Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Elections Part 2: Colorado’s Oil, Natural Gas Future Tops Western Issues

*Part two of four. From east to west, this series previews the Nov. 6 midterm elections and their implications for the oil and natural gas industry. It offers a glimpse of candidates running for state and federal offices, the prominent energy-related issues factoring into campaigns, ballot initiatives and the fight for control of the U.S. House and Senate, which could have implications for key energy committees. Part 1 reviewed Appalachian issues; Part 3 highlights key issues in U.S. Senate races; and Part 4 focuses on implications of a possible Democratic takeover of the House

Led by a Colorado ballot initiative to restrict oil and natural gas drilling, several western states have initiatives and candidate races that hold significant implications for future energy development and use.

Washington state has a carbon tax measure similar to one that voters rejected two years ago. Arizona and Nevada have renewable energy portfolio standard goal-setting measures bankrolled by California billionaire activist Tom Steyer and his NextGen Climate Action group. California has a measure to roll back 12-cent gasoline taxes that fund transportation infrastructure maintenance and repair.

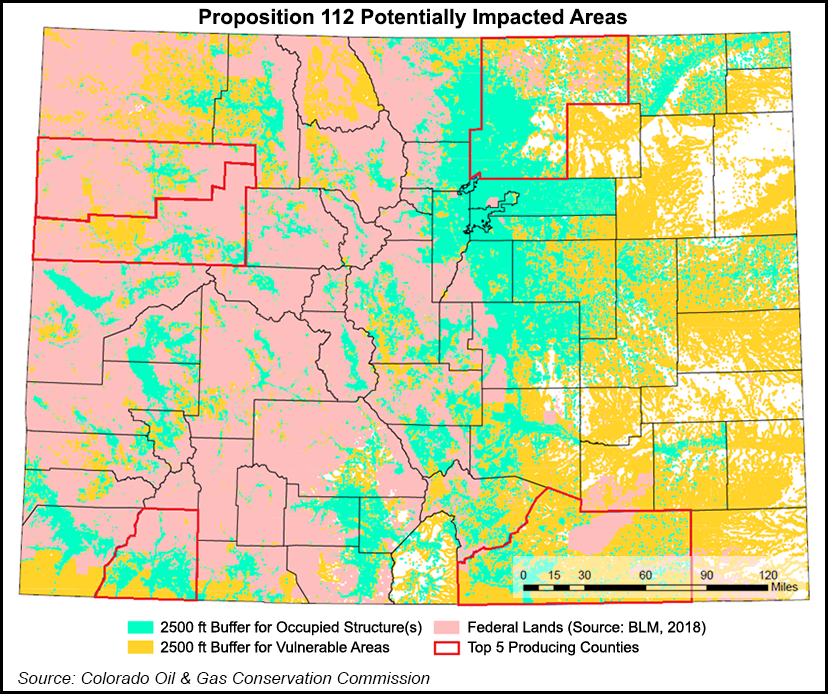

However, the stakes are the highest in Colorado, where Proposition (Prop) 112 to expand drilling site setbacks to a half-mile (2,500 feet) from the current 500-foot requirement has raised concerns that future drilling could be virtually shut down. Originally designated Initiative 97, the proposal qualified in August and is a variation of a measure that was rejected by voters in the past.

The setbacks if approved would apply to residences and workplaces, as well as “vulnerable areas” that include playgrounds, permanent sports fields, amphitheaters, public parks, public open space, public drinking water sources, irrigation canals, reservoirs, lakes, rivers, streams and creeks.

The stakes are enormous. Campaign filings in early October indicated opponents had put nearly $38 million into defeating the proposition, including $6 million each from leading state producers Anadarko Petroleum Corp. and Noble Energy Inc. BP plc recently moved its U.S. onshore headquarters to Denver, and it has provided about $300,000 to the opposition forces. Proponents had raised less than $1 million early this month, based on filings.

Trending Toward Defeat Or Win?

Early voting data as of Friday (Oct. 26) by the Colorado Secretary of State showed a “slightly higher turnout for Republicans,” according to analysts with Height Securities LLC, who said it was a potentially positive sign for the oil and gas industry.

“Using data from our Oct. 15 poll, we found that Proposition 112 would fail based on voter turnout thus far in the election, 47% to 53%,” said Height analysts. “While Republicans generally tend to vote earlier than Democrats in Colorado, these initial turnout numbers could indicate the ”Blue Wave’ will be less dramatic than expected. We maintain our odds at 20% that Proposition 112 passes, though we acknowledge that the margin of victory for the oil and gas industry will likely be slim.”

Proponents of the measure still are predicting a win. According to poll results issued last Monday (Oct. 22), the University of Colorado’s American Politics Research Lab found those in favor of Prop 112 leading 52% to 48%. The constitutional amendment still is considered too close to call.

“As elsewhere, we see stark partisan differences on Proposition 112, with Democrats offering considerably more support, and Republicans considerably more opposition,” according to the survey of 800 registered voters that was conducted Oct. 12-17. The poll was administered online by YouGov with a margin of error, plus or minus, of 3.5%.

The poll also found Democrat Jared Polis leading 54% over Republican Walker Stapleton in the governor’s race, with Polis holding a 15-point advantage among independent voters.

Industry-backed Protect Colorado spokeswoman Karen Crummy described Prop 112 as “so extreme it would put 94% of the private land in the state’s top five oil and gas communities off limits to new energy development.” Crummy predicted “devastating impacts” to the state’s economy if the measure were to be enacted. Industry leaders have been sounding alarm bells for months.

The geographical area of industry concerns about Prop 112 is centered north of Denver in Weld County, the heart of the Denver-Julesburg (DJ) Basin, where most production is ongoing. More than 119 million bbl of oil (330,000 b/d) were produced in Weld last year. Since 2016, nearly 7,000 drilling permits have been filed in Colorado, and 6,000-plus have been for Weld.

While environmental groups are backing Prop 112, the opposition includes the energy industry, outgoing Democratic Gov. John Hickenlooper and the two candidates running to replace him.

The Colorado Oil and Gas Association (COGA) and Western Energy Alliance have stressed the estimated economic harm to the state that could come with passage of the ballot measure, which they characterize as essentially a ban on future drilling. Estimated economic impacts have been detailed as the loss of nearly 150,000 jobs, including 43,000 lost in the first year, the loss of $218 billion in gross domestic product from 2019-30, and $147.6 billion in lost personal income over the same 11-year period.

“A ban on our industry would unwind decades of work that has been put in place to ensure safe and environmentally sound practices,” said COGA CEO Dan Haley, whose group has posted an election guide. “This measure would impact all Colorado basins because it includes all forms of permitted drilling, such as carbon dioxide development.”

Washington Carbon Tax

Meanwhile, in Washington state, a carbon tax is on the ballot as Initiative (I) 1631, similar to a measure rejected by voters two years ago. A recent statewide poll by Crosscut/Elway showed that the initiative could succeed, with respondents surveyed from Oct. 5-9 indicating that 50% of the 400 registered voters supported the measure.

No U.S. state yet has implemented a tax or fee on carbon. Support this year is stronger than it was in 2016 when I-732, a similar carbon measure, was defeated with only 41% support. The current push for the measure includes the support of Microsoft founder and Seattle resident cheerleader Bill Gates.

Opponents of I-1631 earlier this month released a report by NERA Economic Consulting that concluded the carbon tax would result in higher costs for Washington residents and cut fewer greenhouse gas emissions than claimed by the supporters.

I-1631, the Washington Carbon Emissions Fee and Revenue Allocation Initiative, aka the Protect Washington Act, would place fees on large carbon emitters based on the carbon content of fossil fuels sold or used in the state, as well as imported electricity. The fee would be $15/metric ton (mt) of carbon beginning Jan. 1, 2020 and then would increase by $2/mt annually.

According to the ballot measure, billions in revenue would be split among air quality/energy, water quality/forest health and community-based investments. Under Washington law, the measure would create a fee and not a tax because the revenue may not be put on government expenses or public programs, but rather into specific accounts.

In 2016, I-732 was defeated with nearly 60% rejecting an initial $15/mt carbon fee. Even with more favorable polling results earlier in October, supporters of this year’s measure had been outspent by $22 million versus $8 million raised by supporters.

Arizona, Nevada Renewable Energy Measures

The plot surrounding the renewable energy ballot measure in Arizona, Prop 127, became more complicated this month with a brouhaha over the alleged questionable ethics of a state regulator opposing the ballot measure. Meanwhile, Pinnacle West Capital Corp., parent company of private-sector utility Arizona Public Service Corp. (APS), reportedly has contributed more than $5 million to the opposition.

Prop 127 calls for distributed renewable energy to account for at least 10% of the affected utilities’ annual retail sales of electricity by 2030, while exempting the quasi-public power provider in the state, Phoenix-based Salt River Project (SRP). The measure is focused on nongovernmental entities and would include the use of renewable energy credits.

Recently, the elected five-member Arizona Corporation Commission (ACC) voted unanimously to ask the state Attorney General to investigate actions by Commissioner Andy Tobin, a former state legislative leader. Tobin earlier this year used his ACC commissioner letterhead to urge a no vote on Prop 127. Fellow Commissioner Bob Burns alleges that Tobin may have violated the state code of ethics and his oath of office.

A provision in the state legal code prohibits a public agency in the state from spending or using public resources to influence an election, Burns has cited. While voting with his colleagues for the request of an investigation, Tobin defended his action as a legitimate expression of his views on public policy.

In Nevada, a measure to eliminate vertically integrated utilities, Question 3 (Q-3), and the Steyer-backed renewable ballot measure ( Q-6), are part of a longer, less-politicized process surrounding energy measures on the ballot. The measures seek to make the provisions part of the state constitution. Constitutional amendments in Nevada have to be approved at two successive general elections, so Q-3 was passed on the 2016 general election ballot, and it now must be ratified again this year.

Supporters want to require Nevada’s legislature to pass laws by July 1, 2023 establishing “an open, competitive retail electric energy market,” and prohibiting the state from granting electrical generation monopolies to protect “against service disconnections and unfair practices.” It freed up consumers to choose their electricity provider.

“The ballot measure itself would not change the structure of the state’s retail electricity market,” according to a web-based tracking of state ballot measures for the November elections. The group Nevadans for Affordable, Clean Energy Choices had raised nearly $20 million supporting Q-3, while a coalition to defeat Q-3 has a political action committee that had raised $12.7 million to oppose the measure, including from Berkshire Hathaway, which owns Las Vegas-based NV Energy, the state’s major power utility. Under Q-3, Nevada could still award monopolies for owning and operating transmission lines, but not for power generation.

Meanwhile, California’s ballot measure, Prop 6, would roll back a Democratic supermajority legislatively imposed 12-cent gasoline tax. Backed by Republican gubernatorial candidate John Cox, a businessman who has been trailing in the polls, Prop 6 would repeal the gasoline tax increases. The ballot measure also was failing in a recent poll by about 39% to 52%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |