EIA’s Reported Injection Sharply Undercuts Consensus; Natural Gas Futures Rally

The Energy Information Administration (EIA) on Thursday reported a surprisingly lean 34 Bcf weekly injection into U.S. natural gas stocks, lending renewed vigor to a futures market that had shown signs of faltering.

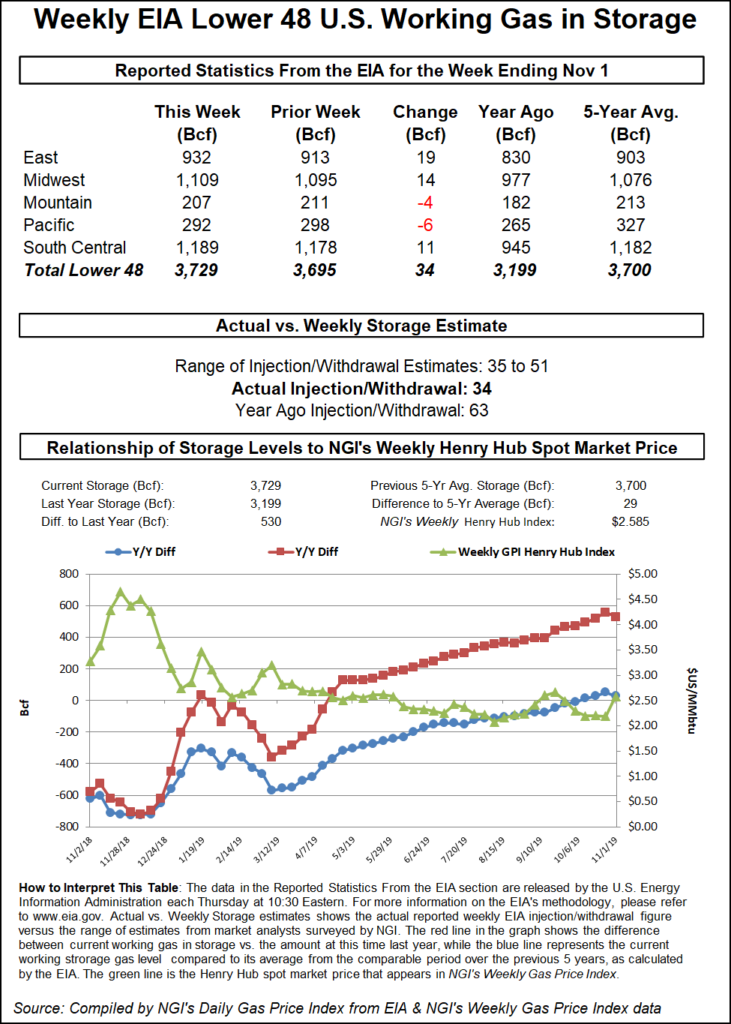

The 34 Bcf build, recorded for the week ended Nov. 1, came in about 10 Bcf below consensus and undercut both the 63 Bcf year-ago injection and the 57 Bcf five-year average.

With overnight guidance advertising a warmer outlook after the second week of November, the prompt month had been trading lower in the lead-up to Thursday’s storage report. But when the 34 Bcf print crossed trading screens, the December Nymex contract immediately shot up from around $2.810-2.820 to as high as $2.882.

By 11 a.m. ET, December was trading at $2.853, up 2.5 cents from Wednesday’s settle and up about 4 cents from the pre-report trade.

Prior to the report, estimates had pointed to a build around 45 Bcf, with predictions ranging from 31 Bcf to 51 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled at 43 Bcf; NGI’s model predicted a 44 Bcf build.

The low injection figure caught market watchers discussing this week’s report on energy chat platform Enelyst.com by surprise.

“Now we’ll get to see if this short covering rally will grow any legs,” Donnie Sharp of Huntsville Utilities wrote soon after EIA’s report went live.

The South Central region, home to growing export demand and Permian Basin associated gas entering the opaque Texas intrastate pipeline network, once again proved a source of consternation for analysts and onlookers trying to pinpoint balances in the region.

“All we can do is say, ”OK, so another surprise in the South Central,’” The Desk’s John Sodergreen wrote. “Since we can’t really see the flows down there, what’s left to say?”

Total Lower 48 working gas in underground storage stood at 3,729 Bcf as of Nov. 1, 530 Bcf (16.6%) above year-ago stocks and 29 Bcf (0.8%) higher than the five-year average, according to EIA.

By region, EIA recorded a 19 Bcf injection in the East for the week, with the Midwest injecting 14 Bcf. The Mountain region withdrew 4 Bcf for the week, while 6 Bcf was pulled from Pacific stocks. The South Central saw a net 11 Bcf injection on the week, including a 10 Bcf build in salt stocks and a 1 Bcf injection into nonsalt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |