EIA Reports ‘Tight’ 98 Bcf Injection into Storage, Futures Rise

The Energy Information Administration (EIA) reported a 98 Bcf injection into natural gas storage inventories for the week ending June 21, snapping a string of triple-digit builds dating back to mid-May and delivering the tightest stat of the summer so far.

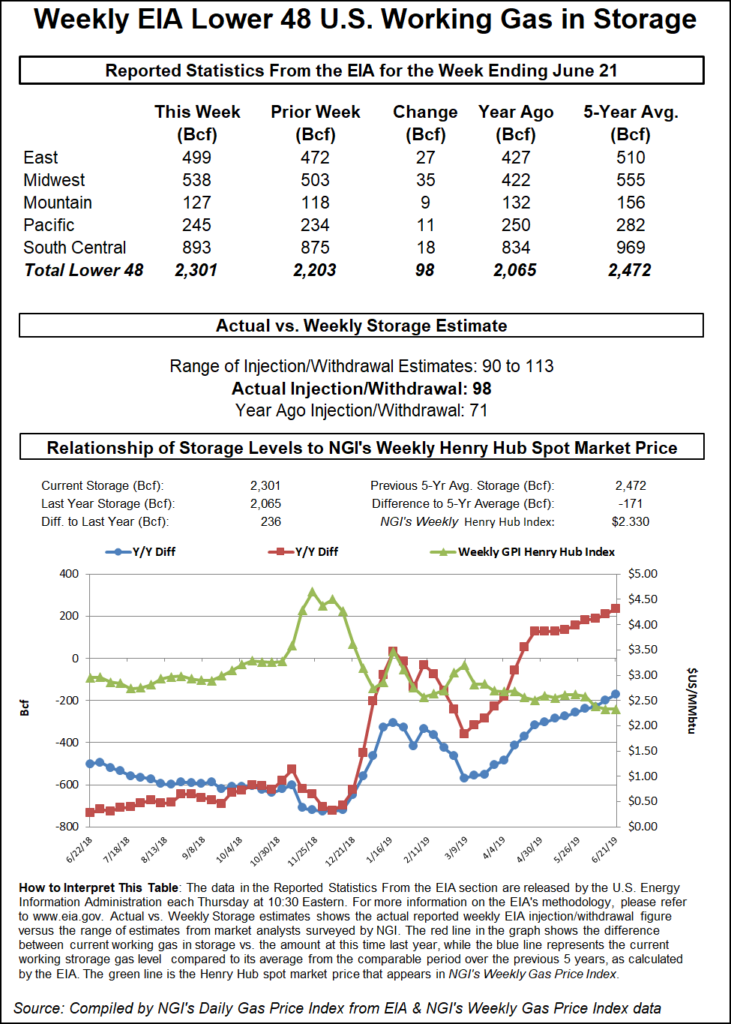

The reported injection was within the range of expectations, although consensus was a couple of Bcf higher. The 98 Bcf build compared with last year’s 71 Bcf injection and the five-year 70 Bcf average, according to EIA.

Natural gas futures responded swiftly to the slightly smaller-than-expected injection. The August Nymex contract was trading about 3 cents higher near $2.30 before the EIA’s 10:30 a.m. ET report. As the print hit the screen, the prompt month shot up to $2.327, up about 6 cents from Wednesday’s settle. By 11 a.m., the August contract was trading at $2.319, up 5.1 cents. September was up 5 cents to $2.294.

The 98 Bcf injection was dead on with Bespoke Weather Services’ projection. Balance wise, the build was the tightest the firm has seen “in a long time” and close to the five-year average balance.

“We will have to see if we can sustain this level of tightness, as we must remember a part of this number was the temporary decline of Canadian imports,” Bespoke chief meteorologist Brian Lovern said. “In-week balances this week do not appear as tight as the ones for the report issued today.”

There were no major surprises in the EIA data. A 35 Bcf injection was reported in the Midwest, and 27 Bcf was added in the East. The Pacific injected 11 Bcf, while stocks in the Mountain region rose by 9 Bcf. The South Central region reported an 18 Bcf injection, including a 1 Bcf withdrawal in salt facilities and an 18 Bcf build into nonsalts.

Working gas in storage as of June 21 was 2,301 Bcf, 236 Bcf above last year and 171 Bcf below the five-year average, according to EIA.

Some market observers on Enelyst, an energy chat room hosted by The Desk, said 100 Bcf-plus storage injections may be in the rearview mirror. However, larger-than-normal builds were likely to continue at a slower pace, especially with warmer weather ahead.

Genscape Inc. senior natural gas analyst Eric Fell said gas prices also pointed to increasing liquefied natural gas (LNG) exports. Genscape’s models indicate that forward supply growth is much slower compared to what the market has seen in the last 12-18 months.

“Big picture, assuming normal weather and current prices (including LNG arbitrage, which is way in money for winter), we have demand up quite a bit more than supply winter on winter,” Fell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |