Eerie Calm Pervades NatGas Bidweek Trading In Contrast To Harvey Tumult

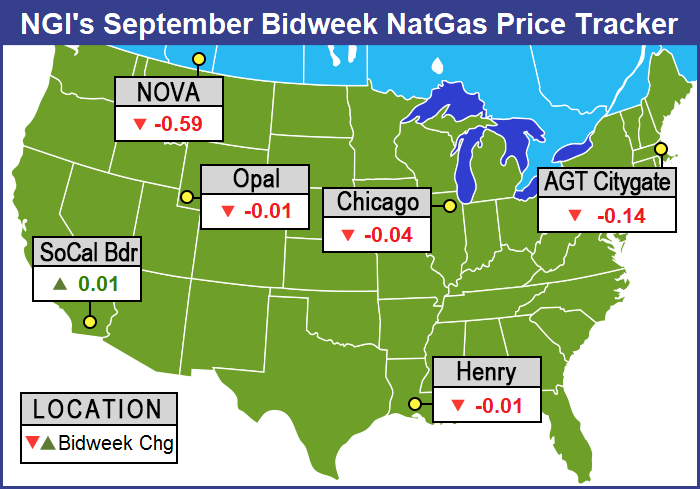

September bidweek trading stood in stark contrast to the chaos and destruction Hurricane Harvey wreaked on the Texas Gulf Coast as prices moved little and most points outside of the Northeast were confined to changes of a few pennies either side of even.

The NGI National Bidweek Average fell just a penny to $2.64 and the range of price changes was diminished also. The biggest changes were found north of the border, where deliveries to Westcoast Station No. 2 plunged $C0.64 to $C0.57/Gj, and bidweek’s greatest gainer was Transco Zone 6 non New York North with a rise of 19 cents to $2.49.

Sweltering under a late August heatwave, California as a region posted the largest gain, climbing 6 cents to average $3.01. Appalachia, Northeast and West Texas proved to be bidweek’s biggest losers with declines of 4 cents apiece to $1.81, $2.41 and $2.55, respectively. Living up to the region’s volatile reputation, individual points in the Northeast saw a wide range of movement — from double-digit gains over August to double-digit losses.

The rest of Texas, Louisiana, the Midwest and Midcontinent all were within 2 cents of unchanged.

The Rockies were unchanged at $2.58.

The move in September futures was equally timid, falling eight-tenths of a penny to $2.961 from the August settlement’s $2.969. The month-over-month decline was miniscule compared to August future’s 9.8 cent-decline from the settlement of the July contract.

“We are slightly ahead of our injections for the summer, so we bought a little less than we normally would,” said a Midwest utility buyer. “We are getting close to where we need to be, and we still have September and October.”

“We do our hedging via fixed price, but we don’t do ceilings, floors, collars and that sort of thing. Everything is physical for us, and between our storage and what we do with physical prices we try to have our winter months about 40% hedged. We are pretty much done with our fixed price hedging for this winter.” he said.

A Michigan marketer was able to make purchases on Consumers and Michcon well below Nymex settlement. “We bought our gas at $2.89 to $2.90. We try to trigger our deals before the settlement of the contract since we have gotten burned so many times waiting for the close that we prefer to step in early.”

As bidweek drew to a close Thursday physical natural gas for Friday delivery plunged on average as traders for the most part looked to get deals done before the release of often volatility-inducing storage data from the Energy Information Administration (EIA).

Next day gains in Texas and flat pricing in the Midwest and Louisiana were no match for hefty declines in Appalachia, the Northeast and California, and the NGI National Spot Gas Average dropped 4 cents to $2.63.

Tropical Depression Harvey was expected to dissipate over the Ohio Valley Friday, but If Harvey weren’t enough the National Hurricane Center (NHC) is also following Hurricane Irma, located in the far eastern Atlantic about 840 miles west of the Cabo Verde Islands. It’s winds are up to 115 mph and Irma is moving toward the west-northwest near 12 mph, and a turn toward the west is expected by Friday night, followed by a turn toward the west-southwest on Saturday. The storm was expected to remain a powerful hurricane throughout the weekend, NHC said.

The EIA reported a storage build of 30 Bcf, about 2 Bcf less than expectations, and that was enough for the bulls to seize the reins. At the close October had risen 10.1 cents to $3.040 and November had improved 8.8 cents to $3.102. October crude oil surged $1.27 to $47.23/bbl.

At first the market response to the slightly bullish storage number was muted, even though the EIA reported a natural gas storage injection that was less than what traders were expecting. When the number was released October futures rose to $2.950 and by 10:45 a.m. October was holding $2.948, up nine-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a storage build on either side of the actual figures. Last year 46 Bcf was injected and the five-year average stands at 67 Bcf. Citi Futures calculated a 35 Bcf injection and Ritterbusch and Associates estimated a 29 Bcf build. A Reuters survey of 19 traders and analysts showed an average 32 Bcf with a range of plus 27 Bcf to plus 50 Bcf.

Traders were unimpressed by the figure. “I wouldn’t consider a 4-cent range off a [storage] number as significant,” a New York floor trader opined to NGI. “The market sneezed higher,” he said.

“I didn’t think it meant much,” said Mike DeVooght, president of DEVO Capital. “Fundamentally natural gas is a mixed bag here, but the potential of getting a 25 cent to 30 cent rally is very, very possible right here.”

The Wells Fargo analytical team saw the report as supportive. “Since the end of April (17 weeks) the surplus versus the five-year average has fallen by 298 Bcf (17.5 Bcf per week), reflecting a market more than 2 Bcf/d undersupplied. However, we believe power-burn demand will be relatively mild due to cooler than normal weather forecasts for much of the U.S. over the next two weeks.

“Our cumulative injection forecast for the next two weeks is 135 Bcf, 37 Bcf above last year’s cumulative injection of 98 Bcf and 17 Bcf above the five-year average of 118 Bcf,” they said.

Traders are positive the market can move higher and are looking for a spot to scale-in sell. “We got a settlement well above $3, and what a lot of people aren’t understanding is we still have a cooling season left, said John Woods, trader and president of J.J. Woods and Associates in New York.

He admitted that the net result of lower demand or lower supply off the impact of Harvey was “a crap shoot, but you are going to find out more before next Thursday. You will probably start to get some information by late Friday. What we have is a wait and see game. There is no one with an accurate number.

“We still have a season, we still have things to do, so look for higher natgas. Right now I am looking at $3.12 to $3.15, and that is the top end of the trading range.

“From there I would go short since that puts us into September and the shoulder month, and it should subside from there. If you do get some adverse weather and a rally, sell into it. You typically don’t have the big price moves in the shoulder months. If there is a move the smart money will take the other side of everybody just jumping on the long side. You don’t want to battle the market, but you will take the other side,” he said.

Inventories now stand at 3,155 Bcf and are 239 Bcf less than last year and 8 Bcf greater than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories rise by 19 Bcf. Stocks in the Mountain Region were down 1 Bcf and the Pacific Region was up 5 Bcf. The South Central Region fell 14 Bcf.

Hurricane Harvey’s longer-term impact on the natural gas industry and prices still remains unknown, though analysts at Barclays opined last week that future Gulf Coast storms would will likely be “increasingly bearish” for U.S. natural gas markets as supply outages will likely be overshadowed by demand destruction.

Pipelines continue to rebound from the effects of Harvey. Wednesday Tennessee Gas Pipeline announced that the Station 9 Force Majeure had been lifted, and the Force Majeure on Station 1 in South Texas remains in effect, industry consultant Genscape said in a report.

“As a result of Hurricane Harvey, Station 1 and Station 9 were reduced 293 MMcf/d and 585 MMcf/d respectively. Starting August 28, Station 9 flows, including deliveries to NET Mexico started to rebound, and are 257 MMcf/d from reaching pre-storm levels. Proprietary estimates indicate that 388 MMcf/d of NET Mexican exports were affected during the storm, primarily as a result of the TGP Station 9 Force Majeure. The Station 1 Force Majeure, which is still in effect, is still affecting flows along the PEMEX and Rio Bravo Laterals, but will likely be lifted in the next couple days,” Genscape said.

In the physical market next day prices at eastern points on Thursday plunged as temperature forecasts showed a sharp decline. AccuWeather.com predicted the high Thursday in Boston of 80 degrees would fall to 69 Friday and 72 by Saturday, 5 degrees less than the seasonal norm. New York City’s Thursday high of 81 was seen sliding to 69 also by Friday and 68 by Saturday, 12 degrees below normal. Chicago was predicted to see its high Thursday of 71 ease to 69 Friday before rising to 74 Saturday, 6 degrees below normal.

Deliveries to the Algonquin Citygate shed 54 cents to $1.56 and gas bound for New York City on Transco Zone 6 rose 43 cents to $2.31. Packages on Tetco M-3 Delivery were quoted down 29 cents to $1.38, and gas on Dominion South came in 17 cents lower at $1.43.

Gas at the Chicago Citygate was flat at $2.79 and deliveries to the Henry Hub fetched $2.89, 3 cents higher. Gas delivered to Transco Zone 4 changed hands 2 cents lower at $2.86, and parcels on El Paso Permian added 15 cents to $2.88.

Out west Kern River were quoted at $2.69, up 3 cents, but Kern Delivery dropped 50 cents to $3.69. Gas at the SoCal Citygate fell 43 cents to $4.17 and gas priced at the SoCal Border Average dropped 52 cents to $3.53.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |