Markets | Coronavirus | Natural Gas Prices | NGI All News Access

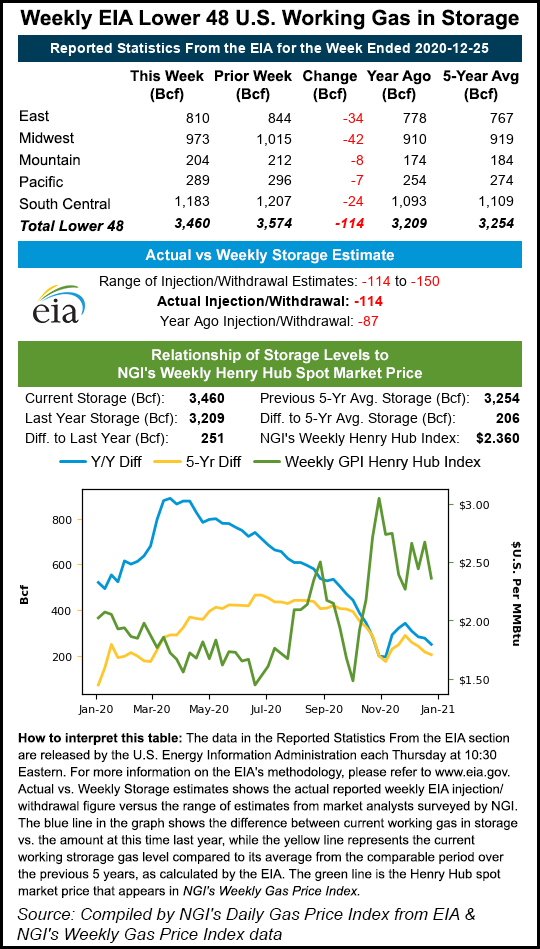

EIA’s 114 Bcf Storage Draw Well Below Expectations, but Natural Gas Bears’ Celebrations Cut Short

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |