EIA Delivers More Bearish Storage Data; Heat Keeps Prompt Month Somewhat Supported

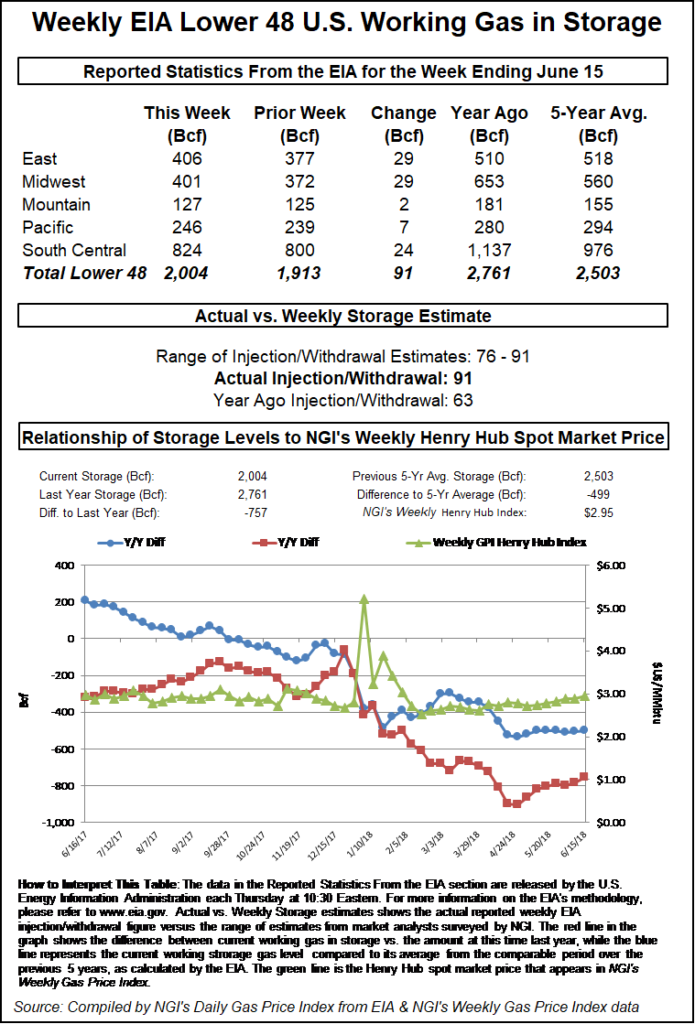

The Energy Information Administration (EIA) on Thursday reported a 91 Bcf build into storage inventories for the week ending June 15, once again well above market consensus of an 85 Bcf build.

Working gas in storage climbed to 2,004 Bcf, which is still 757 Bcf below year-ago levels and 499 Bcf below the five-year average of 2,503 Bcf. The East and Midwest regions each injected 29 Bcf into storage, while the South Central injected 24 Bcf.

“This is the second bearish miss from our expectation in a row, showing the impact of loosening power burns we had observed” through June 15, Bespoke Weather Services said. Balances in the natural gas market continue to remain loose, especially as the past gas week included what were significant maintenance-related production declines.

Indeed, before EIA released its weekly storage report, market consensus had built around a storage injection in the mid-80s Bcf range. IAF Advisors’ Kyle Cooper projected an implied build of 86 Bcf and a headline build of 82 Bcf, while Bespoke estimated an 84 Bcf build. A Bloomberg survey had a range of 76-91 Bcf, with a median of 86 Bcf. A Reuters poll pointed to an 85 Bcf injection, with estimates ranging from 80-91 Bcf and a median build of 85 Bcf.

For the comparable week a year ago, EIA reported a 63 Bcf; the five-year average build stands at 83 Bcf for the corresponding period.

When news of the storage injection hit the market, Nymex July futures immediately pulled back 2.5 cents. Just before 11 a.m. ET, the prompt month was trading at $2.983, an increase of about 2 cents from Wednesday’s settle. July prices had climbed as high as $3.012 before the storage report.

“We have seen decent power burn tightening this week and daily balance data is more supportive, so combined with very bullish weather early in July, we could see prices rebound short term. However, this print confirms any spike above $3 likely fails and once weather flips, prices have far to fall,” Bespoke chief meteorologist Jacob Meisel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |