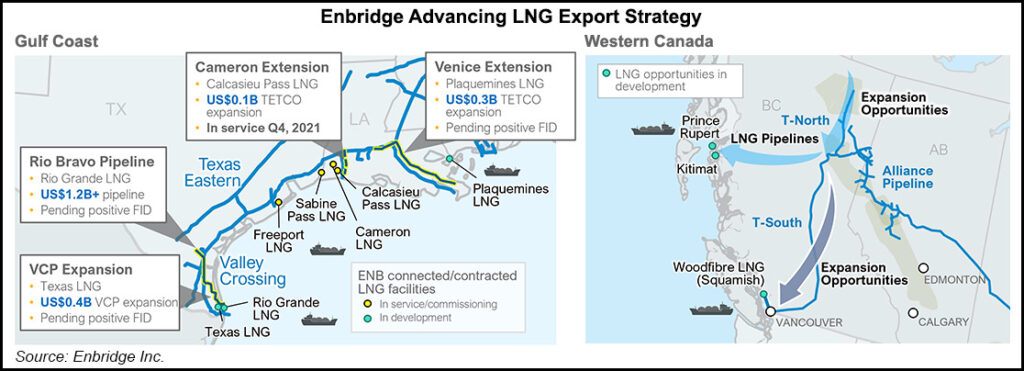

From British Columbia (BC) to the Gulf of Mexico, accelerating global trade in liquefied natural gas (LNG) has emerged as the growth driver for the Enbridge Inc. pipeline network, CEO Al Monaco said.

“It’s clear we are at an inflection point in global energy markets,” Monaco said in delivering 1Q2022 results. “Demand continues to grow, which combined with underinvestment in new supply, is driving energy shortages and higher prices.”

At the same time, the move toward net-zero carbon has prompted the pipeline, utility and power conglomerate into project work to advance its energy transition to cut greenhouse gas emissions.

“The current environment reinforces that our two-pronged strategy to advance both conventional and low-carbon energy investments is a prudent...