Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Elections Part 1: Political Shift Seen Unlikely in Appalachia as Midterms Near

*Part one of four. From east to west, this series previews the Nov. 6 midterm elections and their implications for the oil and natural gas industry. It offers a glimpse of candidates running for state and federal offices, the prominent energy-related issues factoring into campaigns, ballot initiatives and the fight for control of the U.S. House and Senate, which could have implications for key energy committees. Part 2 reviews western U.S. energy issues and races; Part 3 highlights key issues in Senate races; and Part 4 focuses on implications of a possible Democratic takeover of the House.

Operators in the Appalachian Basin shouldn’t expect a radical political shift after the general election next month, according to experts, as Republicans are anticipated to keep a firm grip on statehouses throughout one of the nation’s largest natural gas-producing regions, and various candidates have voiced support for the industry.

Some of the oil- and gas-related issues that have proved divisive in previous elections, such as severance taxes, climate change and how best to regulate development, have been overshadowed by more pressing state issues or the charged midterm elections that find Democrats looking to take back some control of the U.S. Congress.

“When we ask open-ended questions, it just doesn’t resonate at all, it’s just not there,” said pollster Terry Madonna, director of the Center for Politics and Public Affairs at Franklin & Marshall College in Lancaster, PA, of energy issues involving natural gas drilling or pipelines.

“It’s being overshadowed in some respect by the voracious division that exists between the Democrats and Republicans on President Trump and the battle for control of the U.S. House and Senate in ways we haven’t seen before, meaning it’s always about the midterm being a referendum on the president, but this is a degree that we have not seen before.”

In Pennsylvania, incumbent Democratic Gov. Tom Wolf is very quietly fending off a challenge from Republican Scott Wagner, a former state senator who owns a multi-million dollar waste management company. Wolf, who had a 50% approval rating in Franklin & Marshall’s September poll, leads Wagner by double digits in various polls. Wolf is also far outspending Wagner, who has made hundreds of campaign stops and waged a kind of insurgent campaign that’s drawn parallels to that of Trump’s in 2016 for his outlandish comments and bravado.

Wolf has at times done battle with the natural gas industry. He has unsuccessfully fought to implement a severance tax every year since taking office, reinstated a moratorium on oil and gas leases in state-owned parks and forests, and rolled out a broad plan to cut industry emissions, some of which are already in effect. But he’s also taken a more moderate approach in his first term, refusing to acknowledge some of the extremist positions of his party regarding high-volume hydraulic fracturing (HVHF) and watching gas production skyrocket in Pennsylvania to more than 5 Tcf annually.

“The governor from the beginning has been enthusiastic about seeing the natural gas industry succeed, but at the same time, he’s always said, and predicated administration policy, around finding balance between smart environmental protections and regulatory or policy initiatives that are going to enable the continued success of the industry and the growth of the industry,” said Sam Robinson, Wolf’s deputy chief of staff, during an interview in September. “I think that’s likely what you’ll see in a second term.”

Severance Tax Debate

Robinson also indicated that Wolf would continue to push for a “fair and reasonable” severance tax if he’s reelected. “We’ve always said that we’re willing to negotiate and discuss what that rate is or how it’s structured to work on those issues.”

Marcellus Shale Coalition President David Spigelmyer responded by saying “it’s almost like Groundhog Day. It’s a battle over semantics,” noting that his organization would continue to fight such proposals and adding that the industry has paid more than $1 billion in impact fees since they were established in 2012.

Wagner, who has long supported the industry in the state and has criticized the regulatory environment under Wolf, wants to cut spending and taxes. “Scott strongly opposes Gov. Wolf’s severance tax, which would raise utility bills on Pennsylvanians and stifle the economy,” said campaign spokesman Andrew Romeo, who added that Wagner also would do more to support the buildout of natural gas infrastructure in the state.

While the severance tax in Pennsylvania has proved a popular proposition among voters, Madonna said it’s not likely to happen anytime soon. “Wolf would like to get it, but he’s not getting it because the Republicans control the legislature, and it’s just not going to happen.”

While about half the seats in the state Senate are up for grabs and all of the House seats are being contested, it’s highly unlikely that Democrats will gain any significant power in Harrisburg next month, Madonna said.

Candidates from the state vying for high-profile seats on Capitol Hill, meanwhile, have expressed support for Pennsylvania’s role as the nation’s second largest gas producer. Democratic Sen. Bob Casey is leading his race by double digits over Republican Rep. Lou Barletta. Democratic Rep. Conor Lamb, whose win over Rick Saccone in a race earlier this year attracted national attention to shale country in southwest Pennsylvania, is again fighting for a seat in a newly drawn district. Lamb has a wide lead over Republican Rep. Keith Rothfus.

The impacts of steel tariffs on energy production and manufacturing in the state, which Spigelmeyer said are generating some concern among his members, or the environmental opposition to pipelines that’s being litigated rabidly in federal and state courts, has also barely registered on the campaign trail in Pennsylvania and elsewhere in the region.

“I don’t know that it’s a top voting issue, but I think it’s an issue that there’s a lot of interest in across the state,” Robinson said of energy and natural gas development. “In terms of the controversy of the issue, certainly it was a controversial issue that played more in the last campaign.”

He attributed the shift in tone to Wolf’s policies, saying the governor has taken a more balanced approach than the industry or even environmental groups would have thought when he took office in 2015. While Spigelmeyer didn’t entierly agree with that characterization, he said state Department of Environmental Protection Secretary Patrick McDonnell, a Wolf appointee, has been collaborative and helped to ensure the industry is both compliant and successful.

Regardless of the political landscape after Nov. 6, Spigelmyer said MSC would be trained on creating an “environment of certainty. Our focus is going to be trying to promote the downstream use of natural gas to build additional market and manufacturing, and to make sure there’s an environment to invest.”

Ohio’s ”Stealth Race’

In Ohio, a tighter race is unfolding between Democrat Richard Cordray and Republican Mike DeWine for the governor’s office. Cordray leads by about three points, according to a mid-October average among leading polls calculated by RealClear Politics. The race would also seem to have higher stakes, as Republican Gov. John Kasich prepares to leave office and make way for a new state executive for the first time in eight years.

But the gubernatorial election, even on the ground in Ohio, has largely been overshadowed by other more high-profile races across the country, pundits said.

“It’s almost a stealth race,” said political science professor Thomas Wood of Ohio State University, who added that his students have clearly seemed more entranced by the U.S. Senate race in Texas between Rep. Beto O’Rourke and Sen. Ted Cruz.

Both Ohio gubernatorial candidates, veteran politicians with pristine resumes, have demonstrated an unusual discipline on the campaign trail, refusing to go too far left or too far right on most issues, even mirroring one another at times, Wood said.

DeWine, who is serving his second term as the state’s attorney general (AG), is a former U.S. senator who once served as Ohio’s lieutenant governor under George Voinovich. Cordray served as the first director of the Consumer Financial Protection Bureau under President Obama and has held various positions in state government as AG, solicitor and treasurer. He also was a U.S. congressman.

“These are two conventional candidates,” Wood told NGI. “They stand in so well for what you might imagine to be a replacement-level Republican or a replacement-level Democrat. They’ve adopted completely down-the-middle-of-the-road positions for their respective brands. They’ve been too conditioned, too rehearsed to really generate too much news.”

The Shale Economy

Industry spokesman Dan Alfaro of Energy In Depth, the grassroots outreach arm of the Independent Petroleum Association of America, noted as much in a recent blog post. Alfaro wrote that natural gas has remained above the fray in a gubernatorial election that has featured more pointed exchanges on the state’s opioid crisis and criminal convictions, for example. Both candidates clearly support natural gas development, touting its benefits on the stump, he said.

In an interview, Alfaro didn’t exactly agree that other issues are overshadowing energy this election cycle. Instead, he said the industry has become a larger part of the state’s economic fabric after nearly a decade of development in the Utica Shale, something that’s proved worth promoting rather than disparaging. Unemployment rates, while slightly above the national average, are at or near historic lows throughout the region.

“You look at the impact it’s had on the economy, the presence it’s had, particularly in the Appalachian region of the state, and some of the ancillary industries that have been spread throughout the state,” Alfaro said. “I think it’s integrated; it’s something that’s gotten support from the state and local chambers, and labor across the eastern side of the state. We’ve seen what the impacts have been economically for the region. I don’t think there’s a partisan tone when it comes to discussing shale in Ohio.”

Wood agreed on how the parties in Ohio view the industry. Cordray “was pretty firmly assailed from his left” during the primary by former U.S. Rep. Dennis Kucinich, who called for a ban on all oil and gas drilling as well as wastewater injection wells. After Kucinich was defeated, few differences have been aired over gas development this cycle.

“It reflects that the Democratic establishment in the state realizes the economic consequences of fracking are so positive that they can’t sort of indulge this impulse to ban it or to really pay a ton of attention to the most alarmist positions on the environmental impact,” Wood said.

Spokesmen for both campaigns said Cordray and DeWine envision an “all of the above” energy policy for the state. DeWine has said he would work closely with the industry if elected, while Cordray has spoken about the role of natural ga sin helping Ohio transition to a “clean” energy economy.

Kasich has over the years pushed for a higher severance tax on oil and gas production, contending that the state’s current rates are outdated and therefore too low.

DeWine spokesman Joshua Eck said the candidate “has no plans to raise taxes in Ohio as governor.” Cordray spokesman Mike Gwin said the candidate sees natural gas playing a role in the state’s energy mix, but did not provide an answer when asked if Cordray would consider proposing a higher severance tax.

For the first time in years, Democrats have candidates running for all legislative seats in Ohio, with some expected to be flipped. Strong GOP majorities, however, are expected to remain.

“The Republican brand has been so dominant for so long now at the state level that it would really be unexpected if you saw big Democratic gains,” Wood said. “We tend to see smaller swings at the state level than we do at the federal level, even with all this promise of a big Democratic wave at the federal level.”

In another high-profile race, popular Democratic Sen. Sherrod Brown, a fierce proponent of domestic manufacturing and energy development from Cleveland, leads Republican U.S. Rep. Jim Renacci by nearly 20 points in the polls.

Republican Stronghold

In West Virginia, where Republican Gov. Jim Justice is in the middle of his first term and where the gas industry won a major legislative victory earlier this year when co-tenancy was signed into law, things are even quieter on the political front. President Trump carried the state in 2016, just as he did in Pennsylvania and Ohio.

Republicans in the House of Delegates hold 64 seats compared to the 35 held by Democrats. The GOP holds 22 seats in the state Senate compared to just 12 held by Democrats. Some Republicans in the House also are running unopposed for reelection, and the party is expected to keep a firm grip on its majority.

“A lot of associations, a lot of trade groups, a lot industries would be looking to have this conversation after the election, after they can analyze who won, who lost, who’s in, who’s out, and you start kind of formulating where you think your vote base is,” said Charlie Burd, executive director of the West Virginia Independent Oil and Gas Association (IOGA), when asked what’s on the industry’s radar ahead of the regular legislative session that begins in January.

IOGA, just a few miles from the capitol building, hasn’t finalized its legislative agenda, Burd said. But he added that the passage of co-tenancy was a “huge win.” The law is similar to forced pooling in other states. It makes it easier for producers to block-up land for longer laterals and secure rights for properties that are owned by multiple people.

With that milestone reached, and solid Republican control of the legislature and governor’s office, it might be more about defense in West Virginia after the midterms.

“On the defensive side, I can say that we would work to safeguard any attempt to pass legislation that would increase our current severance tax rate or any legislation that would apply some sort of production tax as they have done in previous years.”

The industry narrowly fended off calls by Justice and lawmakers earlier this year to increase the severance tax to help fund pay increases for public school employees. Fees also have been imposed by the legislature in the past, notably in 2005 when lawmakers slapped one on coal and gas production to help pay the state’s workers compensation debts.

Other than that, Burd said his organization would work to advance pro-growth policies.

Democratic Sen. Joe Manchin, meanwhile, leads West Virginia AG Patrick Morrisey, a Republican, in a race that has drawn national attention, as it’s shaped up to be closer than some expected.

“They’re locked in a pretty tight race; you’ve seen polling both ways,” Burd said of the U.S. Senate race. “I don’t know if there’s a strict advantage to one or the other, but both do and have stated their support for oil and gas in the state. Sen. Manchin has referred to it as ”the hope for the future,’ and that’s a slogan we’ve been using for quite some time.”

In West Virginia’s third U.S. congressional district, Democratic state Sen. Richard Ojeda, who supported a severance tax increase to help fund teacher pay raises, is in a narrow contest with Republican Delegate Carol Miller. Energy issues, however, have not featured prominently in that race.

The New York Wall

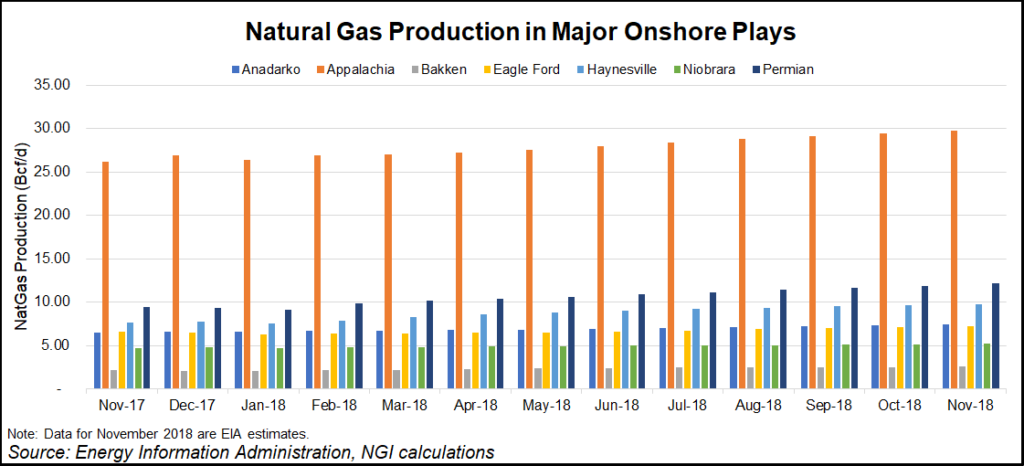

Natural gas production from the nation’s seven most prolific onshore unconventional plays is expected to increase to 74.06 Bcf/d next month, according to the Energy Information Administration. The most growth is expected in the Appalachian Basin, where production is forecast to reach 29.77 Bcf/d in November.

That sort of growth has been partly threatened for years by a wall of sorts in New York. Under Democratic Gov. Andrew Cuomo, New York banned HVHF. Gas infrastructure projects also have faced a series of regulatory snags or been denied altogether.

Not much is expected to change politically in Ohio, Pennsylvania and West Virginia, and the same is anticipated in New York, where Democrats enjoy a wide 104-41 majority in the state assembly and where the GOP is barely holding on to power in the state Senate by a seat.

Cuomo is running for a third term, and was pushed to the left by actress Cynthia Nixon during the Democratic primary. She called for an outright ban on gas pipelines and gas-fired power plants.

Polls show Cuomo with a roughly 20-point lead over Republican challenger Marcus Molinaro, the Dutchess County executive. Molinaro supports a fracturing pilot in the state’s Southern Tier, so long as it’s closely overseen by state regulators. He also favors an expansion of gas infrastructure in the state and supports calls for more renewable energy.

Under Cuomo’s policies, the state would sharply increase renewable energy generation and reduce emissions by 2030 and beyond.

Brad Gill, executive director of the Independent Oil and Gas Association of New York, said the industry shouldn’t expect any significant policy changes after the election.

“I don’t hold out much hope for a change of governor this fall, so we are likely to be stuck with Gov. Cuomo for another four years,” he said. “And that means we don’t see much hope on the horizon for New York’s failing oil and gas industry.”

Rumors of the federal government somehow intervening to accelerate long stalled pipeline projects in the state also have yet to materialize.

“As for the pipeline projects, some have been met with mixed success, but as of yet, I haven’t seen much pressure from the White House — certainly nothing that has been made public or known to me — and nothing that seems to have changed the landscape here,” Gill said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |