NGI Archives | NGI All News Access

EIA Slashes NatGas Price Forecast: $2.25/MMBtu in 2016, $3.02/MMBtu in 2017

Energy Information Administration (EIA) price forecasts for the next two years turned downward Tuesday when the agency said a warmer-than-normal winter, record inventory levels and production growth all weighed on prices. Forecasts had been firming recently.

EIA expects Henry Hub natural gas prices to average $2.25/MMBtu in 2016 and $3.02/MMBtu in 2017, according to the agency’s latest Short-Term Energy Outlook (STEO). That’s down sharply from the previous STEO, which included forecasts of $2.64/MMBtu this year and $3.22/MMBtu next year (see Shale Daily, Feb. 10). Henry Hub spot prices averaged $2.63/MMBtu in 2015, according to EIA. The agency’s price forecasts declined steadily throughout 2015 (see Shale Daily, Dec. 8, 2015) before firming a bit in January (see Shale Daily, Jan. 25).

Henry Hub prices averaged $1.99/MMBtu last month, a decline of 29 cents from January, according to the STEO. Natural gas futures prices for June 2016 delivery (for the five-day period ending March 3) averaged $1.91/MMBtu.

Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for June 2016 contracts at $1.27/MMBtu and $2.88/MMBtu, respectively. At this time last year, the natural gas futures contract for June 2015 averaged $2.83/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $1.92/MMBtu and $4.18/MMBtu, EIA said.

Barclays Capital said last week it also expects higher-than-expected end-of-winter inventories to pressure natural gas prices through this year (to $2.50/MMBtu), but looks for a higher breakout in 2017 (to $3.05/MMBtu) (see Daily GPI, March 3a). And Tudor, Pickering, Holt & Co. (TPH) said recently gas prices have a better shot of increasing by late this year or early in 2017. TPH is forecasting storage levels to exit the withdrawal season at 2.4 Tcf, in line with 2012’s 10-year storage highs.

EIA last week reported a withdrawal of 48 Bcf, leaving 2,536 Bcf in natural gas storage, significantly more than a year ago (1,742 Bcf) and the five-year average (1,870 Bcf) (see Daily GPI, March 3b). The agency expects end-of-March working inventories to reach 2,288 Bcf, compared with 2,096 in the previous STEO and 666 Bcf more than the five-year end-of-March average.

“After withdrawals accelerated in January, they slowed again in February because of warmer-than-normal weather,” EIA said.

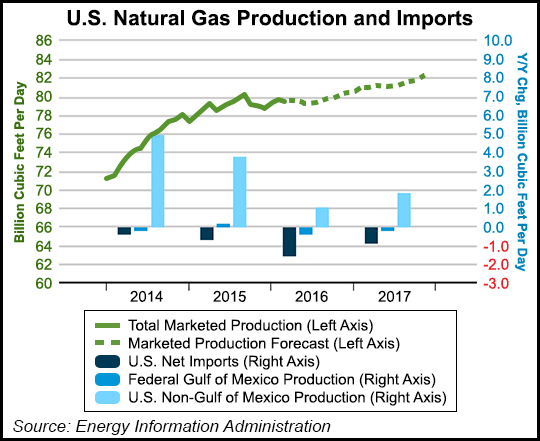

Total marketed production averaged 78.7 Bcf/d in December, a 0.4% decline from November, EIA said. “Production in the Marcellus states (Pennsylvania, Ohio, and West Virginia) increased from the previous months, partially offsetting declines in Texas, Louisiana, and western states,” according to the agency. Marketed production averaged 78.9 Bcf/d last year (a 5.4% increase from 2014), and EIA expects growth will slow to 0.9% this year as low natural gas prices and declining rig activity begin to affect production. But in 2017 EIA expects production growth to increase to 2.1%, as forecast prices rise, industrial demand grows, and liquefied natural gas (LNG) exports increase.

LNG gross exports will increase to an average of 0.5 Bcf/d in 2016 with the start-up of Cheniere’s Sabine Pass LNG liquefaction plant in Louisiana, EIA said (see Daily GPI, Jan. 14). LNG exports will average an estimated 1.3 Bcf/d in 2017 as Sabine Pass ramps up its capacity, according to the STEO.

Total natural gas consumption is expected to average 76.8 Bcf/d this year and 77.3 Bcf/d next year, compared with 75.3 Bcf/d in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |