Natural Gas Prices | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

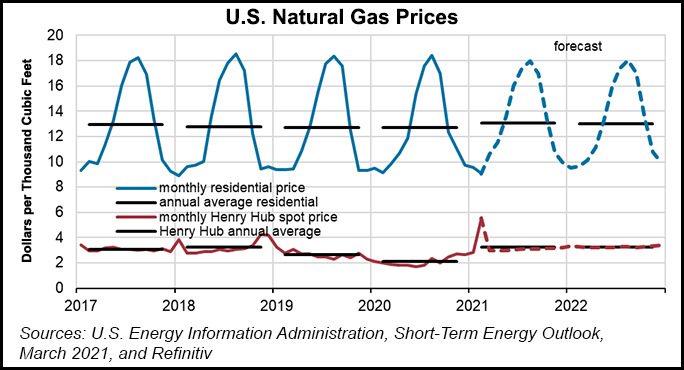

EIA Raises 2021 Natural Gas Price Forecast to $3.14, Up Nearly 20 Cents After Record February Withdrawal

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |