NGI All News Access | LNG | Markets

EIA: Emerging Asian Markets Helping Offset LNG Demand Slack

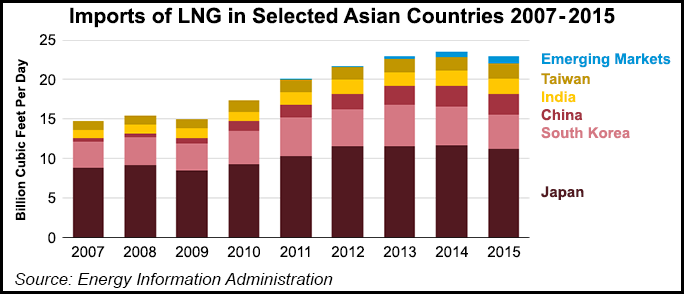

Emerging Asian markets for liquefied natural gas (LNG) are helping to offset declines seen in the three largest importers: Japan, South Korea and China, according to the U.S. Energy Information Administration (EIA).

While Japan, South Korea and China accounted for more than half of global LNG imports last year, averaging 18.2 Bcf/d combined, that was down 5% from the prior year. However, this drop was partially offset by an increase in imports from countries such as Malaysia, Singapore, Thailand and Pakistan.

“Although LNG demand growth prospects are limited in the more mature markets of Japan and South Korea, LNG demand in China, India, Taiwan, and emerging Asian markets is expected to grow in the future,” EIA said.

Emerging Asian LNG import markets, including Thailand, Malaysia, Singapore and Pakistan, currently account for a small share of total Asian LNG imports, but they may have the potential to increase imports soon, EIA said. LNG import growth in these countries is driven primarily by the increased use of natural gas for power generation.

In Thailand, the combined effects of declining domestic gas production near consuming centers and strong growth in demand are driving LNG import growth. “Although LNG imports provide a relatively small share of natural gas supply in Thailand, the country’s LNG imports are projected to increase because of limited growth potential for domestic production and for pipeline imports from Myanmar, its two main supply sources,” EIA said.

Malaysia began importing LNG in 2013, and its imports are projected to grow moderately, limited by competition from lower-priced coal and domestic natural gas prices, EIA said.

Prospects for LNG demand growth in Singapore depend upon the country becoming a regional LNG trading hub. Singapore is increasing regasification capacity and has launched the SGX LNG price index in an effort to establish a regional Asian LNG hub.

Pakistan began importing LNG in March 2015, and its imports are projected to double in the next two years, according to EIA. Declining domestic production and rapidly growing gas demand in the power generation and industrial sectors results in increases in LNG imports.

However, like the more traditional Asian markets for LNG, the emerging markets are also price sensitive, International Energy Agency Executive Director Fatih Birol said last year (see Daily GPI, Sept. 17, 2015).

Asian consumers, as it turns out, will not take “any amount of LNG at any price,” Birol said at the time. Gas has been losing market share to coal in India and in Association of Southeast Asian Nations countries, he said, adding that gas-fueled power generation is half what it was in India three years ago. “That is in absolute terms; the share of gas in total power generation has declined by even more. Meanwhile, coal-fired generation in India has increased by 25% as several new plants came online.” In Malaysia, a major gas producer, they’re burning coal and exporting gas because it is “more economical.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |