Markets | LNG | Natural Gas Prices | NGI All News Access

Easing Heat, ‘Monumental Reshaping’ of Supply Fuels More Losses for Natural Gas Futures

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

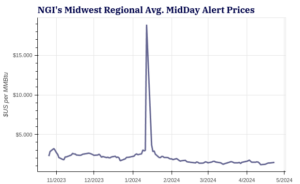

Natural gas futures visited both sides of even through midday Tuesday as traders mulled less-than-inspiring forecasts and strengthening export volumes. Cash markets were mixed, with some chilly spring weather failing to have much impact on Midwest and Northeast prices. Here’s the latest: May Nymex futures up 0.7 cents to $1.798/MMBtu as of 2:08 p.m. ET…

April 23, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.