Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

EIA Trainspotting Crude-by-Rail, Publishing Data Monthly

Now that an increasing amount of crude oil moves by rail — and as these shipments have attracted safety concerns in communities and in Washington, DC — the U.S. Energy Information Administration (EIA) has added crude-by-rail data to its monthly petroleum supply reports.

EIA’s petroleum supply data already include statistics on crude movements by pipeline, tanker and barge.

“The new crude-by-rail data provides a clearer picture on a mode of oil transportation that has experienced rapid growth in recent years and is of great interest to policymakers, the public, and industry,” said EIA Administrator Adam Sieminski. “EIA expects that the new data it has developed using information provided by the U.S. Surface Transportation Board (STB) along with data from other third-party sources and our own survey data, will provide key insights into oil-by-rail movements, including shipments to and from Canada.

EIA is initiating the series with monthly data from January 2010 through the current reporting month, which is last January. Crude-by-rail activity is tracked between pairs of Petroleum Administration for Defense District (PADD) regions (inter-PADD), within each region (intra-PADD), and across the U.S.-Canada border.

A webinar is scheduled for 11 a.m. EDT Tuesday (March 31) to explain the new crude-by-rail data. Information is available on the crude-by-rail webpage.

Like EIA’s other monthly petroleum data, the crude-by-rail data are subject to revision as new information becomes available. Near-month crude-by-rail data are modeled estimates that will be updated upon receipt of quarterly information from the STB. EIA and the Association of American Railroads (AAR) are exploring opportunities for EIA to utilize monthly AAR carload data to refine the near-month data.

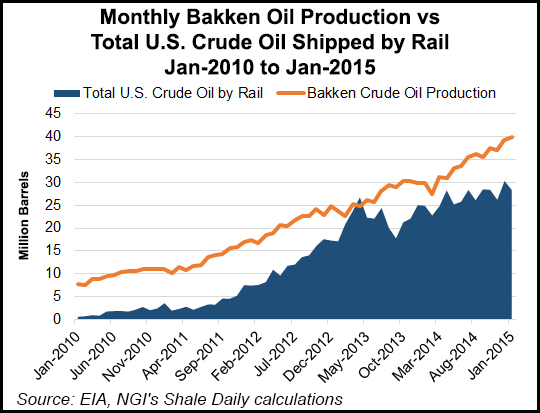

Crude-by-rail has had a significant influence over the growth in crude production from shale plays. Bakken Shale oil production has increased by more than 1 million b/d since 2010, and Niobrara oil production has experienced 300,000 b/d growth from January 2010 to January 2015, according to EIA. Currently, 70% of Bakken production and 64% of Niobrara production is transported by rail.

“The rapid building of unit train loading terminals, which typically require only six-12 months to construct, has been important to accommodating oil output growth in these regions,” EIA said. “In 2010, crude-by-rail movements were primarily within the Midwest to Cushing, OK, where the crude would be transferred to pipelines. The flexibility and adaptability of crude-by-rail has facilitated new flows from the Midwest to the East Coast and West Coast, as well as from the Rocky Mountains to the East Coast and Canada.”

In 2010, the primary flow of crude oil was north from the U.S. Gulf Coast region by pipeline into the Midwest, but significant Bakken production combined with rail transportation reduced the need for the northern flow and introduced pipeline and rail movements of crude oil from the Midwest south into the U.S. Gulf Coast, EIA said. Also, in 2010, East Coast refineries were entirely dependent on waterborne deliveries of crude from foreign sources. Although crude oil imports from Canada continue to grow, 300,000 b/d in rail receipts from the Bakken in 2014 have led to a 60% reduction in waterborne imports from the rest of the world, according to EIA data.

Meanwhile, the U.S. Department of Energy is researching ways to stabilize volatile crude oil to make it safer for rail transport (see Shale Daily, March 25a), and lawmakers in Washington are mulling tougher safety standards for such shipments that could see the early phase-out of some crude rail cars believed to be less safe than others (see Shale Daily, March 25b). These actions follow a number of recent derailments of trains carrying crude oil (see Shale Daily, March 6; Feb. 20; Feb. 17; Aug. 20, 2014).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |