EIA Reports Low-Ball Storage Draw; Reaction Muted as NatGas Futures Already Much Lower

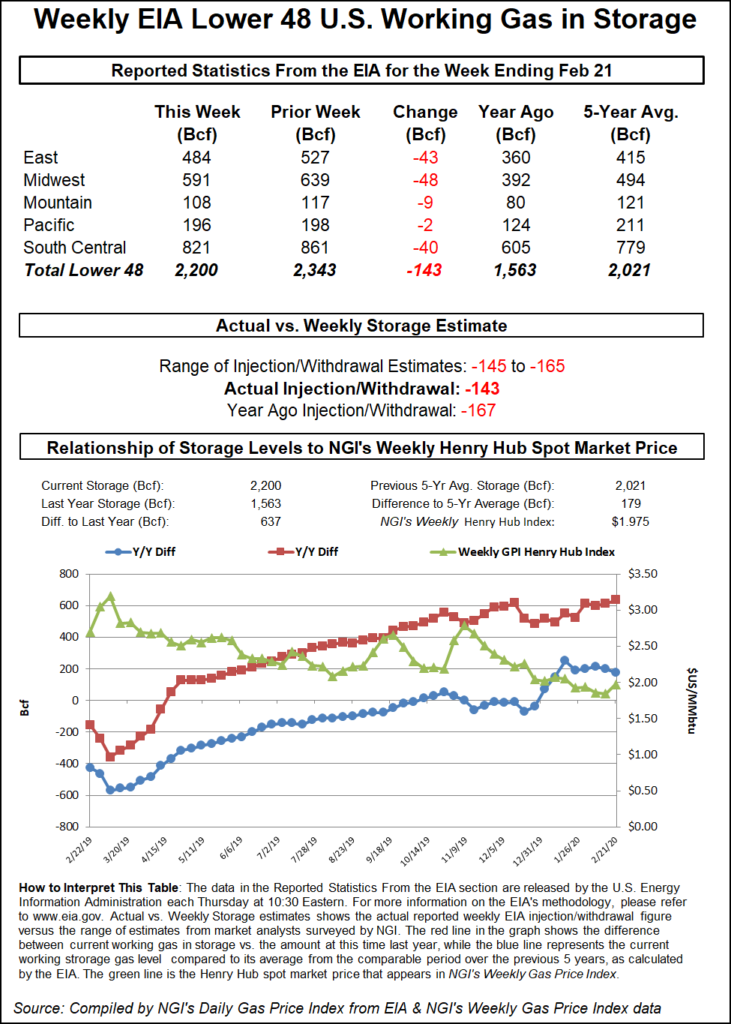

After weeks of tight, bullish surprises, the U.S. Energy Information Administration (EIA) reported a smaller-than-expected 143 Bcf natural gas storage withdrawal for the week ending Feb. 21.

Nymex futures, already lower day/day on decisively warmer revisions to the latest weather models, initially fell even further once the report crossed trading desks. The April gas futures contract was trading at $1.747, down 9.0 cents, in the minutes leading up to the 10:30 a.m. ET report. As the print hit the screen, the prompt month fell to $1.73, and then dropped as low as $1.719.

“That bump last week gave it just enough breathing room to roll down again,” said Huntsville Utilities’ Donnie Sharp. “Anyone who has sat on the sidelines should get on the field directly, with their A team, not the B team. Knock off some risk (end user). Leave an empty pocket for this fall.”

By 11 a.m., however, April Nymex gas was back at $1.75, off 8.7 cents day/day.

During a post-storage chat on Enelyst.com, an energy platform hosted by The Desk, managing director Het Shah said the short position “is building up,” which made him “a bit uneasy. Any bullish sign, and this market bounces quickly.”

Said Sharp, “a $1.60-ish pop could be it. Attention will be shifting to summer very soon.”

Ahead of the EIA report, a Bloomberg survey of 11 analysts showed withdrawals ranging from 145 Bcf to 165 Bcf, with a median of 156 Bcf. Polls by the Wall Street Journal and Reuters produced similar results, while NGI’s model projected a pull of 152 Bcf.

Genscape senior natural analyst Eric Fell, who also had projected a 152 Bcf draw, said the large miss could be attributed to “sloppy weekly storage data. The EIA can only work with the data they get from operators. It is what it is.”

The EIA recorded a 167 Bcf draw for the similar week last year, while the five-year average withdrawal stands at 122 Bcf.

Broken down by region, the Midwest withdrew 48 Bcf out of storage, while the East pulled 43 Bcf, according to EIA. Inventories in the South Central region declined by 40 Bcf, including a 27 Bcf draw from nonsalts and a 13 Bcf drop in salts. The Mountain region pulled 9 Bcf out of stocks, while the Pacific withdrew just 2 Bcf.

Total working gas in storage as of Feb. 21 stood at 2,200 Bcf, 637 Bcf above year-ago levels and 179 Bcf above the five-year average, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |