Natural Gas Prices | NGI All News Access

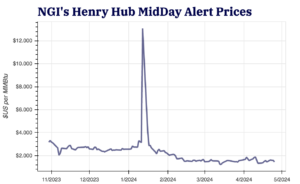

EIA Lowers Winter Natural Gas Price Forecast on Mild Temps, Rising Production

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Markets

After a midweek nosedive, natural gas futures hovered close to even through midday trading Thursday, largely weathering the bearish impact of a high-side injection miss in the latest U.S. Energy Information Administration (EIA) storage data. Here’s the latest: Soon-to-expire May Nymex futures down 2.2 cents to $1.631/MMBtu at around 2:10 p.m. ET Henry Hub spot…

April 25, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.