Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

E.ON Sees Risk for Nord Stream 1 Stakes, but No Plans to Divest

German power supplier E.ON SE has indicated its minority stake in one of Europe’s vital routes for Russian natural gas is at risk, but for now, it has no plans to divest.

The utility holds a 15.5% stake in Nord Stream AG, a subsidiary of Russian state-owned Gazprom PJSC, which operates Nord Stream 1 (NS1). NS1 delivered the most gas volumes to Europe last year at more than 59 billion cubic meters (Bcm).

The company recently disclosed that the stake, estimated to be worth $3.4 billion, could lose value because of Russia’s incursion into Ukraine. The “Impact of the conflict and further escalation” has led many countries to shirk Russian gas faster than previously estimated. E.ON’s actuaries said the range of risk could not yet be reasonably calculated.

CEO Leonhard Birnbaum said the company has no plans to sell the investment, which makes up part of its pension fund. “A divestment is impossible for the moment,” he said. “It isn’t up for sale; there is no market for it.”

‘Who Would We Help?’

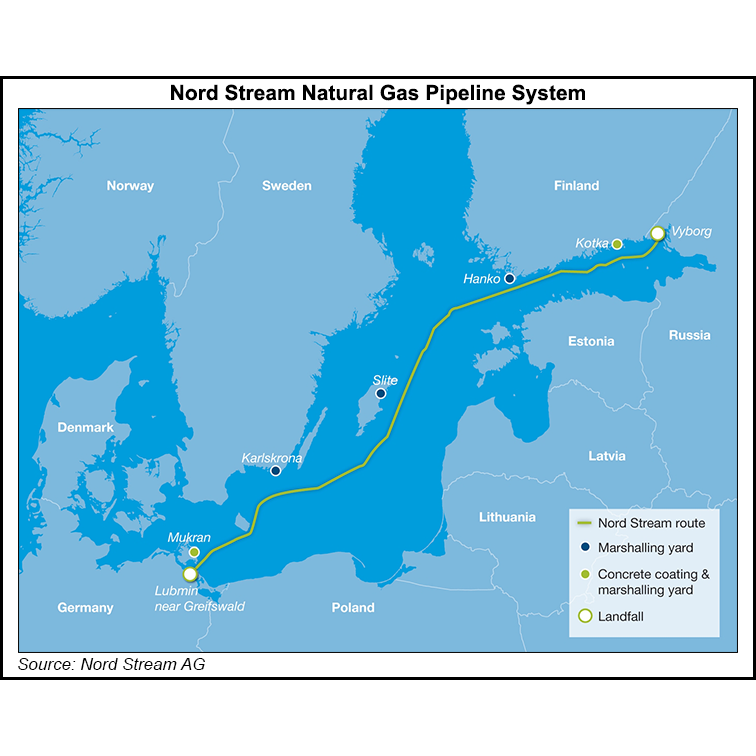

NS1 has delivered gas to Europe since 2011. It runs parallel to the now suspended NS2 system, which was intended to increase Russian gas volumes. The two pipelines are a part of other major routes delivering gas from Russia, including the Ukrainian transit network. Another major system is the Yamal-Europe pipeline to Germany, which delivered 26.5 Bcm last year. TurkStream delivered 12.1 Bcm to Southeast Europe last year.

Although the United States and Western allies to Ukraine have sanctioned Russian businesses and some energy commodities, many European utilities are relying on gas flows through routes to meet demand.

Birnbaum said E.ON is insulated from the gas pressures Russia has been inflicting on Europe since last year. However, he said he agrees with the German government that the routes should stay open as long as Europe relies on Russian gas imports.

“Who would we help if we were to pass this over to the majority shareholder in Russia?” Birnbaum asked.

Russia provided about 45% of the continent’s natural gas imports last year, according to the European Commission.

A Long Transformation

Major producers that include Equinor ASA, Shell plc, BP plc and TotalEnergies SE have announced they will no longer invest in Russia and plan to withdraw from the country. RWE AG, a major German energy provider, also announced it would end non-energy supply business with Russian entities.

Birnbaum said the company’s decision wasn’t based on a need to preserve connections with Russia, and eventually, ending reliance on the country’s energy is “necessary” and “inevitable.” In its place, he said Europe would need to increase its infrastructure for liquefied natural gas and eventually, hydrogen.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |