Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

EIA Says Oil Production Down in Eagle Ford, Bakken; NatGas Up in Haynesville

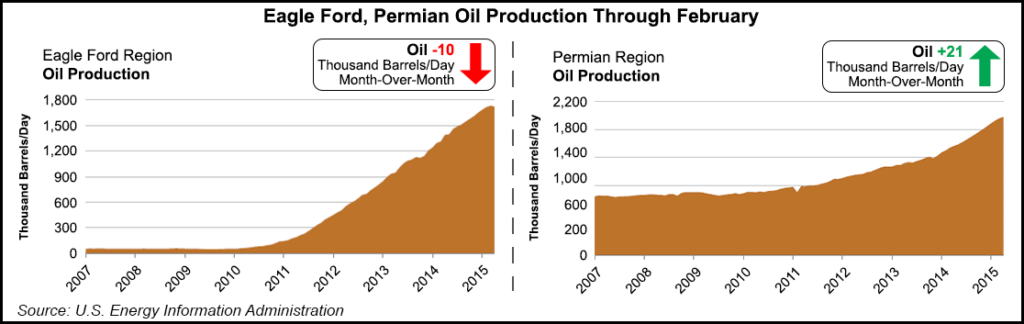

Crude oil production fell in the Eagle Ford and Bakken shales but increased in the Permian Basin in February, while natural gas production accelerated in the Haynesville Shale and isn’t projected to slow down through April, according to drilling productivity reports by the U.S. Energy Information Administration (EIA).

Production in the Eagle Ford region declined 10,000 b/d in February, the most among any of the regions reported by the EIA, but natural gas production increased 14 MMcf/d. The decline in oil production was projected to continue into April, with EIA estimating March production at 1.73 million b/d and April production at 1.72 million b/d. Production from new wells was expected to be 131,000 b/d — not enough to offset a decline of 141,000 b/d in production from legacy wells — and resulting in a net decline of 10,000 b/d.

Natural gas production in the Eagle Ford was projected to total 7.51 Bcf/d in March, increasing 14 MMcf/d to reach 7.53 Bcf/d in April. Production from new wells was expected to total 332 MMcf/d, offsetting a decline of 318 MMcf/d in production from legacy wells.

Monthly additions from one average rig in the Eagle Ford were projected to increase natural gas production by 20 Mcf/d (from 1.71 MMcf/d in March to 1.73 MMcf/d in April), and oil production by 20 b/d (from 660 b/d in March to 680 b/d in April).

In the Permian region, crude oil production increased 21,000 b/d while natural gas production went up 25 MMcf/d in February. Oil production was forecast to be 1.96 million b/d in March, with a net increase of 21,000 b/d bringing total production to 1.98 million b/d in April. Production from new wells (90,000 b/d) was expected to offset a decline in legacy production (69,000 b/d) for the net increase.

The EIA projected natural gas production to total 6.4 Bcf/d in the Permian in March. A net increase of 25 Mcf/d was expected to boost total production to 6.43 Bcf/d in April, after 172 Mcf/d in production from new wells offsets a decline of 147 Mcf/d in legacy production.

Monthly additions from one average rig in the Permian were projected to increase oil production by 38 b/d (from 202 b/d in March to 240 b/d in April), and gas production by 57 Mcf/d (from 402 Mcf/d in March to 459 Mcf/d in April).

The Bakken region saw declines in crude oil and natural gas production in February, and the declines were expected to continue into April.

The EIA said oil production in the Bakken declined 8,000 b/d in February, while gas production fell 8 MMcf/d. The agency’s projections have March production pegged at 1.33 million b/d for oil and 1.56 Bcf/d for natural gas. Production from new wells was expected to add another 72,000 b/d of oil and 73 MMcf/d of gas, but these were not enough to offset production declines of 80,000 b/d of oil and 81 MMcf/d of gas from legacy wells.

Monthly additions from one average rig in the Bakken were projected to increase oil production by 15 b/d (from 577 b/d in March to 592 b/d in April), and gas production by 11 Mcf/d (from 584 Mcf/d in March to 595 Mcf/d in April).

Natural gas production soared 80 MMcf/d in the Haynesville region in February, and the EIA projected a net increase of another 80 MMcf/d between March (7.05 Bcf/d) and April (7.14 Bcf/d), with 293 MMcf/d in production from new wells offsetting a decline of 213 MMcf/d in production from legacy wells.

Haynesville oil production was flat in February and was expected to remain so through April. Oil production is expected to total 57,000 b/d in March and April, with 1,000 b/d in production from new wells cancelling out a 1,000 b/d decline from legacy production.

The EIA said monthly additions from one average rig in the Haynesville region were projected to increase gas production by 111 Mcf/d (from 5.84 MMcf/d in March to 5.95 MMcf/d in April). Oil production was projected to remain unchanged at 24 b/d through March and April.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |