down approximately $757 million in 3Q2016, resulting in a negative net earnings impact of $489 million after deducting non-controlling interest for its earlier announced withdrawal of its pending regulatory applications for the 612-mile Sandpiper Pipeline project from western Canada through the Bakken to Wisconsin (see Shale Daily, Sept. 6).

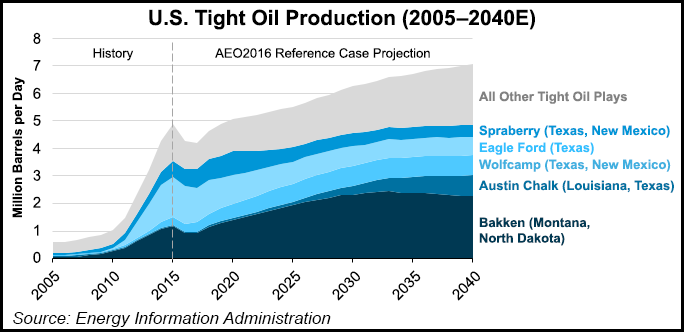

“After completing a review of Sandpiper, we concluded the project should be delayed until crude oil production in North Dakota recovers sufficiently to support development of new pipeline capacity,” Maki said, while reporting the impairment charge, compared to $82.1 million of net profit for the same period last year. He speculated on the conference call that the return of a sufficiently large crude oil production increase likely will be “beyond our five-year planning horizon.”

In response to a question about the prospects for shortening the time before Sandpiper could be reactivated as a project, Guy Jarvis, executive vice president, said it would depend on how quickly production in the Williston Basin turns around and whether rail transport to the West Coast continues to prove to be competitive with pipeline alternatives.

“Timing is going to be a function of both of those things — what is the pace of the production growth and then how is that West Coast rail option performing from a competitive base,” Jarvis said

Absent the Sandpiper conduit for moving Bakken crude to coastal and overseas markets, Maki said the Bakken Pipeline System “provides another important link as our market access strategy, offering customers competitive tools between the prolific Bakken formation and Gulf Coast markets.”

The Bakken pipeline system is an attractive project to Maki, who said the system has a significant level of take-or-pay contracts with “high credit quality customers,” offering the potential for expansion opportunities.

He said the closing of this acquisition is still subject to a number of customary conditions, not all of which have been met at this time. “We remain in regular dialogue with Energy Transfer Partners [ETP] as it relates to project construction, and until the deal closes, we will not make any disclosures of a specific nature respecting the project.”

EEP plans to fund the investment 25% from the partnership and 75% by a wholly-owned subsidiary of Enbridge Inc., specifically Enbridge Energy Co. Inc or EECI, Maki said.

Enbridge said the purchase price of its effective 27.6% interest in the system is $1.5 billion, and its JV partner, Marathon Petroleum Corp. (MPC), would own a 9.2% indirect interest for its $500 million investment.

Maki said the pending merger between EEP’s sponsor Enbridge Inc. and Spectra Energy Inc. (see Daily GPI, Sept. 6) might impact strategic plans developed next year for EEP and its affiliate, Midcoast Energy Partners (MEP).

“Thus, while Enbridge Inc. continues to progress, strategic evaluation of its two existing U.S. sponsored vehicles [EEP and MEP], it is possible that the evaluation and potential execution of any such strategies could be affected by the merger and extend into 2017,” Maki said. “What is pretty clear is we’re still going to continue to advance the work on MEP. But with respect to all the sponsored vehicles in the Enbridge family, we’re going to look at the corporate structure after the acquisition is complete, and it’s possible that our review on MEP does get slowed down as a result of the merger-related activity.”

When EEP and Marathon last summer announced the pull back from Sandpiper (see Shale Daily, Aug. 4), they also announced that they had formed a JV to invest in the Dakota Access and the Energy Transfer Crude Oil Pipeline, collectively referred to as the Bakken Pipeline System.

Subsequently, the new JV acquired a 49% equity interest in the holding company that owns 75% of the Bakken Pipeline (Phillips 66 owns the other 25%) from an affiliate of ETP and Sunoco Logistics Partners LP. Enbridge and MPC would indirectly hold 75% and 25%, respectively, of the JV’s 49% interest in the holding company of Bakken Pipeline.

For the first nine months of 2016, EEP reported a net loss of $242.7 million (minus $1.16/common unit), compared to net income of $125.1 million (minus 11 cents) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |