EIA Reports Storage Pull to High Side of Estimates, but Natural Gas Futures Slide

The Energy Information Administration (EIA) on Thursday reported a 29 Bcf weekly withdrawal from U.S. natural gas stocks, a slightly larger-than-expected pull that nonetheless failed to offer much encouragement for futures bulls.

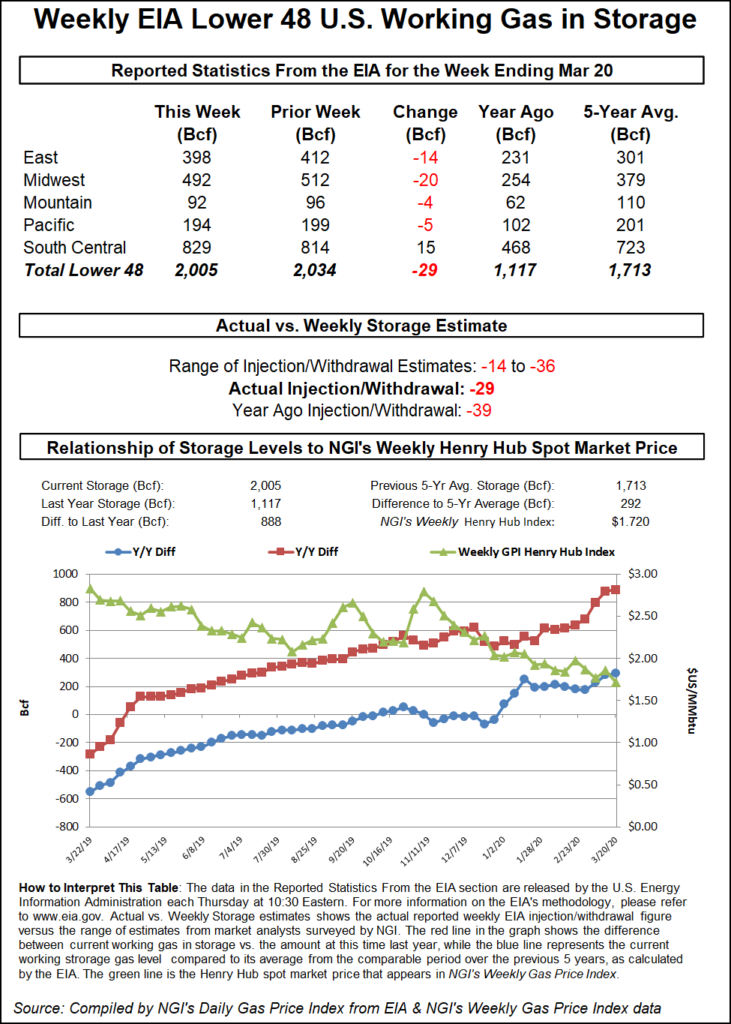

The 29 Bcf pull, recorded for the week ending March 20, compares with a 39 Bcf withdrawal recorded in the year-ago period and a five-year average pull of 40 Bcf.

In the half hour leading up to EIA’s report, the April contract traded around $1.645-1.660/MMBtu. As the report crossed trading screens at 10:30 a.m. ET, prices briefly climbed above $1.670 before falling back to around $1.655.

By around 11 a.m. ET, April had dropped to $1.634, off 2.5 cents from Wednesday’s settle.

“This number is looser in terms of supply/demand balances, which is to be expected as we move forward in the slowdown of the economy,” Bespoke Weather Services said. “Numbers in the next few weeks will be quite useful in determining how much demand loss is actually taking place and, as a result, should carry more weight in terms of market impact, although duration is critical as well, which is a tougher assessment.”

Prior to the report estimates clustered around a withdrawal slightly lighter than the actual figure.

A Bloomberg survey showed a median prediction for a 30 Bcf withdrawal, while a Wall Street Journal poll showed an average estimate of minus 27 Bcf. A Reuters survey landed on a 25 Bcf withdrawal, matching the 25 Bcf pull predicted by NGI’s model. Estimates ranged from minus 14 Bcf to minus 36 Bcf.

Total Lower 48 working gas in underground storage stood at 2,005 Bcf as of March 20, 888 Bcf (79.5%) above year-ago stocks and 292 Bcf (17.0%) higher than the five-year average.

By region, EIA recorded a 20 Bcf withdrawal in the Midwest during the week, with the East seeing a pull of 14 Bcf. The Pacific region withdrew 5 Bcf, while the Mountain region withdrew 4 Bcf, according to EIA. In the South Central, EIA recorded an 11 Bcf injection into salt stocks and a 3 Bcf build for nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |