E&P | Bakken Shale | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

EIA Says NatGas Reserves Up 10%; North Dakota Passes GOM in Crude

U.S. natural gas proved reserves increased nearly 10% and reached a record 354 Tcf in 2013, according to the U.S. Energy Information Administration (EIA). Meanwhile, North Dakota’s crude oil and lease condensate proved reserves surpassed those of the federal Gulf of Mexico (GOM), ranking it second only to Texas among U.S. states.

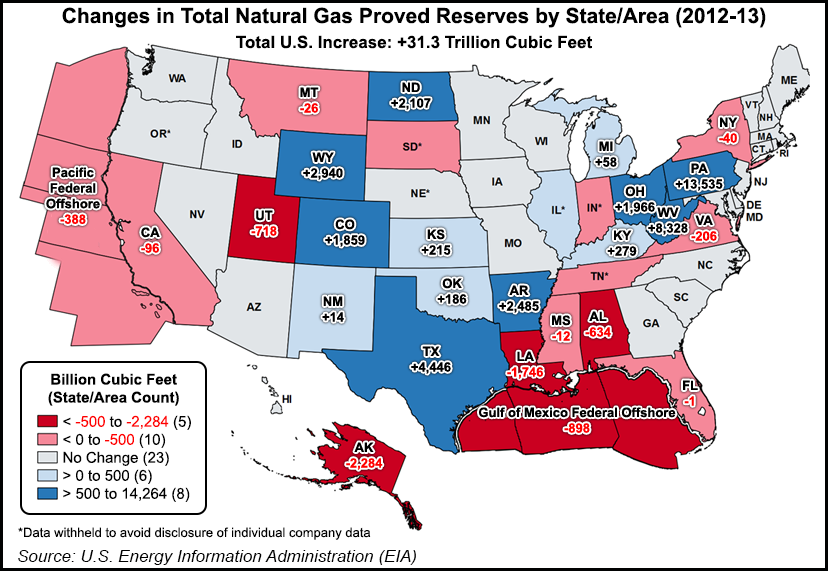

In its annual report, released Thursday, the EIA said net additions to U.S. proved reserves of natural gas totaled 31.3 Tcf in 2013, which offset a 26.5 Tcf decline in production. Total U.S. proved reserves of natural gas increased 9.7%, to 354 Tcf, a record high.

“The reserves were added onshore in the Lower 48 States from ongoing exploration and development activity in several of the nation’s shale formations, including the Barnett, Haynesville, Marcellus, Fayetteville, Woodford and Eagle Ford plays,” the EIA said. “Natural gas proved reserves in Alaska and the federal waters of the GOM both declined in 2013.”

According to the EIA, proved natural gas reserves increased in all of the top five states for natural gas reserves in 2013: Colorado, Oklahoma, Pennsylvania, Texas and Wyoming. Pennsylvania saw the largest increase, 13.5 Tcf, thanks to extensions into fields in the Marcellus Shale.

“The reserves additions in Texas and Oklahoma also were mostly from extensions in shale natural gas plays, but in Wyoming and Colorado, positive net revisions to large conventional gas fields (associated with increased prices) added more gas reserves than extensions,” the EIA said.

West Virginia reported the second-largest net increase in natural gas proved reserves, at 8.3 Tcf. Texas and Wyoming came next — at 4.4 and 2.9 Tcf, respectively — followed by Arkansas and North Dakota, which both added more than 2 Tcf.

The EIA said U.S. natural gas discoveries totaled 53 Tcf in 2013, 95% of which came from extensions to existing natural gas fields. New field discoveries totaled 0.3 Tcf while new reservoir discoveries totaled 1.7 Tcf. Pennsylvania led the field in terms of total discoveries of natural gas reserves at 15.8 Tcf, followed by West Virginia (10.1 Tcf), Texas (9.7 Tcf) and Oklahoma (4 Tcf).

“Total discoveries in each of these states were driven principally by shale gas developments,” the EIA said.

The share of shale gas relative to total U.S. natural gas proved reserves increased to 45% in 2013, up from 40% in 2012, the EIA said. The agency added that estimated production of shale natural gas increased nearly 10% between 2012 and 2013, from 10.4 to 11.4 Tcf.

“Texas had the most shale gas proved reserves at year-end 2013, having the Barnett, the Eagle Ford, and a portion of the Haynesville/Bossier shale gas play within its borders,” the EIA said. “Pennsylvania, which had the second-largest volume of shale gas proved reserves, experienced greater growth of its shale gas proved reserves than Texas.”

The EIA said West Virginia surpassed Oklahoma to become the third-largest shale gas reserves state. Oklahoma is now fourth, followed by Arkansas in fifth and Louisiana sixth.

According to the EIA, six shale plays — Marcellus, Barnett, Eagle Ford, Haynesville/Bossier, Woodford and Fayetteville — held 94% of U.S. shale gas proved reserves at the end of 2013.

“The Marcellus remained the largest shale gas play, and added the most new shale gas reserves (22.1 Tcf) in 2013 through extensions in Pennsylvania and West Virginia,” the EIA said. “The second-largest shale gas play was the Barnett Shale, where proved reserves were revised upward in 2013 mostly in response to higher natural gas prices.”

The EIA said net additions to U.S. proved reserves of crude oil and lease condensate totaled 3.1 billion bbl, which offset a 2.7 billion bbl decline in production. For the first time since 1975, total U.S. proved reserves of crude oil and lease condensate exceeded 36 billion bbl; it increased 9.3%, to 36.5 billion bbl, in 2013.

Proved reserves of crude oil and lease condensate increased in North Dakota and Texas — two of the top five states for crude oil and lease condensate in 2013 — but North Dakota had the largest increase in proved reserves, about 1.9 billion bbl. The EIA said the increase seen in North Dakota represents 61% of the nation’s total net increase for 2013.

“In 2013, North Dakota’s proved reserves of crude oil and lease condensate exceeded those of the federal offshore GOM, making it the second largest oil reserves state in the United States,” the EIA said. The agency later added that North Dakota “led all states in additions of proved oil reserves because of ongoing development of the Bakken/Three Forks tight oil play in the Williston Basin. More than three-quarters of North Dakota reserves additions were from extensions in 2013.”

The EIA said Texas had the second-largest increase in crude oil and lease condensate proved reserves in 2013, adding about 0.9 billion bbl. “Extensions to fields in the liquids-rich section of the Eagle Ford shale play in south-central Texas and to oil fields in the Permian Basin provided the largest portion of new Texas proved oil reserves,” the EIA said.

According to the EIA, North Dakota and Texas accounted for 90% of the overall net increase in U.S. proved oil reserves in 2013.

The EIA found that as of Dec. 31, 2013, tight oil plays accounted for 28% of all U.S. crude oil and lease condensate proved reserves. More than 95% of U.S. tight oil proved reserves in 2013 came from six tight oil plays: Bakken/Three Forks, Eagle Ford, Bone Spring/Wolfcamp Formation, Marcellus, Barnett Shale and Niobrara Formation.

The Bakken/Three Forks regained its rank as the largest tight oil play in the U.S., a title it surrendered to the Eagle Ford in 2012 (see Shale Daily, July 30, 2012).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |