Markets | NGI All News Access | NGI Data

EIA Storage Build Lighter Than Surveys, But Natural Gas Futures Market Not Impressed

The Energy Information Administration’s (EIA) weekly natural gas storage report missed to the low side of most estimates Thursday, but that didn’t seem to catch futures traders by surprise as prompt-month prices fell on the news.

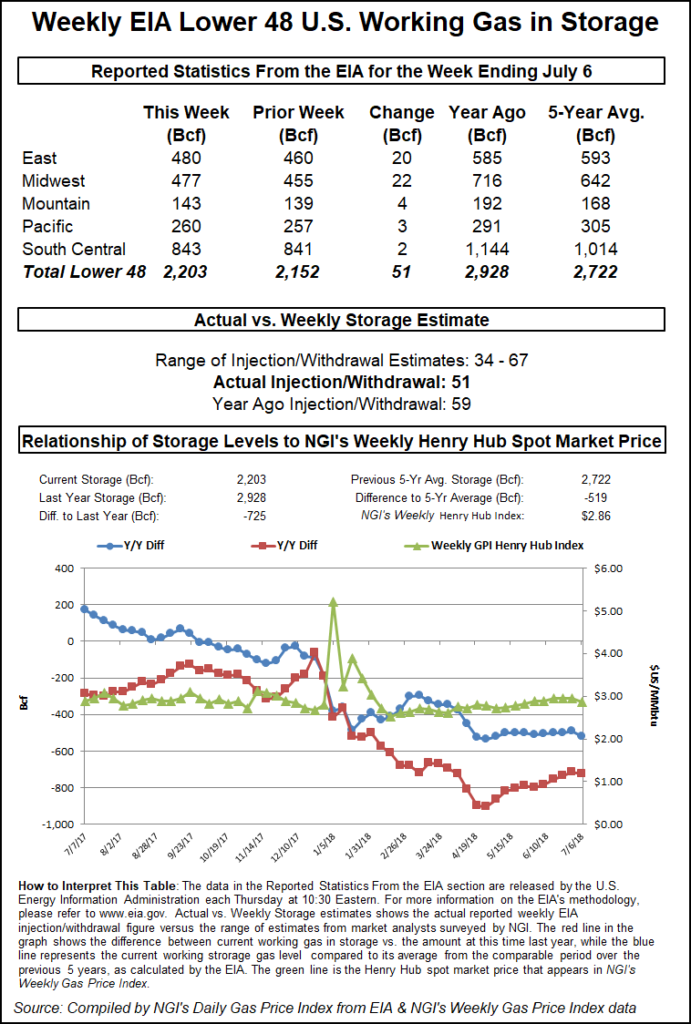

EIA reported a net 51 Bcf injection into Lower 48 gas stocks for the week ended July 6, lower than the 59 Bcf injected last year and well shy of the five-year average 77 Bcf build. The report period saw plenty of heat in key markets but also posed questions regarding potential demand destruction from the mid-week Fourth of July holiday.

Following the 10:30 a.m. ET release of the final number, August Nymex futures made their way down to around $2.798/MMBtu after trading as high as $2.826 just minutes earlier. By 11 a.m. ET, August was trading around $2.803, down about 2.6 cents from Wednesday’s settle.

Prior to Thursday’s report, major surveys had showed the market looking for a build about 4-5 Bcf larger than the actual figure. A Reuters survey of traders and analysts on average had showed respondents anticipating a 56 Bcf build, with responses ranging from 47 Bcf to 67 Bcf. A Bloomberg survey had produced a median 55 Bcf injection, with a range of 34 Bcf to 67 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures had settled at 49 Bcf Wednesday, below the major survey averages and the actual figure.

Bespoke Weather Services had called for a 54 Bcf build and said it viewed the leaner final number “as more of an indication that the holiday impact was slightly less than we had modeled (as some daily balance numbers had shown) as opposed to an indication that the market has tightened further.

“The market appeared to agree, falling off a print that was slightly below our expectation but did not surprise very bullish,” the firm said. “However, we do not see this print as too bearish either, coming in slightly below our expectation and likely allowing for some support from $2.75-2.77. Rather, it confirms a market that could still weakly bounce short-term, but which has strong resistance with risk skewed lower.”

Total working gas in underground storage stood at 2,203 Bcf as of July 6, versus 2,928 Bcf a year ago and five-year average inventories of 2,722 Bcf, according to EIA. Week/week the year-on-year deficit widened from minus 717 Bcf to minus 725 Bcf, while the year-on-five-year deficit increased from minus 493 Bcf to minus 519 Bcf, EIA data show.

By region, the South Central posted a net 2 Bcf build for the week, with 9 Bcf injected into nonsalt offsetting a 7 Bcf withdrawal from salt. In the East, 20 Bcf was injected for the week, while 22 Bcf was refilled in the Midwest. The Mountain region saw a 4 Bcf build, while 3 Bcf was injected in the Pacific, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |