EIA’s Reported 237 Bcf Draw Delivers TKO to Natural Gas; Widow-Maker Flips Negative

The Energy Information Administration (EIA) reported a 237 Bcf withdrawal from storage inventories for the week ending Feb. 1. The reported build fell about 10 Bcf shy of market expectations for a week that featured the coldest temperatures of the winter in key demand regions.

Nymex natural gas futures prices, which were already about a nickel lower ahead of the report, fell another penny or so as the print hit the screen. By 11 a.m. ET, the March contract was trading 7.7 cents lower at $2.585, and April was trading 6 cents lower at $2.597. The flip in the March/April spread reflects no concerns about a supply crunch, and the smaller-than-expected withdrawal fueled that sentiment.

“This came in bearish to market expectations and reflects a market that did not really tighten at all last week, despite severe cold across the Midwest. Modeling indicated bearish risks with the number today, though after a very surprising bearish miss last week, we were looking for an implicit revision,” Bespoke Weather Services chief meteorologist Jacob Meisel said.

Instead, the gas market remains quite loose and will struggle to bounce without clear evidence of tightening in daily supply/demand balances and more bullish weather. March gas at under $2.60 “still seems cheap given lingering cold risks and plummeting imports this week, but this is certainly a bearish EIA number that will limit upside at the front of the gas strip moving forward,” Meisel said.

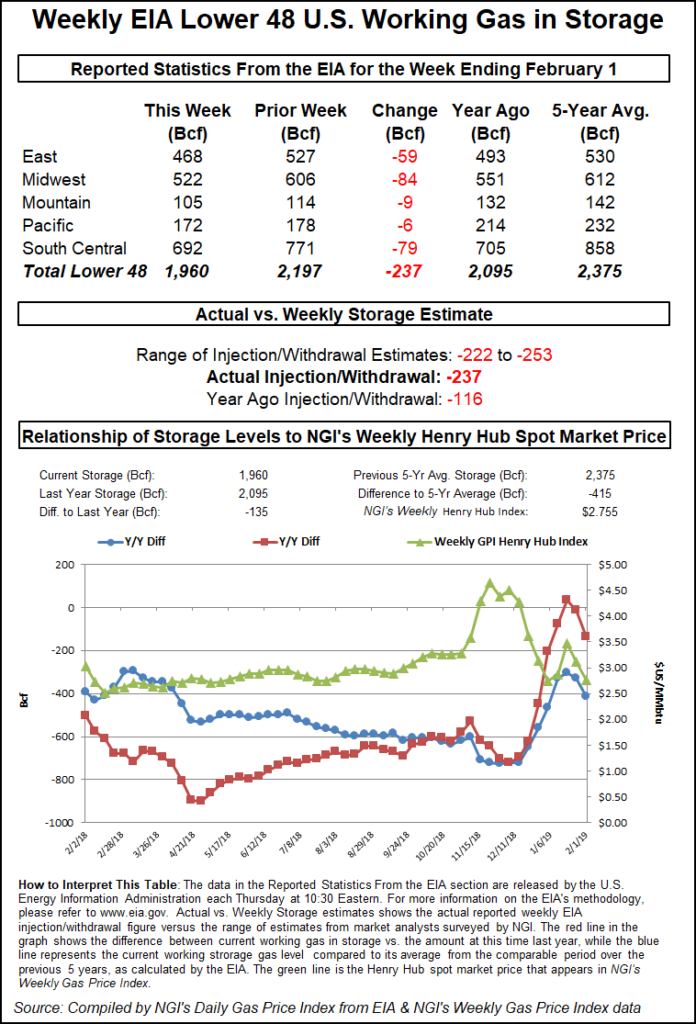

Broken down by region, the Midwest reported an 84 Bcf withdrawal, the second largest pull ever for that region. A 79 Bcf draw was reported in the South Central and a 59 Bcf draw was reported in the East. Both the Mountain and Pacific regions reported pulls of less than 10 Bcf, according to EIA.

Total working gas in storage as of Feb. 1 stood at 1,960 Bcf, 135 Bcf below last year and 415 Bcf below the five-year average.

Ahead of the EIA report, most market participants had called for a withdrawal in the 240-250 Bcf range. Last year, the EIA reported a withdrawal of 116 Bcf for the same week, and the five-year average draw stands at 150 Bcf.

Some market observers said the reported draws in the Midwest and South Central region appeared low but struggled to determine the reason for such a miss, although many wondered about the impact of liquefied natural gas (LNG) demand as exports were low for the reporting week and so far this week as well.

“LNG exports are a big part of demand now. A 3 Bcf/d drop is significant. I have heard LNG people say it is on contract and not flexible, but the trading shops set up around these things tell me otherwise,” Wood Mackenzie natural gas analyst Gabe Harris said on Enelyst, an energy social media platform hosted by The Desk.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |