Markets | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

EIA Says Henry Hub Natural Gas Averaged $1.81/MMBtu January-June

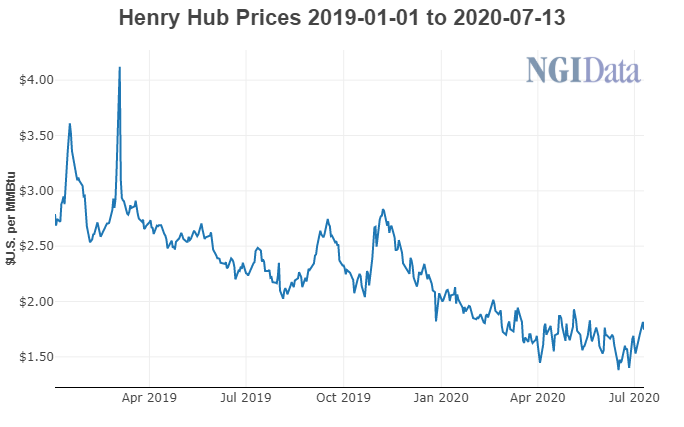

U.S. natural gas benchmark Henry Hub prices tracked nearly $1 below year-ago levels in the first half of the year, averaging only $1.81/MMBtu, according to the Energy Information Administration (EIA).

This included a record low of $1.61 in June and sub-$2 gas in each month from February through June. Before 2020, the Henry Hub price averaged less than $2 in only one month — March 2016. The daily Henry Hub price reached its lowest level in more than 20 years on June 16, settling at $1.38, NGI data show.

“Prices started the year low because of mild winter weather, which resulted in less natural gas demand for space heating,” said the EIA.

Working U.S. natural gas stocks entered the heating season at 3,575 Bcf, nearly the same as the average over the previous five years, according to the agency. From there, tepid demand left inventories at a robust 2,008 Bcf at the end of March, which was 19% more than the previous five-year average and the most working natural gas in storage since the 2016-17 winter. In fact, net withdrawals totaled only 1,718 Bcf during the heating season, according to the EIA, the least in four winters.

“Beginning in March, spring weather and the economic slowdown induced by mitigation efforts for the coronavirus disease 2019 (Covid-19) contributed to lower demand, further lowering prices,” EIA said.

High U.S. storage levels and lower prices also have been the result of a decline in liquefied natural gas (LNG) exports, according to the agency. U.S. LNG export demand has fallen by half from January-June, from 9.8 Bcf/d in late March to less than 4.0 Bcf/d in June. Nevertheless, U.S. LNG exports, which averaged an estimated 5.0 Bcf/d in 2019, are expected by the EIA to increase to 5.4 Bcf/d this year and 7.3 Bcf/d next year.

U.S. industrial demand, meanwhile, is down by 0.6 Bcf/d, or 2.7%, compared with the year-ago period, EIA said.

Natural gas prices are expected by the agency to stay low in the coming months before eventually increasing by the end of 2020.

By the fall, EIA expects low prices to lead to further declines in natural gas production as a result of lags between natural gas price changes and adjustments to production levels. The agency projects U.S. dry natural gas production to decrease by 3% to average 89.2 Bcf/d in 2020, down from 92.2 Bcf/d in 2019.

EIA expects natural gas spot prices to rise by 4Q2020 as production falls and the winter heating season begins. In its July 2020 Short-Term Energy Outlook (STEO), EIA forecasts the Henry Hub natural gas spot price for 2H2020 will average $2.05.

Enverus also said lower production would spur prices later this year, with the firm forecasting that Henry Hub would average $3.90 for the winter 2020-21. A Morgan Stanley research team led by Equity Analysts & Commodities Strategist Devin McDermott sees Henry Hub prices averaging $1.94 for 2020 and $2.65 in 2021. The team maintains their long-term assumption of $2.75 Henry Hub.

The low price of natural gas is expected by the EIA to encourage more natural gas consumption in the electric power sector in 2020, which already is tracking 7% higher in the first half of 2020 compared with last year. Consumption in all other sectors is projected to decline, with overall 2020 natural gas consumption set to fall by 3 Bcf/d year/year, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |