E&P | Haynesville Shale | NGI All News Access

DTE’s $2.65B Deal with Indigo, Momentum Adds Haynesville Natural Gas Gathering Options

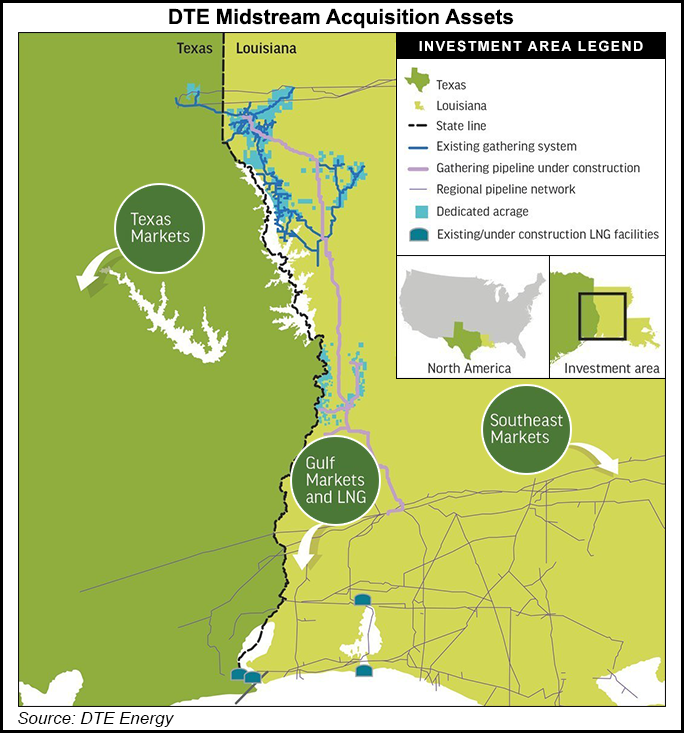

The midstream arm of Detroit-based DTE Energy is reaching its tentacles into Louisiana to acquire an existing natural gas system and a gathering pipeline under construction that would move Haynesville Shale supply to the Gulf Coast.

DTE Midstream cinched a transaction worth about $2.65 billion to acquire the assets of Momentum Midstream LLC and private Haynesville producer Indigo Natural Resources LLC assets.

Under the terms of the agreement, DTE would pay $2.25 billion cash for the existing gathering system and other assets, as well as $400 million when the 150-mile gathering pipeline is completed in 2020.

“DTE’s nonutility operations continue to grow, perform well and fit nicely into our planned utility and non-utility mix,” said CEO Jerry Norcia. “This acquisition significantly enhances the strength and diversity of DTE Midstream, adding premium assets in one of the fastest growing and best positioned U.S. shale formations.”

Indigo and Momentum jointly partner in M5 Louisiana Gathering LLC, which had 1 Bcf/d of throughput last April. The M5 assets include 300 miles of gathering pipeline, 15,000 hp of compression, gas dehydration/carbon dioxide removal capability, multiple interconnects and centralized facilities near Longstreet, LA.

The rich gathering system, which delivers to various processing points in East Texas, runs 30 miles, mostly with 20-inch diameter pipeline and 7,100 hp of compression. A 20-inch diameter fresh water system traverses 10 miles and has a 3 million barrel fresh water impound facility, which producers access via truck or pipeline. The produced water gathering system is 30 miles and has associated saltwater disposal wells.

Indigo and Momentum also partner in Gen6 Proppants, which is building a 1.5 million ton/year sand mine in Louisiana’s Red River Parish to serve the Haynesville that is expected to come online by the end of the year.

“The successful operation of the Link asset, also purchased from Momentum, demonstrates the operating expertise and value creation DTE Midstream brings to this new system,” Norcia said. “In addition, the company gains a strong commercial partner in Indigo, one of the nation’s largest private natural gas producers supplying the rapidly growing demand in the Gulf Coast region.”

The acquisition “has excellent access to large markets, and is in the early- to mid-cycle development phase. It checks all of our boxes,” he added.

The assets are fully contracted, with a remaining tenor of 13.5 years for the existing gathering system and a 10-year contract for the gathering pipeline under construction.

In addition to holding assets in Michigan’s producing basins, DTE has held assets in other gassy Lower 48 basins including the Barnett Shale in North Texas; it now has a foothold in the Appalachian Basin.

DTE Midstream provides natural gas storage, pipeline and gathering services across the Midwest, Appalachia, Northeast and Ontario. DTE’s strategic plan is to invest $4-5 billion in the midstream business from 2019-2023, and the Haynesville acquisition is in line with it, management said.

The transaction is expected to be completed by the end of the year. DTE’s financial adviser is Barclays, with Shearman & Sterling LLP serving as legal counsel and Dechert LLP assisting with the Hart Scott Rodino filing. Jefferies and Credit Suisse are serving as financial advisers to Momentum while Vinson & Elkins is legal counsel. Kirkland & Ellis is legal counsel to Indigo.

DTE Energy’s operating units include an electric company serving 2.2 million customers in Southeast Michigan and a natural gas company serving 1.3 million customers across the state. The utility operations have a goal to reduce carbon dioxide and methane emissions by more than 80% by 2040, with DTE Electric aspiring to achieve net zero carbon by 2050.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |