Markets | NGI All News Access | NGI Data

East Leads Broad Decline; Traders See Futures Set to Rally

Weekend and Monday physical gas fell hard in Friday’s trading as weather forecasts were non-threatening, traders saw little need to commit to three-day packages, and power loads and prices weakened.

The greatest declines were seen at New England locations, but losses of a few pennies to a dime were pervasive. The Rockies was one of the few regions to show some strength, adding just a few pennies. Overall, the market shed 15 cents. Futures posted double-digit gains as traders noted weather forecasts calling for a cold incursion late in the month, but few desired to hold a short position over a weekend in December. At the close, January had added 16.1 cents to $3.795 and February was higher by 15.3 cents to $3.816. January crude oil continued to post new five-year lows, plunging $2.14 to $57.81/bbl.

Weekend and Monday parcels in New England, the Mid-Atlantic, Marcellus and Appalachia all were in the loss column as power loads Monday were seen lower and peak power prices ebbed. IntercontinentalExchange reported that Monday peak power at ISO New England’s Massachusetts Hub fell $7.66 to $53.05/MWh. Peak power at the PJM West terminal eased 33 cents to $36.65/MWh.

New York ISO forecast that Friday’s peak power requirements of 21,743 MW would fall to 21,403 MW Monday, and PJM Interconnection predicted peak power Friday of 39,113 MW would drop to 37,945 MW Monday.

At the Algonquin Citygates weekend and Monday gas was quoted at $5.04, down $3.16, and deliveries to Iroquois Waddington were seen down 2 cents at $4.10. Gas on Tennessee Zone 6 200 L tumbled $2.39 to $5.04.

Gas on its way to New York City via Transco Zone 6 fell 6 cents to $3.69, and packages on Tetco M-3 were off 12 cents to $3.18.

On Millennium, gas for Friday-Monday delivery changed hands 8 cents lower at $2.24, and gas on Transco Leidy fell 17 cents to $1.79. Deliveries on Dominion South came in 23 cents lower at $2.63, and packages on Tennessee Zone 4 Marcellus dropped 16 cents to $1.76.

Temperature forecasts hovered right around seasonal norms. Wunderground.com predicted that Friday’s high in Boston of 38 would rise to 40 Saturday and reach 42 Monday, the seasonal high. In New York Friday’s high of 40 was anticipated to rise to 41 Saturday and 45 by Monday, one degree above normal. In Philadelphia, Friday’s max of 39 was seen reaching 42 Saturday and 46 by Monday. The seasonal high in Philadelphia is 44.

The National Weather Service in suburban Philadelphia reported that “a persistent area of low pressure over the Canadian Maritimes will gradually move east over the weekend as high pressure from the Tennessee River valley builds over the region Sunday and Monday. A cold front is forecast to cross the middle-Atlantic region late Tuesday, followed by another area of high pressure later in the week.

“Saturday is shaping up to be a fairly nice day. We should start to see the sun break out from behind the clouds as the high to our southwest starts to push more toward the region. The gradient between the high and the departing low will still continue to be fairly tight and this means we will have some gusty winds to contend with through the afternoon. Temperatures will be slightly warmer than they were today as the air mass continues to modify. Highs will be in the low to middle 40s across the region with some 30s across the Poconos and the higher terrain of northwestern New Jersey.”

Rockies locations managed to avoid the weaker pricing seen elsewhere. On CIG Mainline, weekend and Monday gas came in 4 cents higher at $3.38, and at the Cheyenne Hub packages changed hands flat at $3.36. Gas at the Opal Plant tailgate was down a penny to $3.40, and gas on Northwest Pipeline WY added 3 cents to $3.38.

“Ultimately you will see higher prices in natgas. It was just a question of when traders were going to pull the trigger,” said a New York floor trader.

Following Thursday’s brief rally and ultimate failure to advance off a supportive inventory figure, technical analysts point out that the bullish case currently rests on a classic double bottom chart pattern unfolding. At present that’s a stretch.

“No change,” said United ICAP analyst Brian LaRose in closing comments Thursday to clients. “To have any shot at a double bottom forming into the $3.541-3.537 vicinity bulls need to launch a rally that clears the 0.500 retracement of the decline from $4.529 (currently $4.057). The 12-month strip would need to clear $3.771. [We] have no case for a bottom forming otherwise. [We] see room down to $3.305 for natgas and $3.330 for the strip at minimum if the bears crack $3.537 first.”

On a more fundamental note in its morning outlook, Natgasweather.com said Thursday’s storage report will not be able to hold a candle to upcoming storage reports expected to make significant inroads to the short- and long-term storage shortfalls.

“Deficits were able to gain 20 Bcf on supplies, but it will pale in comparison to the impressive amount of ground that will be made up when next week’s draw comes in significantly lighter than the five-year average. These light draws are clearly bearish for prices, and if the string is going to end, colder temperatures would need to arrive after Dec. 22 as weather patterns until then will just not be nearly cold enough over enough of the U.S. to be significant,” the firm said.

“The weather system for next week over the Midwest will be fairly chilly, but the truly cold arctic air will remain confined over the northern U.S. We still expect how weather patterns shape up going into the last week of December very well could dictate the future direction of natgas prices. We still like colder temperatures returning sometime around or just after Dec. 22-24 as the gates holding very cold arctic air over northern Canada begin to open, although the weather models continue struggling on how much cold air the first weather system or two will tap as they track through the Midwest and Northeast. But even if the first systems fails to grab a significant amount, the next several that line up to follow will have better chances.”

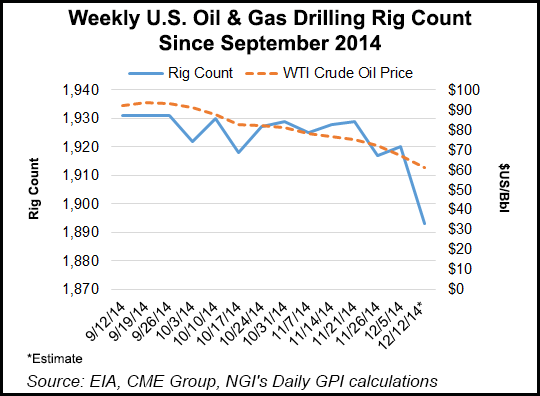

Baker Hughes reported that active U.S. rigs dropped 27 for the week ended Dec. 12, to 1,893, the first large drop since the slide in oil prices began in September, but still well ahead of a year ago by 111. Gas rigs, however, added two to 346 for the week, down from last year’s 369, and horizontal wells fell by one to 1,367, well ahead of last year’s tally of 1,145.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |