Shale Daily | Marcellus | NGI All News Access

EIA Sees Southwest PA Gas Prices Slipping Below Henry Hub…Again

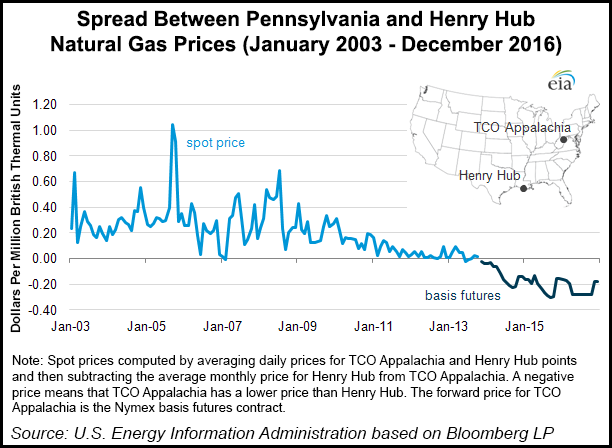

With the natural gas production boom out of the Utica and Marcellus shales of Pennsylvania, West Virginia and Ohio continuing to lower prices of the commodity in the region, analysts at the Energy Information Administration (EIA) believe by early next year the price of southwestern Pennsylvania natural gas at the TCO Appalachia trading point (NGI‘s Columbia Gas index) will more regularly fall below the benchmark Henry Hub located in Erath, LA.

“Natural gas prices in the Mid-Atlantic have traditionally been more expensive than Henry Hub, reflecting the cost of moving natural gas from the production in the Gulf region to consumers along the East Coast,” the EIA said Wednesday. “Increased production from the Marcellus region began changing that relationship in 2011.”

According to EIA data, natural gas production in the Northeast has grown by about 3.2 Bcf/d so far in 2013, a 30% increase from the same period last year. Total natural gas production in this region reached 12.2 Bcf/d in August, a 4.1-Bcf/d increase from August 2012 and a 2.5-Bcf/d increase from the end of last year.

Production in West Virginia reached 2.4 Bcf/d in August, which is 0.8 Bcf/d above the August 2012 level, with 0.6 Bcf/d of that growth occurring in 2013, EIA data show. The liquids-rich areas of the state experienced the most growth as a result of the beginning of operations at two new natural gas processing facilities — the Mobley (Wetzel County, WV) and Natrium (Marshall County, WV) — and the expansion of several existing plants (seeShale Daily, Sept. 5).

The EIA said the Pennsylvania growth is coming mostly from dry gas production in the northeastern portion of the state, which coincides with infrastructure improvements in the region, as gathering lines and pipeline capacity expansions have helped flow more gas to market. However, capacity constraints still plague Marcellus production in northeastern Pennsylvania, which has put downward pressure on associated prices. NGI Shale Daily’s Shale Price Indices show a significant gap in prices between the two major production zones of the Marcellus. For gas traded Tuesday for Wednesday delivery, NGI‘s Marcellus Northeast-PA index averaged $2.33/MMBtu, whileNGI‘s Marcellus Southwest-PA/WV index came in with an average of $3.54/MMBtu. NGI‘s Henry hub index on the day averaged $3.71/MMBtu.

NGI Director of Strategy and Research Patrick Rau noted that the Marcellus in Pennsylvania is so large that if it were in two different states, it may very well be considered to be two different basins due to well economics and pipeline infrastructure.

“Gas in some portions of southwest Pennsylvania is more liquids rich, so that obviously gives a boost to the economics,” Rau said. “But what hasn’t been as obvious is the fact that the southwest portion of Pennsylvania has been served by pipelines that were designed to handle both receipts and deliveries in the same general area. There was already legacy, more conventional production in southwest Pennsylvania, so pipelines like Dominion Transmission and Columbia Gas (TCO) were in a much better position to absorb the surge in Marcellus production.”

However, Rau pointed out that northeastern Pennsylvania was a little less prepared. “The two main pipelines in the northeastern Marcellus, which are Tennessee and Transco, were built to transport gas from the Gulf Coast to areas farther downstream, such as New England and New York,” he said. “It just so happens that they pass through counties that are now flush with Marcellus production.

“Those lines weren’t really built to receive full scale receipts in northeast Pennsylvania, and that has led to major capacity constraints there, which in turn has created massive negative basis differentials relative to both the Henry Hub and to pipelines in the southwest part of the state. But those southwest Pennsylvania pipelines are becoming more constrained themselves, and we are starting to see negative basis differentials there as well.”

The EIA added that the forward curve for TCO Appalachia was also negative relative to Henry Hub in the middle of 2012, but unusually cold winter weather in late 2012 and early 2013 changed the dynamic in the spot market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |